Bitcoin (BTC) has dropped over 12% in the past week. This marks the biggest drop in two months. Analysts say bears are taking control ahead of the US Federal Reserve’s annual economic symposium in Jackson Hole, Wyoming, on Friday.

Bitcoin and altcoin investors will follow Jackson Hole closely

The leading cryptocurrency was sold as the Fed’s July meeting minutes were actively withdrawn against hopes of liquidity easing in 2023. According to observers, Bitcoin’s decline has broken the technical charts and reinvigorated the downtrend. Trader and analyst Alex Kruger said in a statement:

Last week’s slide put the bears in the driver’s seat. The market reversal will take some time and good news will be needed. That said, Fed Chairman Jerome Powell is unlikely to deliver good news later this week.

According to Coinbase head of institutional research, David Duong, Bitcoin’s daily technical chart has entered a bearish trend. So, it is possible that the coin will continue to lose ground in the short term. Duong, in his weekly market comments,

BTC will likely retest support at $20,830, and $19,230 in the next few weeks. Traders will follow Powell’s comments closely at the Jackson Hole symposium.

What will Jerome Powell’s stance be like in Jackson Hole?

After last week’s Fed minutes, there is a consensus in the market that Powell will be on the hawkish side during the Jackson Hole Economics Symposium. Sponsored by the Kansas City Federal Reserve Bank, the annual meeting welcomes central bankers, finance ministers, academics and financial market participants. David Duong says:

Fed Chairman Jerome Powell will likely try to take a more measured approach in Wyoming. In this context, it will emphasize that the tightening cycle is not over yet. The Fed’s monetary tightening has turned the cryptocurrency market upside down this year.

Michael Kramer, founder of Mott Capital Management, wrote in a weekly market update:

I would expect Powell to make it pretty clear that the pace of future rate hikes may slow, but they still have a lot to climb and they will stay higher for a while.

“It is too early to make further predictions for Bitcoin”

cryptocoin.com As you follow, the Fed said at some point it would be appropriate to slow down tightening. This triggered a relief rally in risk assets. However, according to Dean Peng, Vice President of Singapore-based digital asset management platform Metalpha, monetary policy is lagging. So the Fed will likely stick with the hawk scenario, at least for a while. Peng explains his views as follows:

The effect of high interest rates on inflation will appear after about six months. It is too early to make any further predictions for Bitcoin at the moment.

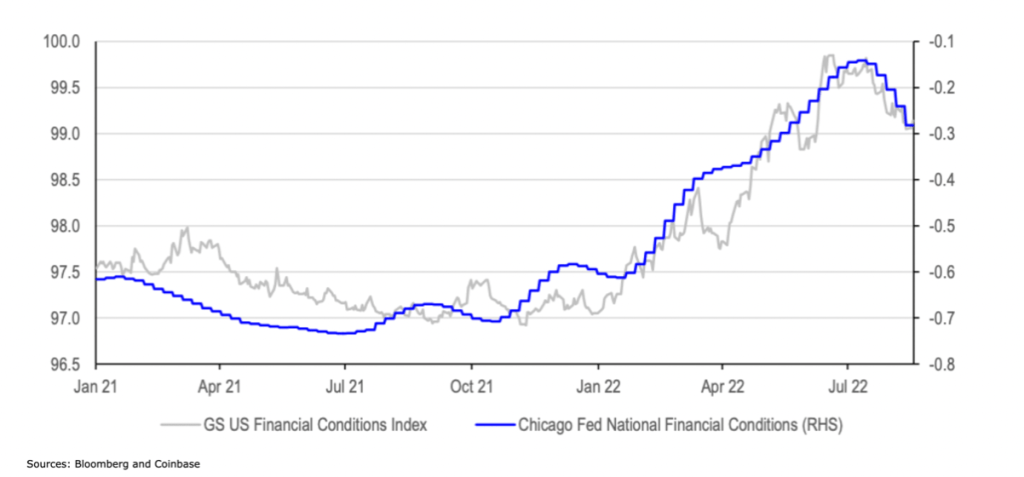

Conditions in nearly all US financial markets have eased since mid-June. So the Fed has plenty of room to sustain the pro-tightening bias for a little while longer. Tighter economic conditions are widely seen as a sign of slowing growth. At the same time, the opposite is also true. The tighter the conditions, the harder it is for the central bank to drain liquidity from the economy without curbing growth.

While Bitcoin’s short-term prospects look bleak, most of the downtrend has likely materialized. Metalpha’s Peng said, “In the medium and long-term perspective, the current market is at the bottom of the Kitchin cycle. Meanwhile, the bottom-building process will repeat over the next few months.”

Chart shows US financial conditions have eased since mid-June Source: Bloomberg, Coinbase

Chart shows US financial conditions have eased since mid-June Source: Bloomberg, Coinbase