-

Price Point: The total crypto market capitalization has fallen below the $1 trillion mark. Also, bitcoin’s 200-week moving average multiple, a critical level of support used to determine an overall long-term market trend, is suddenly trending down.

-

Market Moves: Ethereum Merge drama continues as traders pile out, then back in. CoinDesk’s Jimmy He looks at what traders are doing.

-

Chart of the Day: Data shows the Merge is increasingly being mentioned on social media.

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Price point

Bitcoin (BTC) and ether (ETH) gained ground slightly Tuesday as markets continued to stabilize following last week’s bloodbath. U.S. stock futures posted modest gains and bond prices edged up.

Over the last seven days, BTC is still down 10% and ETH by 12%. This has pushed the overall market capitalization to below the $1 trillion mark.

Total Crypto Market Cap (TradingView via Crypto AG)

The one-day Heiken Aishi (average bar) candles called a reversal this week as the open/close spread is very tight.

Some analysts are expecting the upcoming Merge, a major milestone for the second-largest blockchain, Ethereum, to have a positive impact on the crypto market as a whole, while others are saying it will have little effect on price.

“A short-term rally towards $1.2 trillion is plausible, but I would expect the market to keep being range-bounded going into the Merge,” wrote David Scheuermann, analyst at Crypto Finance AG in a market note.

