A recession is coming. But will it really be positive for yellow metal? After all, gold prices fell in 1980 despite the economic downturn. Investment advisor Arkadiusz Sieroń assesses the current state of the shiny metal and takes a historical perspective.

Are Recession and Stagflation good for gold prices?

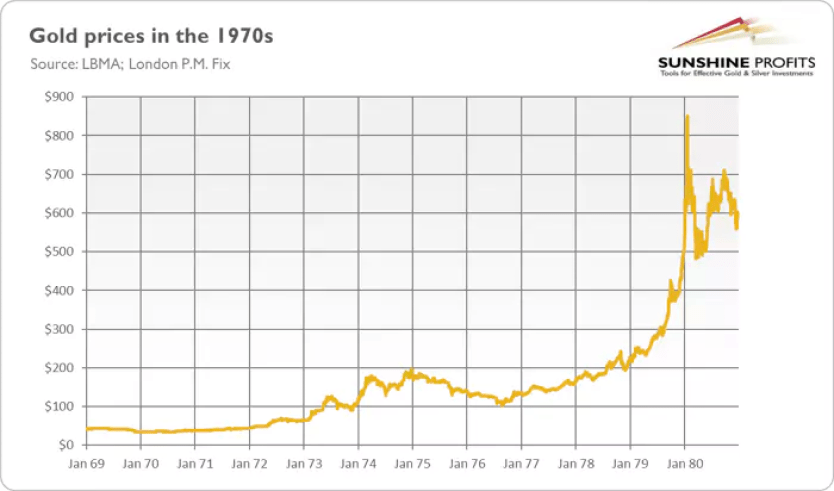

Everyone says the impending recession and stagflation will be good for gold. However, will they really happen? I also had some doubts in my mind, so let’s investigate them. Of course, I do not object that gold rose in the 1970s. This is a fact beautifully illustrated in the chart below.

But was it really caused by stagflation or was it just a coincidence of time? What I mean here is that the 1970s were unique. So, the end of Breton Woods. In 1971 Nixon closed the gold window and the price of gold was allowed to fluctuate freely. Under the gold standard, the US dollar was defined as 13.71 grains of gold, implying that it could be converted to gold at a flat rate of $35 per ounce.

However, such a fixed exchange rate appeared in 1934. Since then, the dollar has been losing its purchasing power. Therefore, the rise in gold prices after convertibility ended was completely natural. It could also have had a limited relationship with widespread inflation. The fixed exchange rate was artificially high for years. That’s why gold was undervalued while the dollar was overvalued.

It is possible for these forces to re-emerge.

Another problem was that in the 1970s the world was moved to a new world made entirely of fiat, floating currencies. Therefore, there was a lot of concern and safe-haven demand for gold. In short, the 1970s was a very special time when several bullish factors occurred that drove up gold prices. But some of these drivers will not exist in the 2020s as the fiat currency system is well established today when it was in its infancy in the 1970s. You can’t break the gold standard twice.

That’s true, but there were also sub-bull markets in the 2000s and 2019-2020, although there were some factors unique to the 1970s. Also, it is very difficult to separate the end of the gold standard from stagflation, as concerns about the new monetary system would have been lower had it not been for hyperinflation. It is clear that Nixon’s shock contributed to the overall economic situation. However, trends in gold prices were ultimately driven by macroeconomic forces. Therefore, it is possible for these forces to re-emerge.

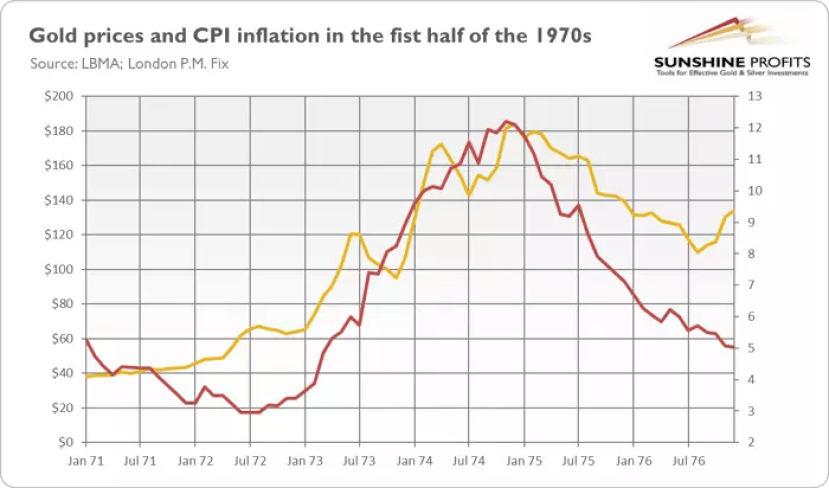

Finally, it seems to me that the initial rise of gold in 1972-1973 has more in common with the abandonment of the gold standard than with CPI inflation and other macroeconomic variables. However, trends in gold prices after that period were mostly related to inflation and other fundamental factors (see table below). Therefore, it would be difficult to argue that the entire bull market of the 1970s was due to the collapse of the gold standard.

After all, what does not rise does not fall!

