Gold closed every day of the week in negative territory, ending a four-week winning streak. U.S. Treasury bond yields, rising on the Fed’s hawkish comments and rising fears of a global recession, put pressure on the gold price throughout the week. The focus shifted to the appearance at next week’s Jackson Hole Symposium. Market analyst Eren Sengezer notes that sellers are trying to keep control.

Last week’s event was the FOMC’s July meeting minutes.

Disappointing Retail Sales and Industrial Production data from China revived fears about the global economic slowdown. Thus, it reminded investors of the potential negative impact of gold on the demand outlook. With the safe-haven influx dominating financial markets at the start of the week, gold tumbled more than 1% on Monday before moving into the consolidation phase on Tuesday.

cryptocoin.com As you follow on Wednesday, data from the US revealed that Retail Sales were unchanged on a monthly basis in July. This data failed to trigger a significant market reaction. Later in the day, the FOMC’s July meeting minutes revealed that some respondents said the policy rate should reach a ‘restrictive enough’ level and stay there ‘for a while’ to control inflation. The Fed’s publication did not include policymakers’ views on the latest inflation and employment data. That’s why market participants largely ignored it. However, the benchmark 10-year US Treasury yield rose more than 3% midweek. Therefore, the gold price extended its decline to $1,760.

Gold price declined as the Fed did not compromise its hawkish stance

In the first half of Thursday, markets remained relatively calm. Weekly data released by the US Department of Labor showed that Initial Unemployment Claims fell to 250,000. The data came in low compared to the market expectation of 265,000. Other data revealed that the Philadelphia Fed’s Manufacturing Business Outlook Survey’s main Diffusion Index for current overall activity rose to 6.2 in August from -12.3 in July. On a negative note, Existing Home Sales in the US fell to 4.81 million year-on-year in July. While the dollar’s response to mixed data has been muted, the currency has benefited from hawkish Fed comments. Thus, it recorded impressive gains against its main competitors.

San Francisco Fed President Mary Daly spoke about her policy outlook in an interview with CNN. “Markets lack understanding, but consumers understand that rates won’t fall right after they go up,” Daly said. Meanwhile, St. Louis Fed President James Bullard said he was in favor of the Fed continuing to pay interest rate hikes upfront. He also noted that he would prefer an increase of 75 basis points at the September policy meeting. Following these comments, gold slumped to its lowest level since the end of July, around $1,750. On Friday, in the absence of high-impact data releases, gold struggled to make a recovery. Accordingly, it lost more than 2% on a weekly basis.

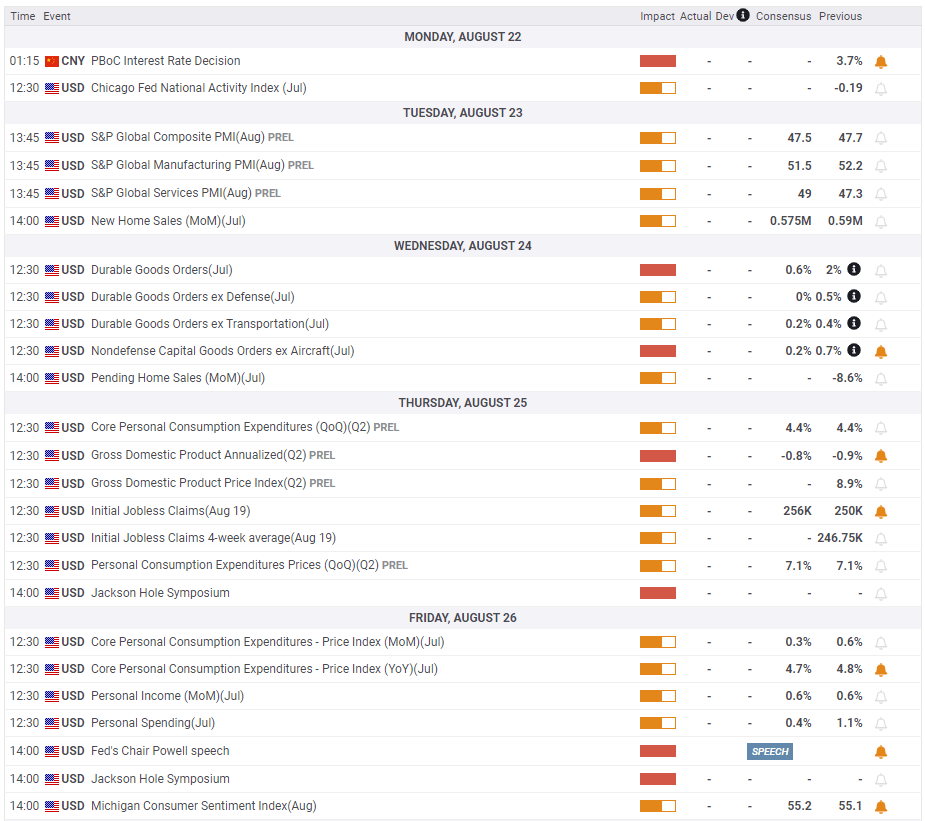

Manufacturing and Services PMI surveys and New Home Sales data will be tracked

S&P Global will release its preliminary Manufacturing and Services PMI surveys for August on Tuesday. The market expects headline PMIs to recover modestly from July levels. Market participants will be watching closely for details surrounding price pressures. If polls point to softer inflation, the dollar is likely to struggle to maintain its strength, he said. It is possible that this may also help gold recover. Of course, the opposite is also true. Also, a significant drop in Headline PMIs is likely to put pressure on the dollar.

