Gold prices fell 3% last week. The yellow metal slumped on Monday as the strong dollar continued to press the metal, but rose on a rebound on Tuesday. According to Bloomberg Intelligence, there is another reason for the poor performance of gold. Gareth Soloway of InTheMoneyStocks says gold will be the best performing asset by the end of the year.

“It is still early for gold to recover against copper and crude oil”

High inflation is still the top concern for central banks around the world. Gold, however, is down 4.3% from year-to-date. And one possible explanation could be that the gold market is seeking deflationary forces to win in the long run. Mike McGlone, senior commodity strategist at Bloomberg Intelligence, comments in a note:

Gold’s poor performance despite its highest inflation in 40 years may indicate that the metal, which is considered a store of value, expects permanent deflation. Therefore, it is possible to say that it continues to outperform most commodities.

McGlone says it’s still early for gold to recover against copper and crude oil. He also adds that the precious metal looks promising. In this context, the analyst makes the following statement:

Our analysis with wheat shows that the shiny metal tends to surpass other commodities. The juxtaposition between the temporary wheat price increase in 1 Hour and gold. It is possible for metal to play in favor of 2H with lasting results. An important economic indicator for 2H. Gold and the Bloomberg Commodity Spot Index could show whether the rate will bounce back from a support zone held since 2008.

“This indicates a buoy for gold prices”

cryptocoin.com As you follow on , the two biggest hurdles for gold in the first half of 2022 were a strong US dollar and an aggressive Fed. Still, the result for gold could be a solid price foundation. Mike McGlone has this to say on the subject:

Gold has appreciated against crude oil since the financial crisis. The ratio of gold to crude oil is similar to the bottom in 2018. This is mainly because of the paradigm shift of North American oil supply exceeding demand.

This year’s rise in energy costs has led to an accelerated path of rate hikes. McGlone sees it possible for gold to benefit as this increases the likelihood of a global recession. In this context, he comments:

The gold-copper price ratio is probably in the early stages of a 2-hour climb from a permanent support level. The fact that the price of copper and the Nasdaq 100 Stock Index both fell by about 20% in 2022 through August 19 could signal a resumption of more persistent deflationary forces and a buoy for gold.

“Inflation will not return to 2% or below for a long time”

The stock market rally, which started in mid-June, started to reverse as of mid-August. On Monday, the S&P 500 fell 2.1% from the market close. InTheMoneyStocks chief market strategist Gareth Soloway says the volatility isn’t over yet. He also notes that stocks will likely see new lows. The strategist makes the following assessment:

This is fear that the Fed will not back down. We got the FOMC minutes last week. It was the end of this kind of movement. In those minutes, we touched the 200-day moving average, which is the technical resistance level. And as soon as they heard from the Fed, they didn’t seem as dovish as the market would like.

Soloway says it’s possible that stocks won’t return to their 2021 highs for many years. Therefore, “The stock market peaked in 2021. We’re not going to take those peaks for five to ten years,” she says. Soloway also notes that worsening macroeconomic conditions are to blame. In this regard, he makes the following statement:

You will have this Genie out of the bottle as inflation. It won’t go back to 2% or below for a long time. This means that the Federal Reserve can’t get us out of the next recession, especially the next one.

“Gold will be the best performing asset by the end of this year”

Soloway says an economy ‘soaked in stagflation’ will not survive for years. It also states that it will put pressure on stock prices and earnings. He notes that investors and traders will have to become prospective stock collectors. In addition, Soloway maintains his view that gold will be the best performing asset by the end of this year. The strategist makes the following assessment:

I think you’ll want to stay away from indexes. You need to start looking and seeing what new technology is, for example, what a stock with a good dividend is.

“Gold prices face solid support around $1,730”

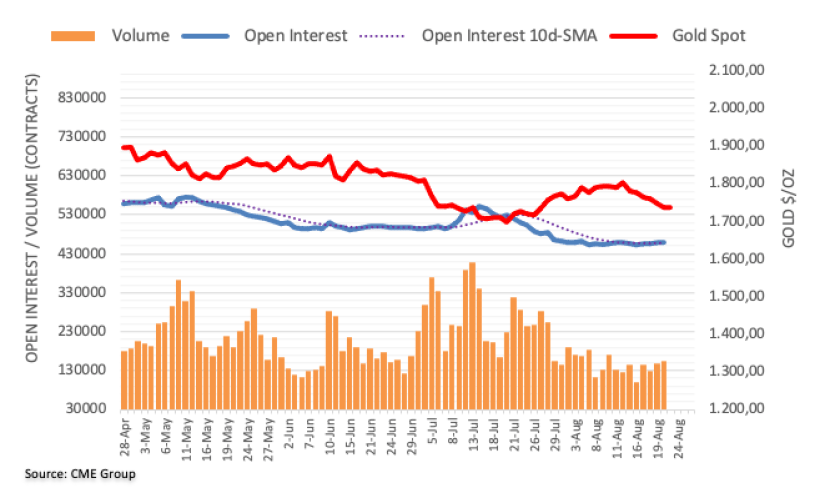

Open interest for gold futures markets rose for three consecutive days, according to preliminary data from CME Group. After that, only 483 contracts were shrunk at the start of the week. Instead, volume rose for the second straight session, now with around 5.8k contracts.

Gold prices fell for the sixth consecutive session on Monday. However, the daily pullback was in the midst of declining open interest, according to market analyst Pablo Piovano. This points to the view that the pullback may take a breather in the very near term. So far, solid support looks to be near $1,730 for now.