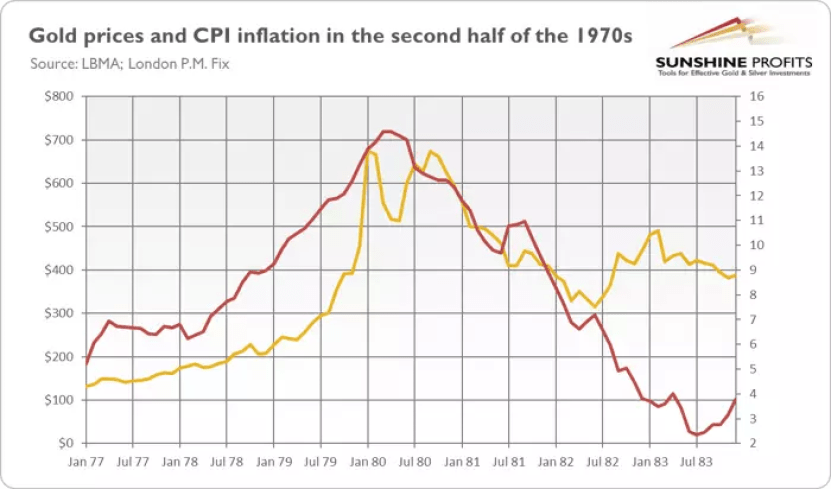

My second concern is probably more troubling. Although the 1970s were a great time for gold, gold prices peaked in the early 1980s with inflation (see chart below). It then entered the bear market for two decades. My concern, therefore, is that when inflation peaks, gold may fall, as it did in 1980-1981, due to low inflation expectations and high interest rates that increase the opportunity costs of investing in gold. As a result, real interest rates increase while inflation expectations decrease during the disinflation period. This should have a negative impact on gold prices.

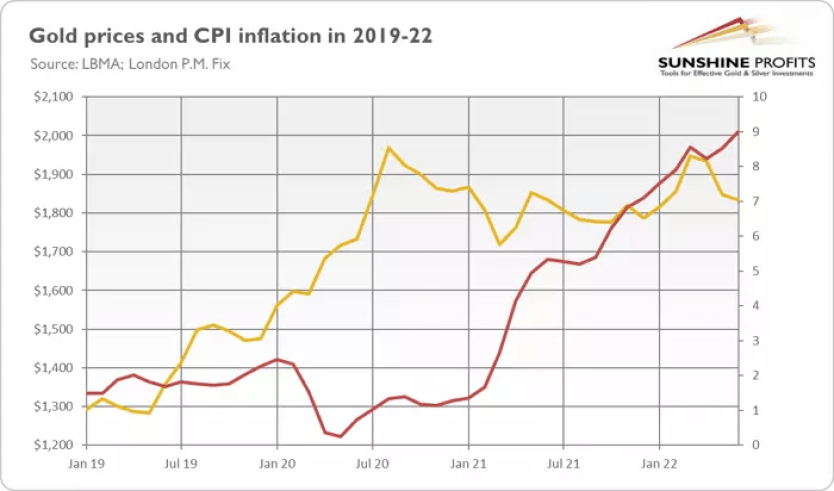

But history doesn’t repeat itself (though it often rhymes). As the chart below shows, gold prices have not actually risen with current inflation. The rally took place in the first half of 2020 amid the coronavirus recession, where both real inflation and inflation expectations initially fell. Therefore, a peak in inflation need not be detrimental to gold. After all, he who does not rise does not fall.

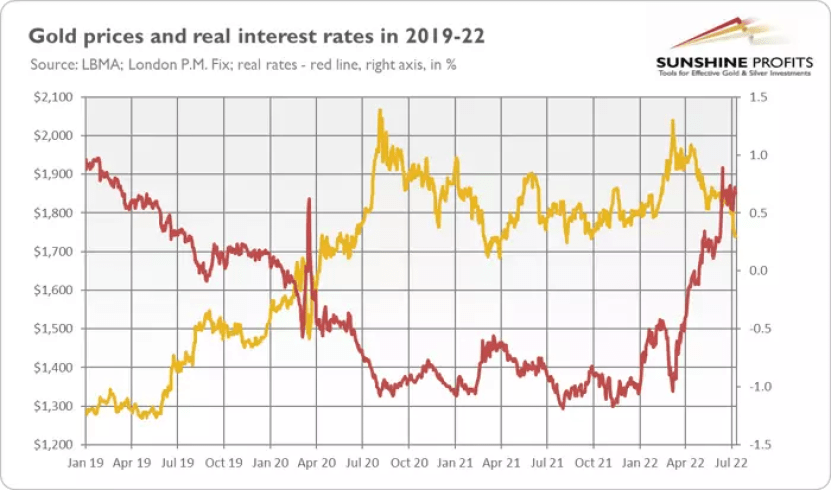

Moreover, real interest rates have already risen (see chart below). The space for further movement is therefore limited. Of course, it is always possible for them to rise. However, the risk of an increase similar to that seen in 1980-1981 is much lower, especially given the recession concerns and the downward impact of interest rates.

Will it be a repeat of 1980 for gold prices?

Additionally, please note that years of ultra-low interest rates have created numerous economic bubbles. So the upcoming economic crisis is likely to be really severe, especially given the pace of the Fed’s tightening cycle. In other words, the level of debt and financial imbalances is higher than in the 1970s. Therefore, even if inflation remains high, it is possible for the Fed to take a dove stance. Or at least likely to soften his hawk stance.

Until now, Jerome Powell had the opportunity to relax his muscles. But one reason why this isn’t is, cryptocoin.com As you follow from , unemployment rate remains low. Also, the increase in interest rates has not yet affected the financial sector. However, once the unemployment rate starts to rise and financial markets begin to falter, the Fed will come under strong pressure to reinvigorate the economy.

I seriously doubt whether he would be willing to accept a truly enormous economic cost to fight inflation. So, fortunately, the upcoming recession for gold doesn’t have to be like it was in 1980. On the other hand, it is possible that it will be quite similar to the one in 2007-2009 or 2020.