Extremely tense emotions returned to the cryptocurrency market last week. As a result, Bitcoin (BTC) starts the new week at its lowest level. So what events will take place this week that are expected to affect BTC, SHIB and altcoins?

How about the BTC price?

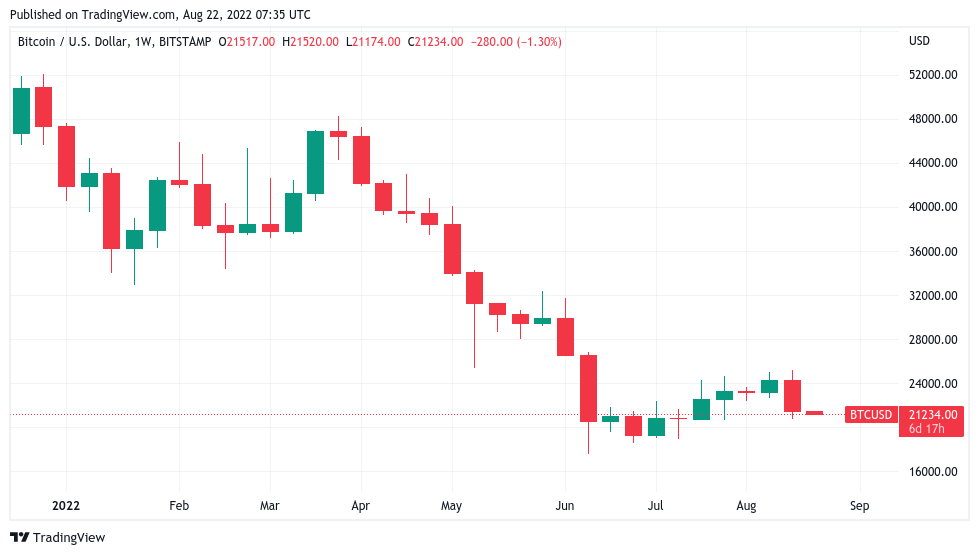

The leading cryptocurrency dropped below $21,000 this past weekend. It is now consolidating around 10% lower than a week ago. Therefore, the resurgence of fear in the crypto markets seems to have been revealed. Some are listing forecasts for new declines. Others point to difficulty for the next few months. Accordingly, the bulls have a lot to deal with in both the long and short timeframes.

Events that will affect Bitcoin, SHIB and altcoins this week

The Fed’s annual Jackson Hole symposium will take place this week. September will be a month of reckoning when it comes to inflation and related macro price triggers. It is possible that this could mean new volatility among risk assets such as cryptocurrencies. Exasperated investors will no doubt not welcome this after the BTC/USD run-ins last week.

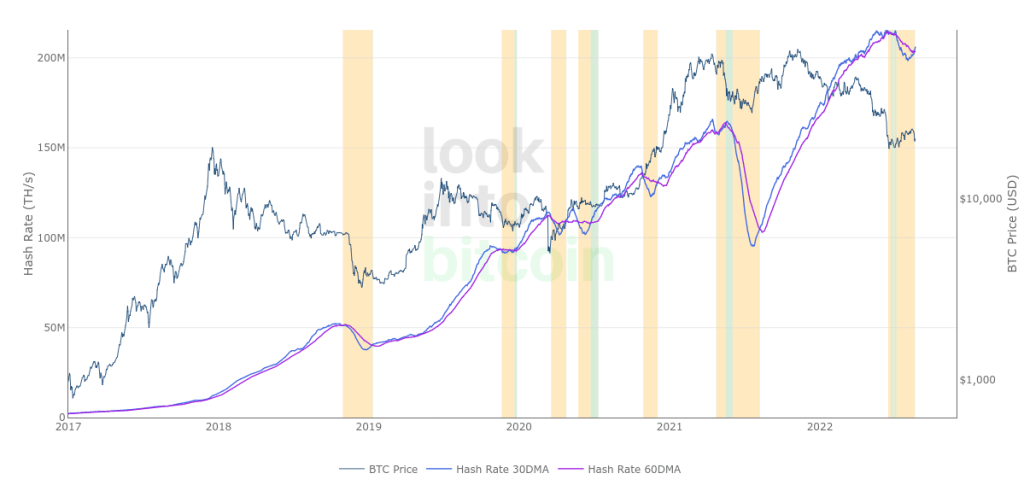

Mining is starting to recover from a rare “capitulation” phase of the hash rate. That’s why Bitcoin miners are giving strong signals that the worst is over. keeping this in mind cryptocoin.comkeeps an eye on events that will impact Bitcoin, SHIB, and altcoins in the coming days and beyond.