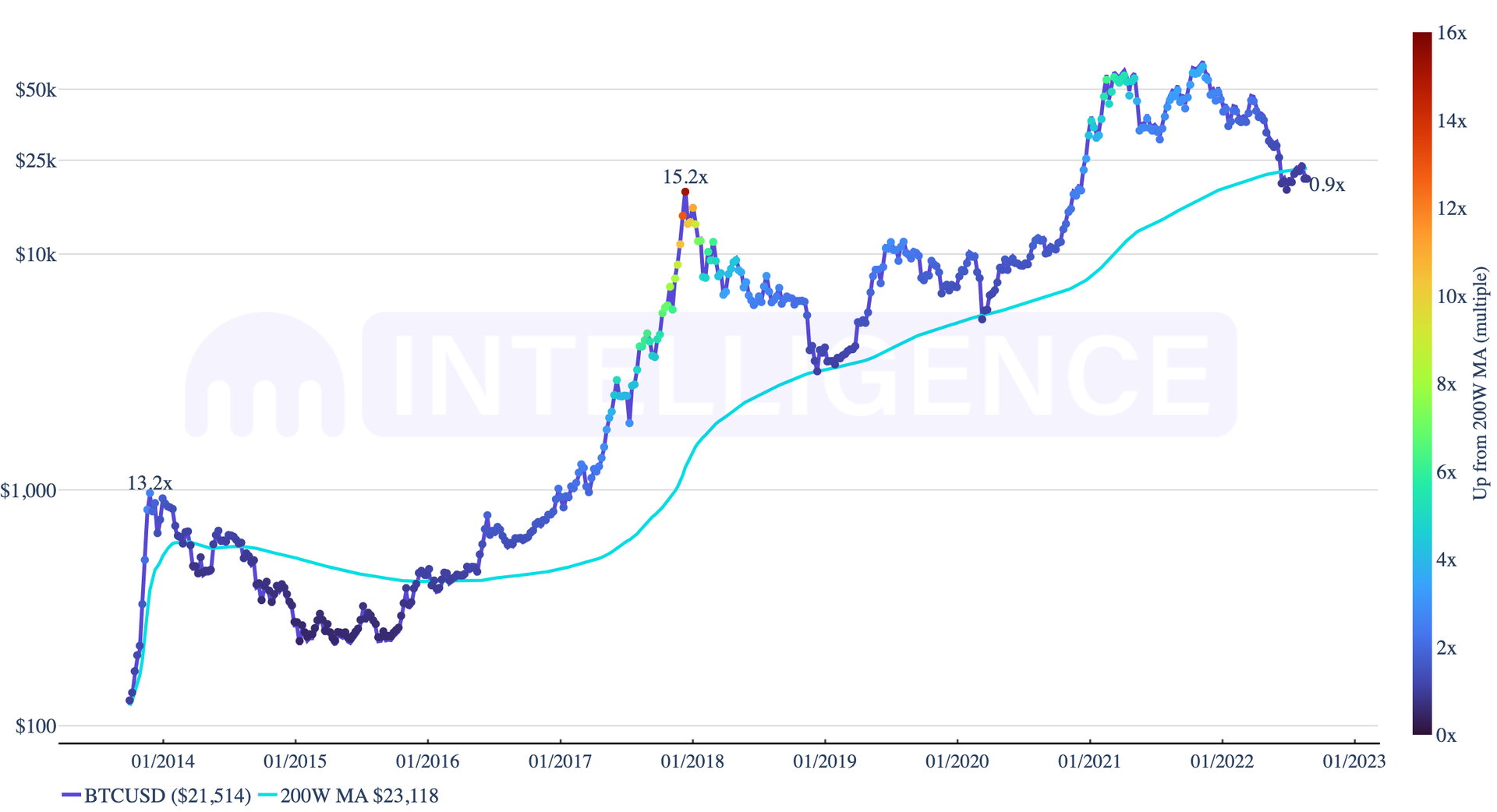

Another indicator, bitcoin’s 200-week (200W) moving average multiple, a critical level of support used to determine an overall long-term market trend, is suddenly trending down.

The 200W moving average is a critical level of support used to determine an overall long-term market trend. The trendline measures the average price of BTC over the prior 200 weeks.

Bitcoin’s 200W Moving Average Multiple (Kraken)

According to data from Kraken, BTC is trading at 0.9 times its 200-week moving average, which is down 0.3% week-over-week, now at $23,118.

At the current 200-week moving average, a 10x to 15x multiple (historical range) implies a price range of $231,188 to $346,782, according to a report from Kraken Insights.

In March 2021, the multiple hit a local high of 5.8x before entering into a downtrend.

In the news, crypto exchange Coinbase faces a class action lawsuit over alleged lapses in security. Filed in a Georgia court, the suit alleges the crypto exchange failed to secure users’ accounts against theft and hacks, and seeks damages upwards of $5 million.

Andreessen Horowitz, months after it established a $4.5 billion crypto fund, the venture capital firm has said it sees the crypto-market slump as an investment opportunity. The company said crypto can shift power away from big internet companies in a report.

Also, CoinDesk’s Amitoj Singh was on the ground in Istanbul for Eurasia’s largest blockchain conference. You can read more about it here.

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Cosmos | ATOM | +13.0% | Smart Contract Platform |

| Polkadot | DOT | +6.1% | Smart Contract Platform |

| Loopring | LRC | +4.0% | Smart Contract Platform |

Biggest Losers

Market Moves

Ethereum Merge Drama Continues as Traders Pile Out, Then Back In

By Jimmy He

For the past month, crypto markets have been buffeted by speculation over the potential impact of Ethereum’s (ETH) coming Merge – a major milestone for the second-largest blockchain. A key question is how the shift to a proof-of-stake system, which is supposed to be faster and more energy-efficient than the current proof-of-work protocol, will affect prices for ether and related digital assets.

And with the event now approaching, expected next month, the market narrative keeps twisting.

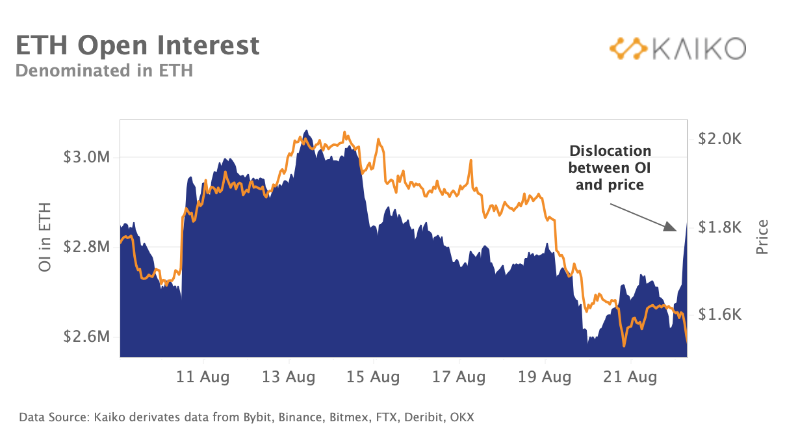

According to a weekly report from the data provider Kaiko, ether’s steep price plunge on Friday brought a swift decline in open interest on derivatives – contracts that traders used to make leveraged bets on the cryptocurrency’s future price. Many traders had their derivatives trades liquidated, or wiped out due to margin calls, according to Kaiko.

But on Monday, money flooded back into the ETH futures market, the data provider found.

“As the price dipped below $1,600, we observed a significant spike in open interest,” Kaiko wrote.

