Gold prices rose as traders increased their Fed pivot bets after a soft US CPI data. According to market analyst Thomas Westwater, the Fed may back down against the enthusiastic risk-taking that potentially threatens gold. Market analyst Christopher Lewis, on the other hand, notes that gold markets rose significantly throughout the week to break above the previous week’s shooting star. We have compiled the analyzes of Thomas Westwater and Christopher Lewis for our readers.

“Fed members push back pigeon fever”

Gold prices ended the week around 1.5% as the Treasury yields moderated on Friday. Traders watched inflation data through the consumer price index (CPI) and producer price index (PPI) throughout the week. cryptocoin.com As you can see from , both indicators have cooled down compared to the previous month. Federal Reserve rate hike bets eased after 8.5% annual CPI. This d pushed interest rates down. The US dollar index (DXY) fell during the week.

Confidence plummeted after the initial CPI response. Fed members, including San Francisco Fed President Mary Daly and Minneapolis Federal Reserve Bank President Neel Kashkari, pushed back the pigeon fever. In a Financial Times interview, Ms. Daly said, “There is good news in the monthly data that consumers and businesses are getting some relief. However, inflation is very high. In addition, price stability is not close to our target,” he said.

“This will likely have a negative impact on gold”

Gold-sensitive nominal and inflation-indexed rates ended the week slightly higher on most of the curve, despite renewed appetite for Treasury bonds on Friday. The University of Michigan consumer confidence survey showed that short-term inflation expectations have cooled. The 1-year inflation expectation fell from 5.2% to 5.0%, possibly due to the decline in gasoline prices. Gold does not pay interest. Therefore, government bond rates are an effective factor in the gold price.

U.S. stock investors acted partly out of fear of losing at this point. In this way, it took the Nasdaq-100 Index (NDX) to its highest level since April. High stock prices facilitate financial conditions in the economy. So the Fed may be running out of patience with hot stock traders. Because that’s the opposite of Jerome Powell’s point. It is possible that the Fed chair will remind markets of this target later this month in Jackson Hole. The impact on bullion prices will likely be negative.

“As short closing slows, gold prices may fall”

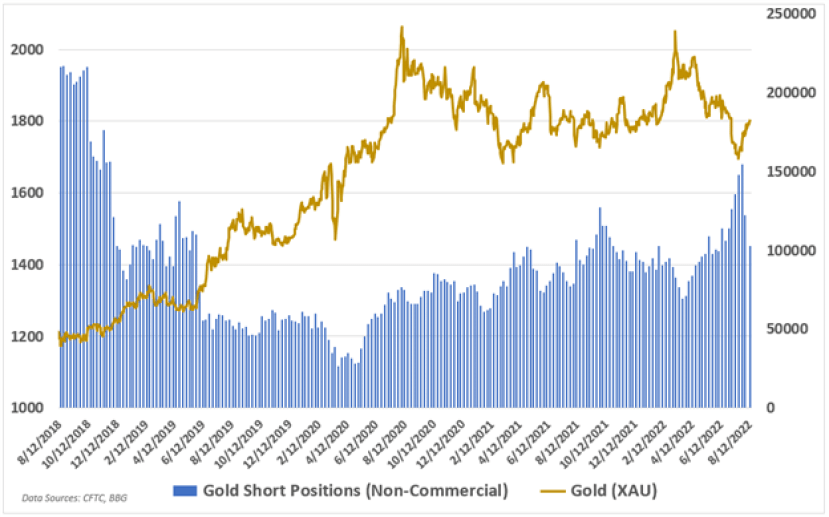

Normalization in shorts against gold is likely to bring another headwind to prices. According to CFTC data, shorts against gold among speculators reached the highest level since November 2018 for the week ended July 26. By August 2, these short bets were down 23.3% as gold prices rose. This helped to generate more profits as traders repurchase borrowed contracts.

The Commitments of Traders (COT) report for the week ending Aug. 9 showed a smaller drop and total shorts returning to relatively normal levels. However, he showed another one. The gold rally faces a tough rally as the short closing slows and the Fed pushes back against the pivot narrative. US retail sales data for July and FOMC minutes dated August 17 will provide markets with additional data that is likely to affect gold prices.

Weekly gold prices technical analysis

Christopher Lewis, on the other hand, analyzes the technical outlook of gold as follows. Gold markets rose significantly during the trading week to break above last week’s shooting star high. The 50-Week EMA is sitting above the $1,830 level. This also offers some resistance. It was a nice rally. But like the stock market, one has to wonder if it’s just a bear market rally at this point. All in all, I believe this is a situation where we will continue to see a lot of volatility. This makes sense considering we have a lot of noise when it comes to the Fed. The Fed will of course have a huge impact on interest rates and therefore gold.

If we break below the candlestick of the week, then a drop to the $1,750 level is possible. If we go down from there, we can retest lows, which is essentially the bottom of the larger consolidation range. On the upside, if we break above the $1,830 level, we will likely continue higher, at least $40 more. Once we break above the $1,880 level, the possibility of a much larger gain opens up, perhaps up to the $2,000 level.

Having said that, the market seems to be starting to run out a bit. But whether we will return is still somewhat of an open question. I think it’s more likely that it doesn’t. However, at this point, you need to be aware of how volatile the bond market is.