After years of waiting, Ethereum is finally ready to become a full-fledged proof-of-stake (PoS) blockchain. Besides Ethereum’s native token ETH, many other altcoin projects are expected to perform well in conjunction with it. Here are the altcoins that can gain momentum along with Merge, which symbolizes this transition, according to analyst Yashu Gola.

Ethereum Merge is approaching

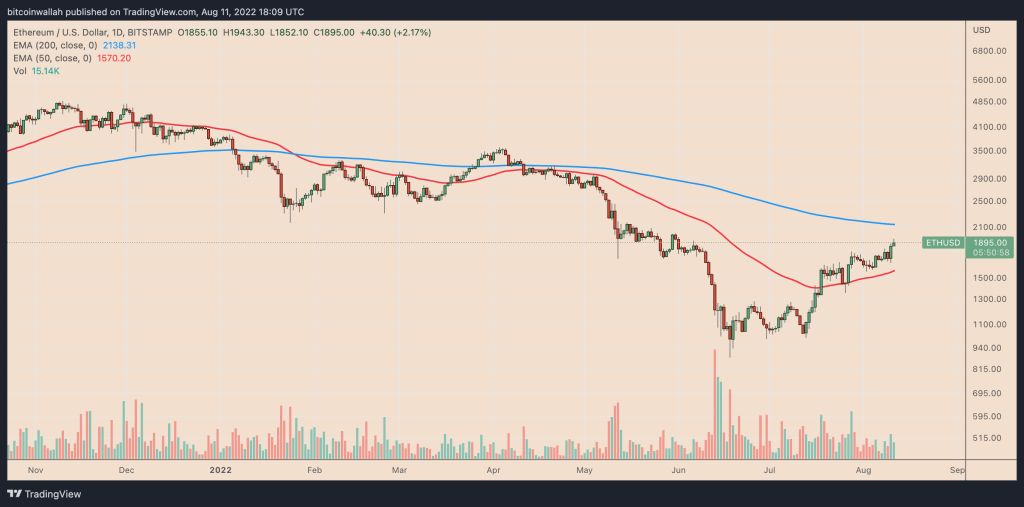

cryptocoin.com As we reported, Ethereum completed its public testnet called “Goerli” on August 11. Therefore, Ethereum’s Merge, which is expected to be released on September 19, is expected to have no delays. Ether price has risen 15 percent to around $1,950 after the Goerli update, hitting its highest level in more than two months. Meanwhile, some crypto assets that could benefit from a successful Merge are exhibiting upward moves. It even outperforms ETH in the past month. So, will these tokens continue to outperform the ETH price until September? Yashu Gola analyzes this as well.