ETH open interest denominated in ETH (Kaiko)

Ether perpetual funding rates

There’s also been plenty of movement in funding rates on ether perpetual contracts, which are similar to futures contracts on commodities but without expiration dates. The funding rates recovered to near-neutral levels after dipping alongside the token’s price.

“When combined with the spike in open interest we observed this morning, it seems these new positions in ETH futures are biased long and investors are bullish at these price levels,” Kaiko wrote.

Trading volumes flipped

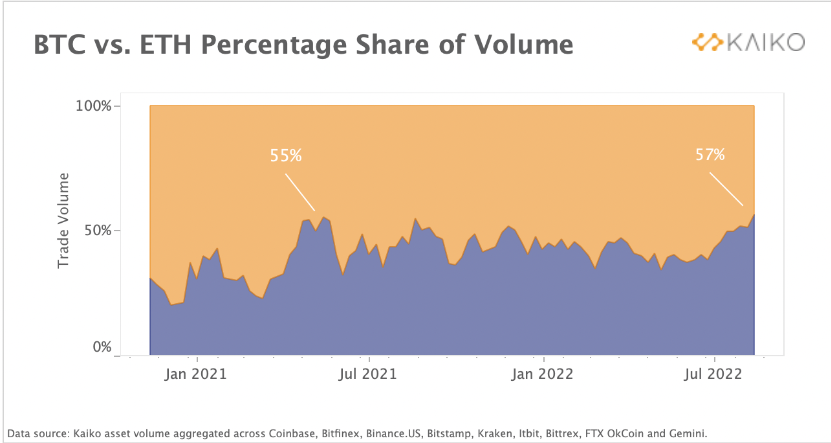

BTC vs. ETH percentage share of volume (Kaiko)

Separately, ether’s share of the weekly, combined trading volume of ether and bitcoin hit 57%, the highest since 2018. This trading activity exceeded Ethereum’s previous peak of 55% during the May 2021 crypto sell-off.

“The main driver of ETH trading activity in July has been increased optimism around the Merge and an improvement of global risk sentiment. However, last week’s selloff across markets confirms that ETH remains a higher beta play,” Kaiko wrote.

Read the full story here.

Chart of the Day

ETH Merge Discussions Heat Up

By Omkar Godbole

Ethereum’s social volume (Santiment)

-

Data tracked by analytics firm Santiment shows Ethereum’s impending technological upgrade, dubbed “The Merge”, is increasingly being mentioned on social media.

-

Large spikes in social media mentions indicates retail investor euphoria, often observed at local price tops. Ether has come under pressure with social media seeing record interest in the topic.

-

Interest is likely to remain high as we near the supposedly-bullish Merge, slated to happen in mid-September.

-

“As we draw closer, it’s very likely we see yet another spike in ‘Merge’ social dominance and similar price action (alts dropping, ETH rising) as late comers pile in whatever they have to ride it, which eventually increase the chance of things leading to a blow off top,” Santiment said in the blog post published last week.

Latest Headlines

-

RBI Governor Says Central Bank’s Warnings Pushed People to Avoid Crypto, ET Now Reports:The central bank has maintained banning cryptocurrency is the most suitable choice for India.

-

LooksRare Fork Sudorare Rugs for $800K Despite Crypto Twitter Warnings: Developers behind the project deleted Sudorare’s social media channels and its website on Tuesday morning.

-

Andreessen Horowitz Says Crypto Can Shift Power Away From Big Internet Companies, Financial Times Reports:Months after it established a $4.5 billion crypto fund, the venture capital firm also said it sees the crypto-market slump as an investment opportunity.

-

No Safety Net From Crypto Collapses, German Regulator Warns: The financial regulatory authority for Germany, BaFin, has toughened warnings about consumers potentially losing all their crypto investments, unlike holdings with regulated banks.

-

Bitcoin’s Weekly Chart Shows Bear Market Likely to Worsen or Does It?: The upcoming weekly chart bearish crossover has a perfect record of trapping sellers on the wrong side of the market.

-

Coinbase Faces Class Action Lawsuit Over Alleged Lapses in Security: A class action lawsuit filed in a Georgia court alleges the crypto exchange failed to secure users’ accounts against theft and hacks, and seeks damages upwards of $5 million.

-

Turkish Delight or Slight: Decoding Eurasia’s Largest Blockchain Event: Billed as Eurasia’s largest blockchain conference, Blockchain Economy Istanbul didn’t live up to the hype, some attendees said.