Is the recession really coming? We already know that the yield curve has inverted for the second time this year, last month. But what are the other indicators of emerging economic problems? So, what does this mean for the gold market? Investment advisor and economist Arkadiusz Sieroń seeks answers to these.

recession indicators

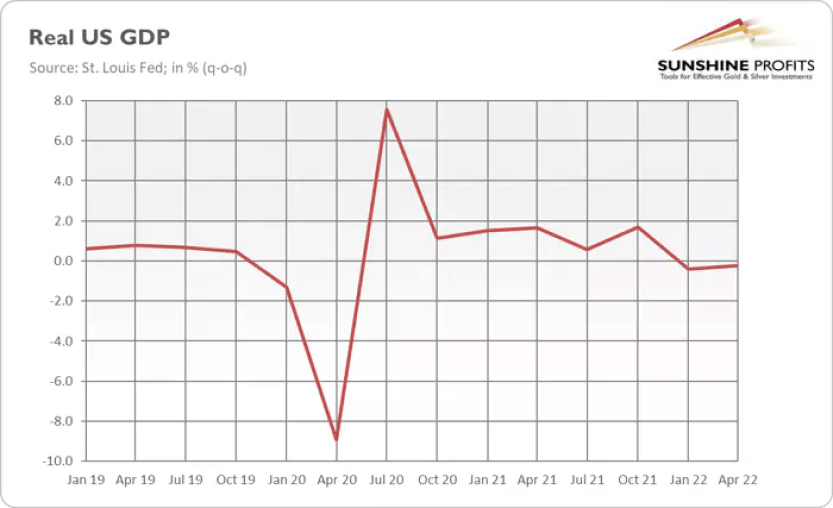

GDP Growth

Real GDP fell 0.9% in the second quarter, after a 1.6% drop in the first quarter, according to the Bureau of Economic Analysis’s first measurement. On a quarterly basis, real GDP decreased by 0.4 percent and 0.2 percent, respectively. Because cryptocoin.comAs you follow, the US economy recorded two quarters of negative growth, which meant a technical recession.

New York Fed’s DSGE Model

Second, the New York Fed’s DSGE Model predicted modest negative GDP growth in both 2022 (-0.6%) and 2023 (-0.5%). For this, he became pessimistic in June. According to the model, the probability of a soft landing is only 10%. However, the probability of a hard landing is about 80%. When the Fed’s own models predict a recession, you can be sure it’s serious!

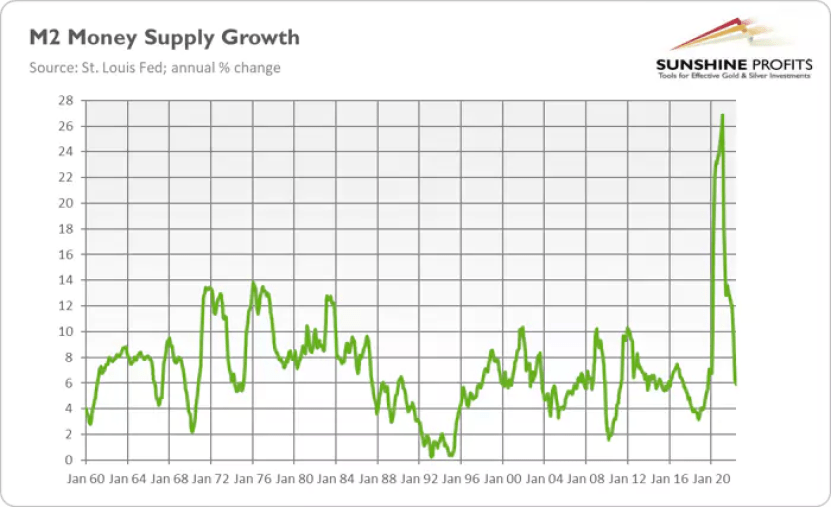

money supply growth

Third, money supply growth has slowed significantly in recent months. As the chart below shows, the growth rate dropped from a peak of 26.9% in February 2021 to 5.9% in June 2022. This is an important change. That’s because the money supply tends to increase rapidly during economic booms and slow down before recessions. The reason for this is that banks put the brakes on creating money.

S&P 500, credit spreads and more

That’s not all! The S&P 500 entered a bear market. However, it has recently managed to recover some of its losses. Credit spreads expanded significantly. Financing costs of ‘garbage’ companies have nearly doubled this year. Housing investment fell 14% in the second quarter of 2022 (excluding the pandemic period), the biggest drop in 12 years. The housing market in general is suffering right now.

The car bubble is showing signs of bursting. Banks are already renting out more land to cope with the expected increase in seized used cars. Business confidence and consumer sentiment are very low. Commodity prices (like copper) have fallen recently. In addition, increased stocks at retailers could also be a harbinger of impending economic weakness.