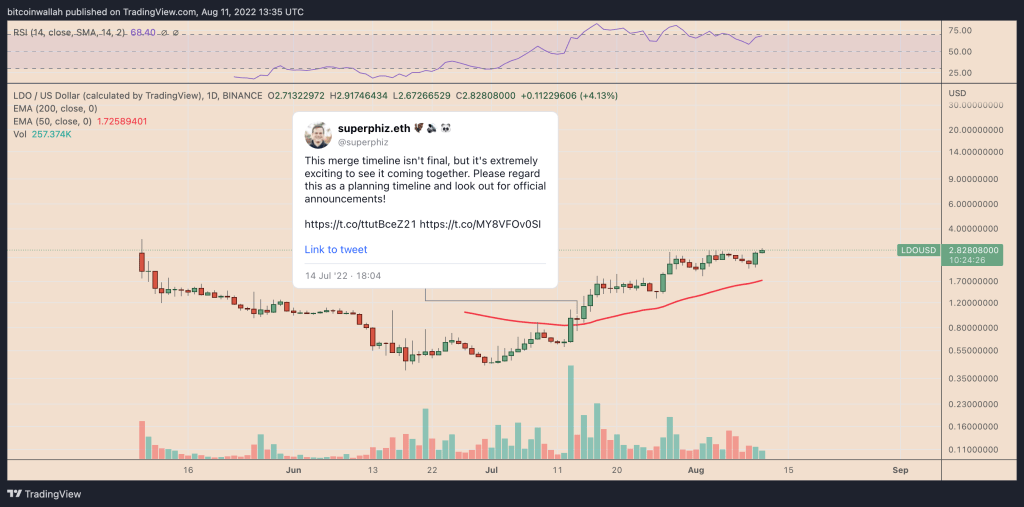

Lido DAO (LDO) can benefit with ETH Merge

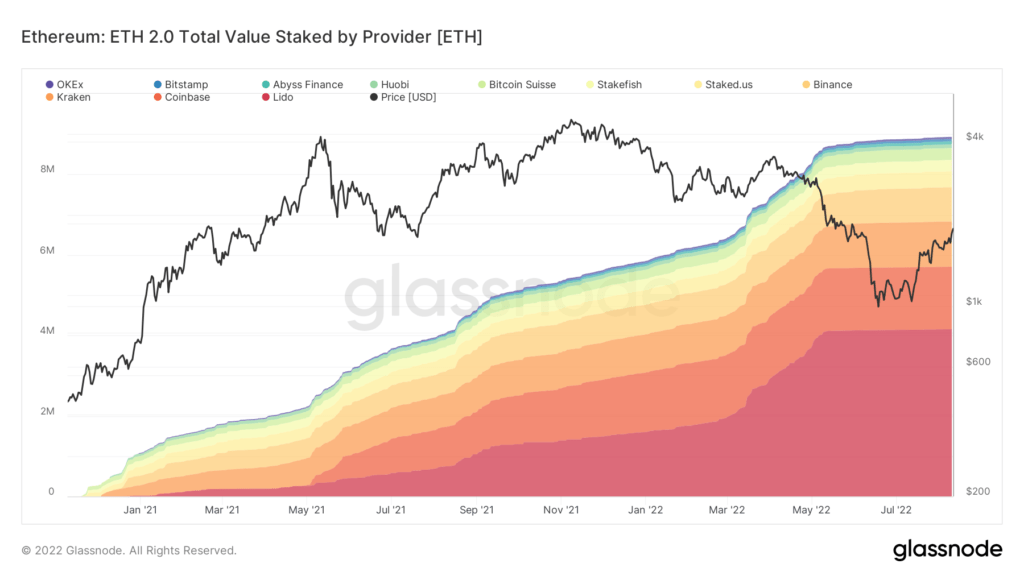

Merge will replace Ethereum’s army of miners with validators that should front 32 ETH as an economic share. This massive staking requirement has created opportunities for brokers. So platforms that collect Ether from underfunded stakers and pool the proceeds to become validators on the Ethereum Blockchain can come to the fore. Lido DAO is one of them. Lido DAO is the leading staking service in terms of locked value in Merge’s official smart contract. Specifically, he poured 4.15 million ETH into the ETH 2.0 contract. Thus, it even surpasses Coinbase and is the leader. Coinbase had staked 1.55 million ETH on behalf of its clients into the ETH 2.0 contract.

A successful Merge could increase demand for Lido DAO services, according to analyst Gola. Conversely, it could prove bullish for LDO, the platform’s official management token, whose value has already risen more than 200 percent since July 14, when Ethereum first announced the possibility of a PoS chain in September. As such, LDO is one of the primary crypto assets that could benefit the most from Ethereum’s successful transition to POS, according to the analyst.