Fed’s Jackson Hole symposium this week

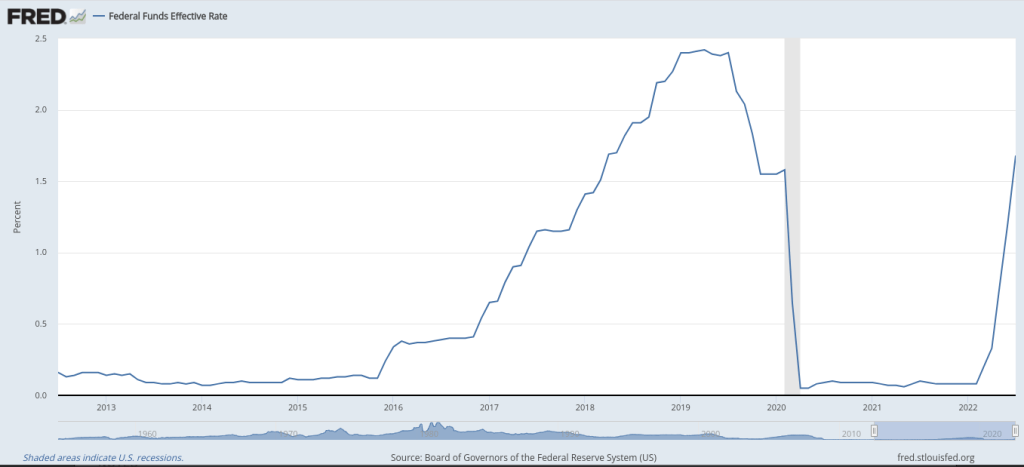

The Fed is once again in the driver’s seat this week on the price of Bitcoin, SHIB and altcoins. Together with banking figures from around the world, they will gather for the annual Jackson Hole symposium on August 25-27. This year’s symposium comes at a critical time for markets in the US and further afield. Inflation under the Fed’s mandate seems to have started to cool. Elsewhere, however, the opposite story holds true.

At the symposium, Fed chairman Jerome Powell may make hawkish statements on interest rates. With that in mind, it’s possible that price volatility could easily rise at symposium time. Interest rate hikes or related disclosures bring volatility to risky assets. However, strong correlations like Bitcoin/stocks make it difficult to break down. Expectations for a 75 or 50 basis point rate hike in September are high.

“Bitcoin, SHIB and altcoins enter 6-month decline”

Bitcoin fell this past weekend, creating a new low for August. After the sudden drop, BTC/USD spent the next days hitting lows in the overall consolidation pattern. This was still going on at the time of writing. A new bearish fear has emerged among analysts. Others, however, argued that the circumstances did not definitively point to further misery.

Crypto analyst Michaël van de Poppe says we will see BTC drop to $21,200 and everything will be fine after that. “The next 6-12 months will be ugly,” said Brian Beamish, founder of The Rational Trader. However, he added, a true macro decline is far away. Another analyst, Matthew Hyland, sees a long-term recovery as certain.

Miners exited the capitulation stage

By looking at Bitcoin miners, we understand that the end of the hard times seems obviously imminent. On-chain data shows that Bitcoin miners have emerged from a two-month period of “capitulation”. The hash strips metric, which uses two moving average hash rates to identify miner engagement trends, is now revealing a rebound.

The aforementioned capitulation was the 3rd longest capitulation, according to Capriole CEO Charles Edwards. The hash rate estimates from the MiningPoolStats tracking resource are remarkable. Accordingly, it indicates that an increase of over 200 exahash per second (EH/s) has begun in recent days. Historically, capitulations have led to BTC price drops. When they expire, they push the entire market up, including SHIB and altcoins.

