-

Price Point: Ether outperforms bitcoin as the Ethereum blockchain completes the third and final testnet ahead of the Merge. Bitcoin still hits a two-month high.

-

Market Moves: A Georgetown University law professor sounds an alarm on how the proof-of-stake protocol will make it easier for ether to be considered a security under the Howey Test. What could happen post-Merge?

-

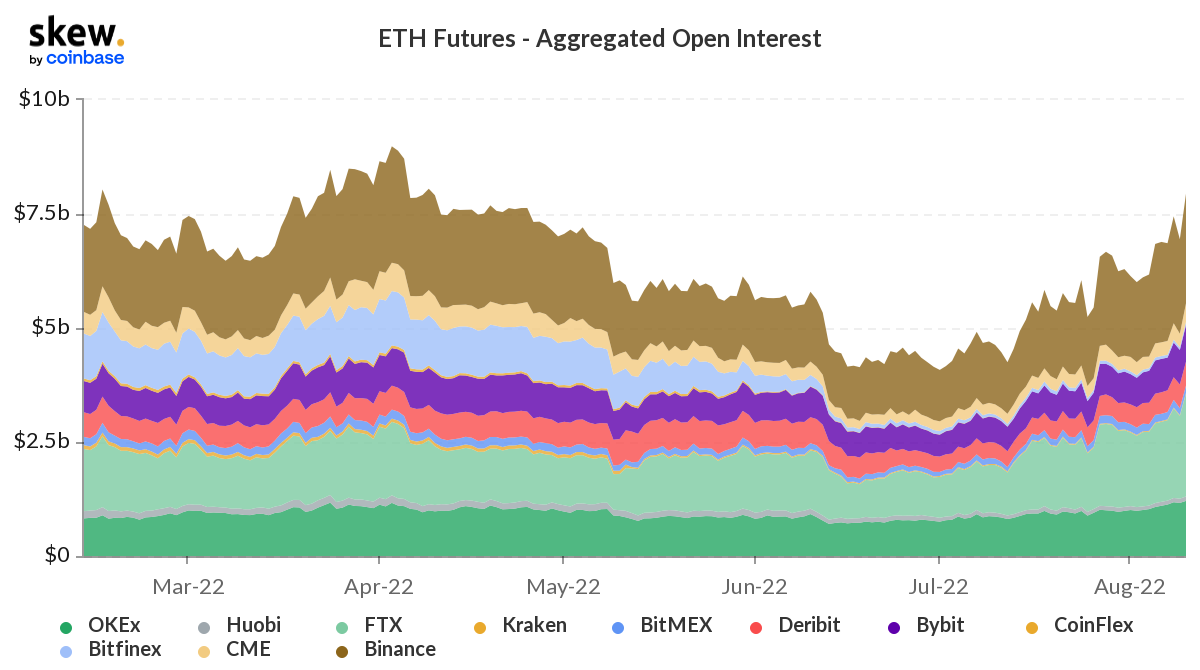

Chart of The Day: Ether futures open interest hits a four-month high.

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Price point

Investors appeared more upbeat Thursday as bitcoin (BTC) and ether (ETH) both traded higher, extending gains after this week’s cooler-than-expected U.S. inflation reading calmed fears of a more aggressive rate hike from the Federal Reserve.

“The inflation report has further fueled the optimism already apparent in the markets and could set the tone for the rest of the summer,” said Craig Erlam, Oanda analyst, in an emailed note.

ETH is outperforming BTC today, up 12% over the last 24 hours thanks to the successful third and final testnet on the Ethereum blockchain ahead of the Merge.

“Goerli” was the last of three public testnets to run through a dress rehearsal of the Merge, which will shift Ethereum from the current proof-of-work system to a proof-of-stake system. With Goerli done, the Merge is expected to take place at some point at the end of September. ETH has been rising ahead of it.

Bitcoin hit a two-month high of $24,658 on Thursday morning. Erlam wrote that he’s “still not seeing the momentum I would expect and want.”

“That may change, of course, and a break of $25,000 could bring that, but we still appear to be seeing some apprehension that may hold it back in the near term,” according to Erlam.

