The cryptocurrency market started the new week with lows, with the return of extremely tense emotions. Almost the entire altcoin market, including Ethereum, is down over 10% from last week. As the new week revolves around ETH due to the upcoming major update, stablecoins are coming to the fore due to sales.

Whales collect these altcoin projects while prices are 15% off

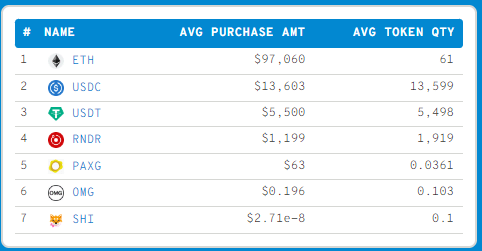

According to data provided by WhaleStats, the top 100 Ethereum whales have bought the following altcoins, mainly ETH, USDC and USDT, in the last 24 hours.

It seems that despite all the sales, the whales continue to accumulate Shiba Inu. Render, the Ethereum-based decentralized GPU rendering network, is in 4th place with $1,199. The general view of the list is as follows.

- Ethereum (ETH)

- USD Coin (USDC)

- Tether (USDT)

- Render Token (RNDR)

- Paxos Gold (PAXG)

- OMG Network (OMG)

- Shina Inu (SHIB)

Meanwhile, among the top 100 Ethereum whales, the holiest position was also held by the Shiba Inu. This list also includes cryptocurrencies such as LINK and MANA.

🐳 The top 100 #ETH whales are hodling

$155,613,759 $SHIB

$85,475,623 $BIT

$77,398,824 $LOCUS

$64,612,224 $MKR

$45,738,864 $BEST

$44,322,056 $MOC

$43,710,843 $LINK

$41,188,732 $MANAWhale leaderboard 👇https://t.co/N5qqsCAH8j pic.twitter.com/MSWDmmZywg

— WhaleStats (tracking crypto whales) (@WhaleStats) August 22, 2022

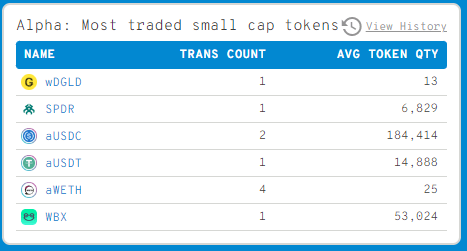

Most traded small-volume altcoins

The table below shows the small-volume altcoin projects that the most whales trade the most. These cryptocurrencies have a market capitalization of between $5-15 million.

- wrapped-DGLD (wDGLD)

- SpiderDAO Token (SPDR)

- Aave interest bearing USDC (aUSDC)

- Aave interest bearing USDT (aUSDT)

- Aave interest bearing WETH (aWETH)

- WiBX Utility Token (WBX)

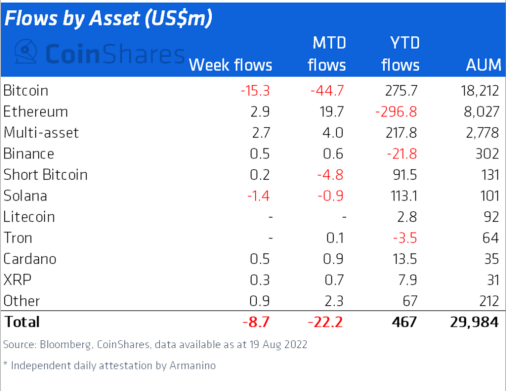

Institutional investors did not sell their crypto despite the sales

Despite huge market-wide sales last week, crypto investment products only saw small outflows of $9 million. According to a recent report by CoinShares, Bitcoin (BTC) saw a total outflow of $15 million for the third week in a row, while Ethereum (ETH) reported inflows of $3 million last week. Meanwhile, the report reveals that it saw small outflows of $9 million last week in cryptocurrency investment products. Also, crypto investment products recorded $1 billion in volume, still down 55% year-on-year on average.

The report shows low participation from investors due to crypto market pressure at the moment. Most of the exits were mostly reported in the USA, Germany and Sweden. Whereas, investors in Brazil, Switzerland, and Australia are pouring funds into crypto investment products. Highlights of the report include:

- Other altcoin investment products, including Cardano (ADA), XRP, and Binance Coin (BNB), have witnessed mild inflows.

- Solana (SOL) saw $1.4 million total debuts for the second week.

- Institutional investors are waiting for an upcoming crypto market rally.