Meanwhile, July New Home Sales data are also important for a new momentum. The US housing market is in bad shape due to rising interest rates and weakening mortgage demand. Therefore, disappointing data hurting the dollar is likely to prompt a direct market reaction. On Thursday, the US Bureau of Economic Analysis (BEA) will release its second forecast for annual Gross Domestic Product (GDP) growth in the second quarter. Markets expect the BEA to revise GDP to -0.8% from the initial estimate of -0.9%.

“Depending on Powell’s tone, gold can react both ways”

In the second half of the week, market participants will closely follow the annual Jackson Hole Symposium. On Friday, the second day of the event, FOMC Chairman Jerome Powell will deliver a speech. The dollar is likely to outperform its rivals if Powell opposes the market view that the Fed will turn into a dovish in the second half of 2023, according to the analyst. It is possible that this will also bring it down. On the other hand, the analyst sees a relief rally possible if the president hints at a 50 basis point (bps) rate hike in September, rather than a 75 basis point increase. In this case, US T-bond yields are likely to fall sharply. Sixa is likely to open the door for a decisive recovery below.

The CME Group FedWatch Tool shows that markets are currently pricing in a 46.5% probability for a 75 basis point gain. This means that investors have not yet decided on the size of the next rate hike. So, depending on Powell’s tone, it’s possible that gold will react significantly in both directions.

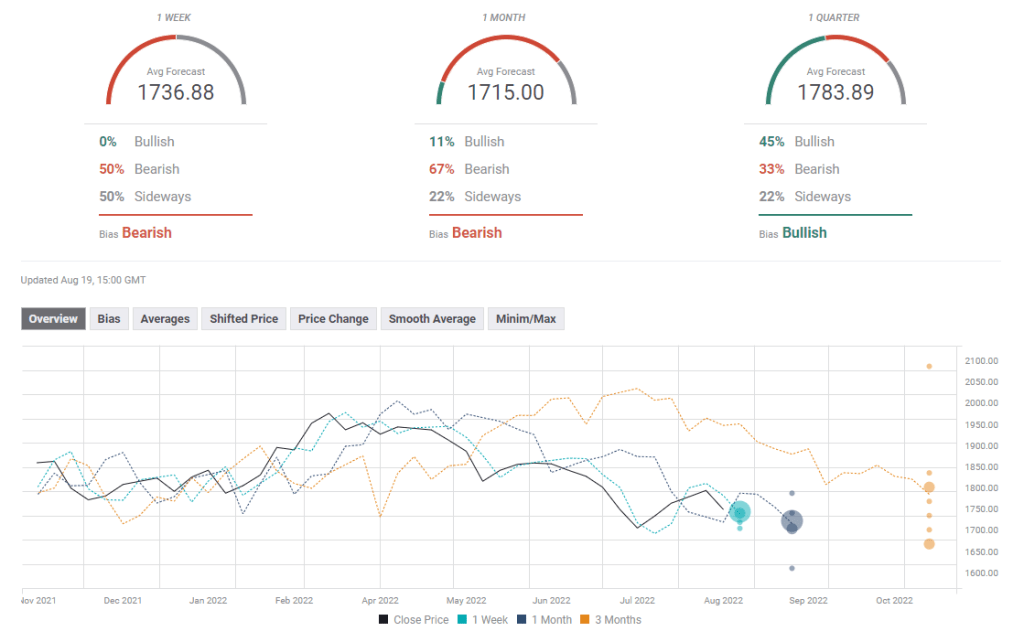

Gold price technical outlook and gold sentiment survey

Market analyst Eren Sengezer draws the technical picture of gold as follows. The short-term technical outlook points to a bearish bias. The Relative Strength Index (RSI) indicator on the daily chart has dropped below 50. Thus, gold has closed the last two trading days below the 20-day SMA. On the downside, immediate support stands at $1,740 (static level), $1,720 (static level) and $1,700 (psychological level, end point of latest downtrend).

The 20-day SMA holds temporary resistance at $1,770 before $1,780 (50-day SMA, Fibonacci 23.6% retracement). If the price breaks above the second level and starts using it as support, the next recovery target is likely to be $1,800 (psychological level).

Half of the experts surveyed by FXStreet expect gold to continue falling. The other half predicts it will consolidate its losses. The one-week average price target is $1,736. In the one-month outlook, several experts are predicting that gold will drop to $1,700. Therefore, the bearish trend remains intact.