In traditional markets, stock futures rose and the Nasdaq Composite, which includes big technology companies such as Apple (AAPL) and Microsoft (MSFT), rose into bull market territory Wednesday. The Nasdaq rose 2.9%, ending its longest bear market since 2008.

In the news, Near Protocol’s native NEAR token jumped 12% to a high of $5.97 Wednesday after Coinbase (COIN) added the token to its listing roadmap, which shows assets the cryptocurrency exchange plans to add.

Blockchain analytics firm Elliptic said that it can now track crypto movements across and between all blockchains concurrently and in a matter of milliseconds. The firm said the offering can help thwart exploits on cross-chain bridges.

From Seoul, South Korea, CoinDesk’s Shaurya Malwa reported that options trading is more likely to be a key bet among institutional investors in cryptocurrencies than other niches such as decentralized finance(DeFi) or non-fungible tokens (NFT) in the coming years, says prominent crypto fund QCP Capital.

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Solana | SOL | +4.7% | Smart Contract Platform |

| Ethereum | ETH | +4.1% | Smart Contract Platform |

| Loopring | LRC | +3.8% | Smart Contract Platform |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Avalanche | AVAX | −0.6% | Smart Contract Platform |

| Polkadot | DOT | −0.1% | Smart Contract Platform |

Market Moves

What’s at Stake: Will the Merge Turn Ether Into a Security?

By Frederick Munawa

Ethereum’s upcoming Merge could make the second-largest blockchain greener, faster and cheaper. But a law professor says it could also create regulatory headaches by transforming ether, the network’s native asset, into a security under U.S. law.

“After the Merge, there will be a strong case that ether will be a security. The token in any proof-of-stake system is likely to be a security,” tweeted Georgetown Law professor Adam Levitin on July 23.

If Levitin is right, and, more importantly, if the U.S. Securities and Exchange Commission (SEC) shares his view, exchanges that list ether (and that would be nearly all of them) would be subject to more onerous regulatory requirements. Like the bitcoin cryptocurrency, ether has until now been treated as a commodity, outside the SEC’s jurisdiction.

Most chatter in the Ethereum ecosystem has concerned technical aspects of a post-Merge proof-of-stake network rather than such legal questions. Goerli, a software update that took place late Wednesday Eastern time, is the final test before the second-largest blockchain fully transitions from the more energy-intensive proof-of-work to proof-of-stake. The switch is expected to be complete by October.

Levitin’s argument is anchored in the Howey Test – detailed in a 1946 U.S. Supreme Court ruling often used to determine whether an asset is a security. To fully appreciate Levitin’s perspective, it’s important to understand Howey and the concept of staking in a proof-of-stake system.

Read the full story here.

Chart of the Day: Ether’s Key Price Indicator Turns Bullish

By Omkar Godbole

ETH Futures – aggregated open interest (Skew)

-

The dollar value locked in the open ether futures contracts has risen to $7.9 billion, the highest since April 9, according to data provided by Skew.

-

Increased leverage typically means greater price volatility.

Latest Headlines

-

Bakkt’s Q2 Loss Narrows to $27.6M, Tones Down Yearly Guidance: The firm lowered its yearly net revenue guidance to $57 million-$62 million.

-

JPMorgan: Ethereum Miners Face an Abrupt Change Following the Merge: Ethereum Classic miners are likely to be among the main beneficiaries of Ethereum’s shift to proof-of-stake validation, the bank said.

-

Genesis Digital Locks In 708 MW of Energy for Bitcoin Mining: The power capacity is spread across sites in west Texas, as well as North and South Carolina.

-

South Korea’s Financial Watchdog to Expedite New Crypto Rules, local media outlet Edaily Reports: Thirteen bills related to virtual assets are waiting to be debated in Parliament, the chairman of the Financial Services Commission said.

-

Crypto Exchange dYdX Blocked Accounts That Received Even Small Amounts From Tornado Cash: Many users were locked out even though they had no idea they had received funds from the crypto mixer.

-

‘Copycats’ Stole $88M During Nomad Exploit by Copying Attacker’s Code: Coinbase: Over 88% of the addresses involved in the $190 million Nomad attack likely belonged to users copying a code that was initially used by the exploiters.

-

Ether Tops $1.9K as Ethereum Runs Final ‘Merge’ Rehearsal: The Merge optimism has seen ether rally 60% in four weeks.