Ethereum Classic may also rise

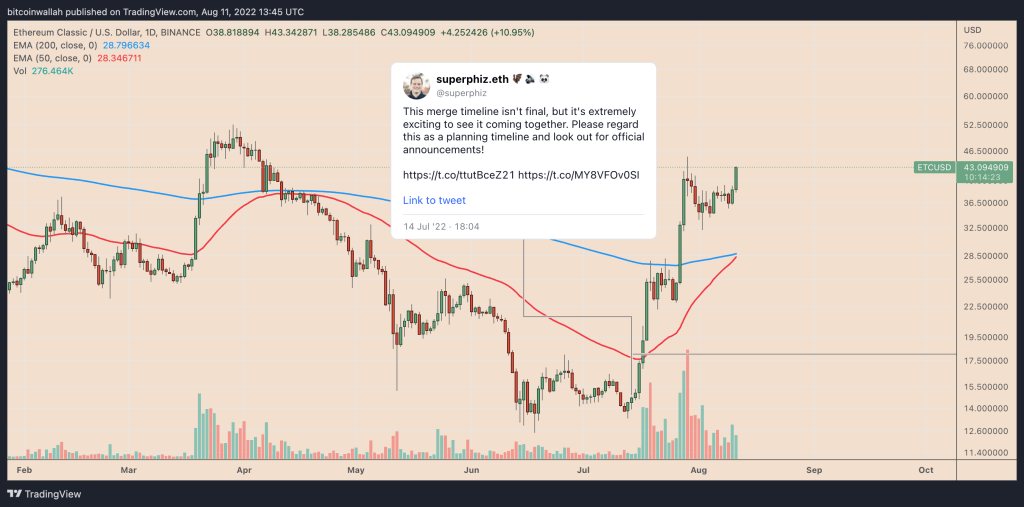

Ethereum Classic (ETC) is another asset that has caught the attention of bulls in recent weeks. This is primarily due to its potential to provide a haven for miners leaving the Ethereum network. Since Ethereum Classic is the split chain of a contentious hard fork in 2016, it showcases almost all the technical features of the current PoW Ethereum network. This makes it a natural haven for ETH miners. Like LDO, ETC has rallied over 200 percent since Ethereum’s Merge launch announcement on July 14. Therefore, it is highly likely to continue the uptrend.

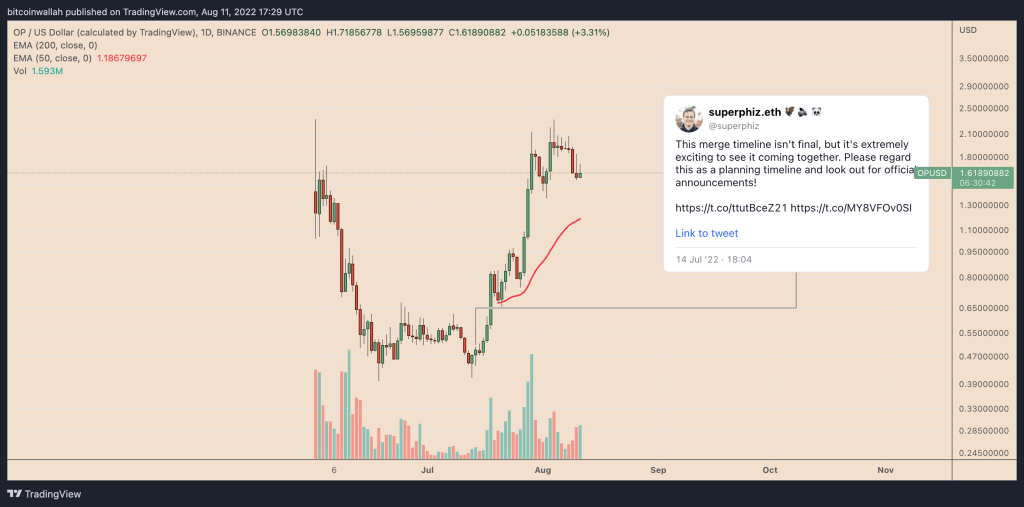

Last altcoin on the list: Optimism (OP)

Optimism is an Ethereum rollup service. In other words, off chain aggregates transaction data in batches. It sends the results back to the Ethereum mainnet when a consensus is reached. Dubbed Layer-2, the solution could leverage Ethereum’s “Rollup Centric Roadmap” after Merge. Interestingly, Optimism’s management token OP has increased by nearly 250 percent since the Merge release date announcement. According to the analyst, Ethereum’s prospects of deploying Optimism on its network after Merge could act as a bullish catalyst for the OP price.