Low unemployment rate

Of course, not all data points to a recession. In particular, the unemployment rate is still very low. The labor market remains tight. The problem is that the unemployment rate is a lagging indicator, as people start losing their jobs only when the economy is already falling. However, as the chart below shows, the unemployment rate has remained unchanged since it reached 3.6% in March 2022.

It indicates that it has found its bottom and may be ready to rise after a while. Also, the rise in unemployment claims from 166,000 on 19 March to 262,000 on 11 August is a harbinger of imminent problems. If we can get rid of unemployment from the 2001 crisis, why can’t we have an employment recession, at least in theory?

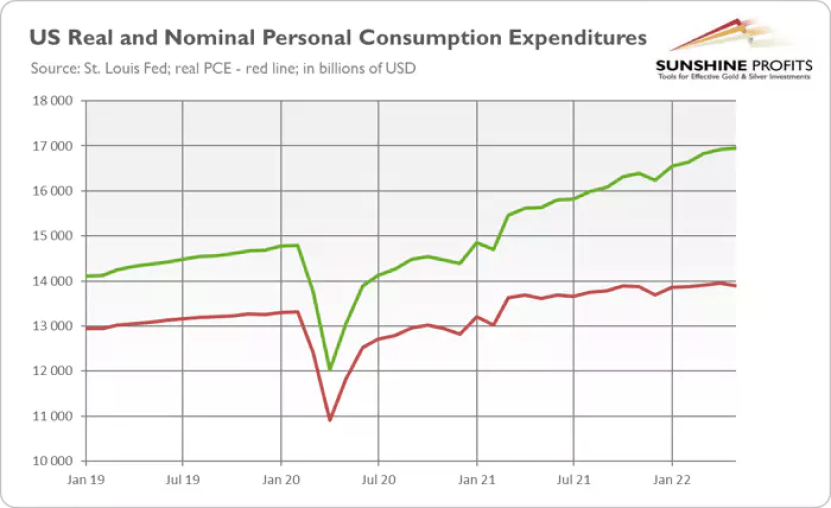

Consumer spending stays healthy

The second popular counter-argument is that consumer spending remains healthy. That’s true, but it’s showing some signs of slowing down as inflation hits Americans’ budgets. In particular, real expenditures adjusted for inflation present a less optimistic picture, as the chart below presents.

Generally speaking, it doesn’t make sense to point to high spending during inflation. Because that’s exactly why we have inflation. The money newly created by the Fed and commercial banks goes to the people who spend it. Also, during high inflation, spending money on goods and services is a reasonable action. Because it is better to have some tangible assets rather than money that loses its purchasing power every month.

More generally, inflation has become so persistent that only serious monetary policy tightening can bring it back to the Fed’s 2% target. In fact, inflation was so high that it seriously disrupted economic life. It is possible for this to trigger a recession on its own. The problem here is that there is a huge amount of private and public debt. Moreover, the aggressive rate hikes necessary to combat inflation are likely to burst asset bubbles and trigger a debt crisis.

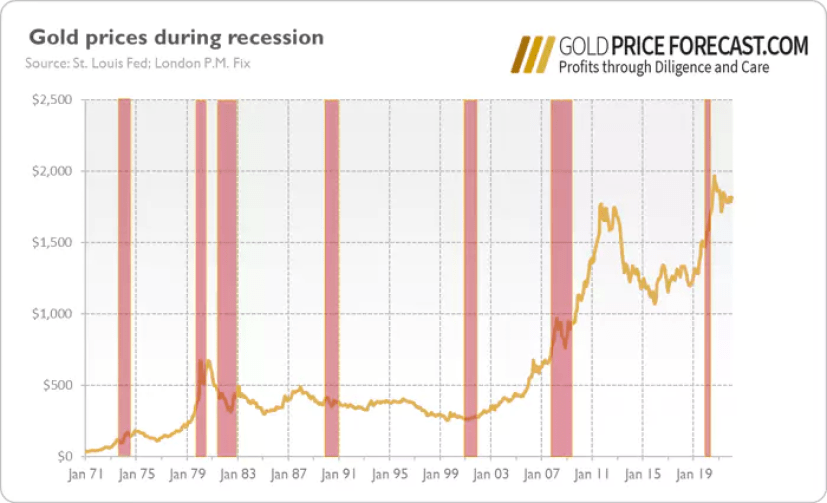

What does all this mean for the gold market?

For me the situation is clear. We are either already in a recession or heading towards a recession. Given that gold is a safe-haven asset, there should be a recession for its prices. As the chart below shows, gold often rises during economic downturns. This has been the case in the last three recessions.

However, this relationship is not set in stone. The double bottom recession of the early 1980s was bearish for gold. The yellow metal rose during stagflation. But it fell when Volcker raised interest rates to combat inflation, despite the Fed’s tightening cycle triggering the recession. Thus, if the inflation rate falls, real interest rates can rise even higher. It is possible that this will put downward pressure on gold. However, a recession is likely to be accompanied by declining bond yields, which should support a dovish Fed and gold.