BTC on exchanges reaches 4-year lows

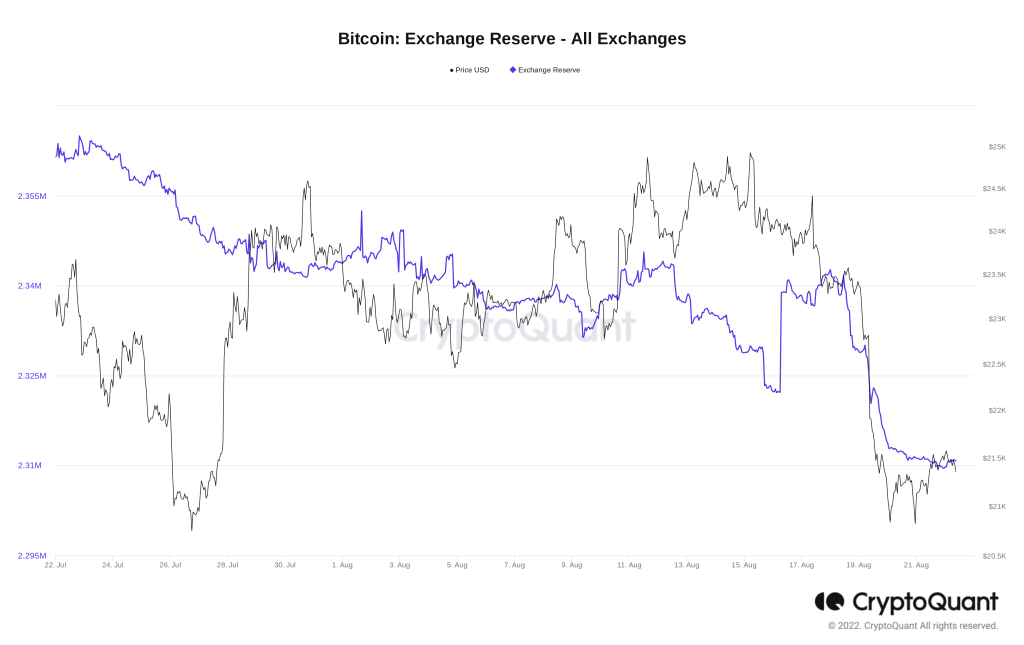

Price struggles on short timeframes have not been a problem for buyers this time. Behind the scenes, investors are entering the market at a noticeable speed rather than fleeing BTC. According to data from on-chain analytics platform CryptoQuant, as of August 18, available Bitcoin on 21 major exchanges fell from 2,342,662 BTC on August 22 to 2,309,727 BTC. Exchange users received 30,000 Bitcoins in just four days.

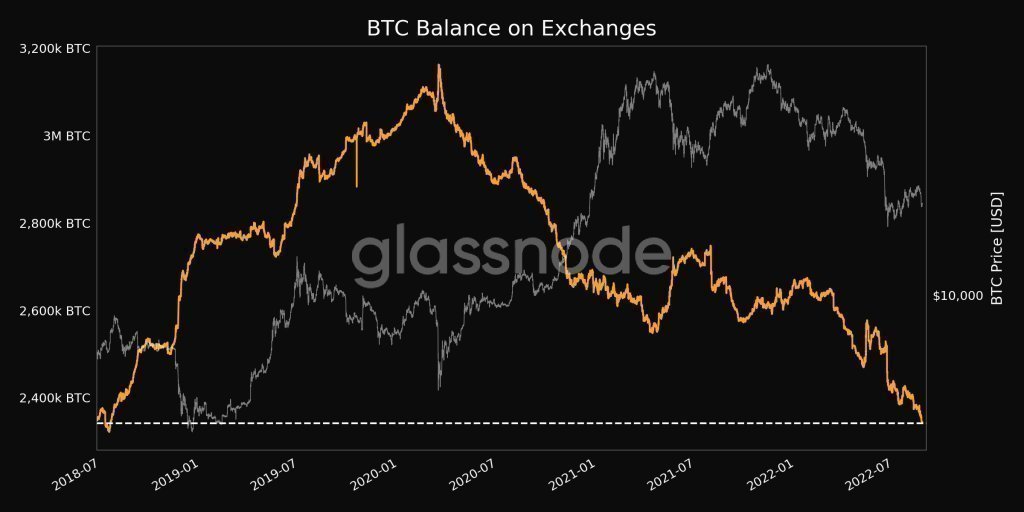

Meanwhile, other data firm Glassnode added that the current combined balance on the exchanges it monitors hit a four-year low on August 22. For comparison, in August 2018 BTC/USD was climbing to $7,000. However, it was still a few months away from the bear market low of $3,100. The fact that investors are buying BTC is a positive indicator for the price.

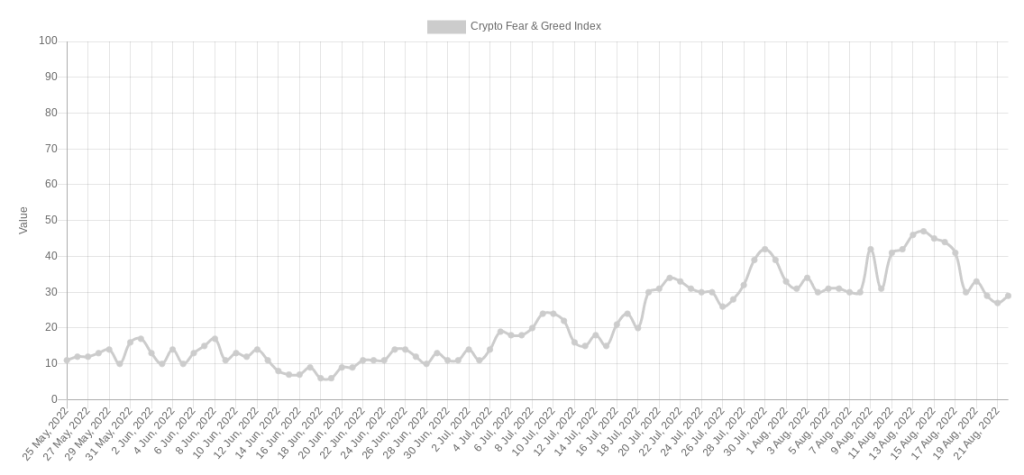

Emotion indicator dropped 40% in one week

Meanwhile, compared to before the price drop, the sentiment is not as it was in crypto. Exchanges are seeing an increase in the number of Bitcoins leaving their reserves. But the overall picture is now definitively “fear” when it comes to Bitcoin, SHIB and altcoin investors. According to the Crypto Fear & Greed Index, the state of “extreme fear” is just one step away. Seven days ago, there was a 40% drop in a single week. The index was at 45/100 and recorded its most optimistic level since April. But it’s currently around 29/100.