Whale movements say a lot to cryptocurrency investors. Because big investors know more about cryptocurrencies than ordinary investors. Recent data based on whales reveals that major non-exchange wallets are leaving an altcoin. Accordingly, whales are selling ETH as the leading altcoin project Ethereum’s Merge upgrade approaches.

Over-the-counter whales sell on leading altcoin project

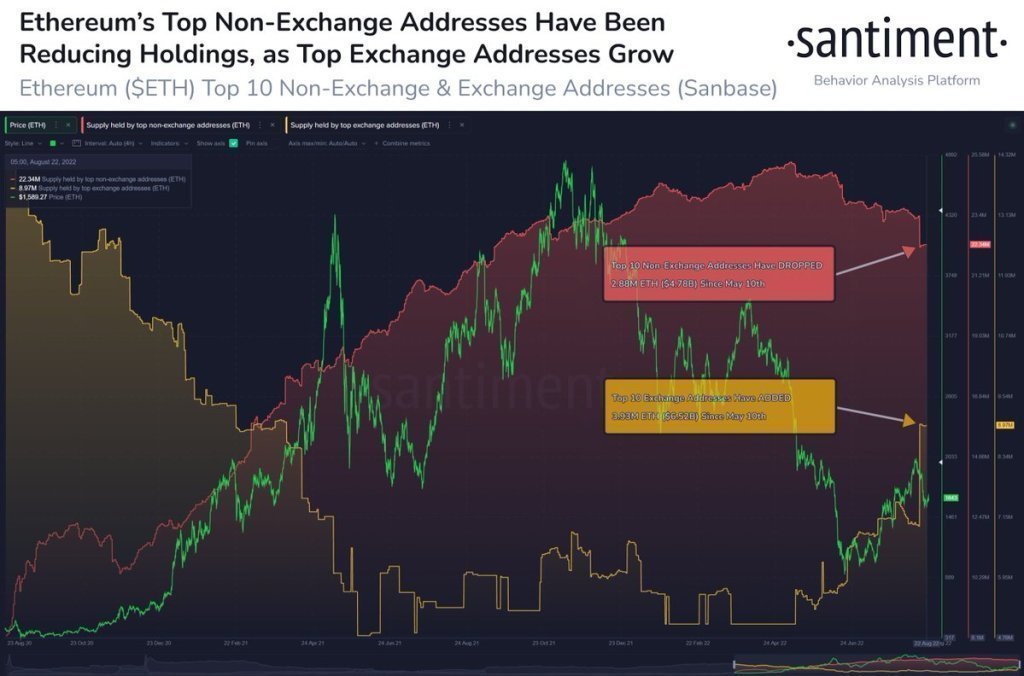

On-chain analytics firm Santiment reveals the bearish sentiment of the 10 largest over-the-counter whales in Ethereum. The supply of Ethereum (ETH) held by over-the-counter whales continues to decline. So whales are selling on the leading altcoin project. However, a different mood prevails in stock market whales. The supply of stock market whales continues to increase in August.

cryptocoin.com As we have previously reported, on September 15, Ethereum will perform the Merge upgrade. Despite the growing investor hype about Merge, the biggest whales have dwindled their holdings. The top 10 whales over the stock market have sold around 3 million ETH since May 10. These ETHs amount to almost $5 billion according to current data. This indicates that the whales have reduced their accumulation by 11%.

Stock market whales continue to accumulate ETH

During the same period, the top 10 exchange whales made more room in their wallets for the leading altcoin project. These whales have accumulated massive amounts of ETH since May 10. Accordingly, the top 10 exchange whales have added 4 million Ethereum worth approximately $6.52 billion to their portfolio. The increasing inflow of altcoin assets to the stock markets shows the selling sentiment among investors. It also reveals that they increased their ETH savings by 78% during this period.

Why are whales selling Ethereum?

The sales of the biggest whales over the exchange show that they are expecting a drop in the price of Ethereum (ETH) after the Merge. As it is known, the altcoin after Merge will be quite deflationary. It’s possible that this was the reason behind the sale. Ethereum founder Vitalik Buterin has already confirmed that the ETH price will be more deflationary with Merge. With the upgrade, the EIP-1559 burning mechanism will come and the circulating Ethereum resource will decrease.

Also, it is unlikely that the Ethereum Merge upgrade will lower gas fees, increase transaction fees, and enable withdrawals of staked Ethereum. The clarity of the Ethereum Foundation surrounding Merge also led to a drop in ETH price. However, Merge preparations gained momentum as Ethereum clients released execution layer and PoS layer updates. The network will see the Bellatrix upgrade on September 6 and the Paris upgrade on September 15.

Leading altcoin may see massive depreciation

On August 19, chart analyst Ali Martinez stated that Ethereum risks a 28% price correction. Also, the analyst said that Ethereum has broken the ascending wedge pattern to the downside and failing to hold the $1700 price point could prove fatal. The analyst stated that more than 680,000 addresses can be purchased at this price and that if the level is violated, panic selling may occur. In addition to Martinez, CoinShares Chief Strategy Officer (CSO) Meltem Demirors also evaluated the leading altcoin project. According to him, Merge will reveal little price impact for Ethereum.