A trading robot with a reputation for outperforming the markets has shared their new analysis. The robot reveals the latest portfolio allocations as Bitcoin and most altcoins try to recover from an overall downtrend. Here are the details…

Robot altcoin trader shares his weekly portfolio

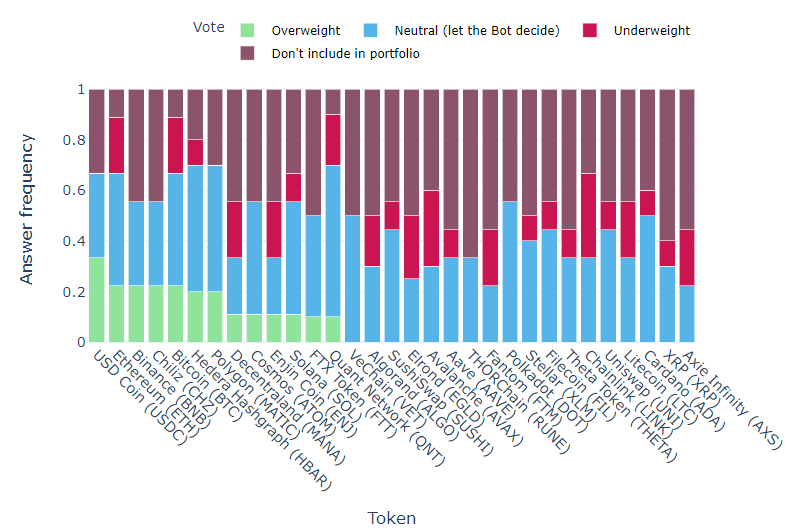

Every week, Real Vision Bot compiles algorithmic portfolio reviews based on a “hive mind” consensus. When compiling it, it uses a poll in which users vote. The latest data from the bot reveals that the risk appetite of traders has decreased significantly compared to a week ago. Most market participants vote with 11 altcoins in their portfolio, in addition to the top crypto assets Bitcoin (BTC) and Ethereum (ETH).

US Dollar Coin (USDC), a dollar-pegged stablecoin with increased allocation, took the top spot, while last week the altcoin was around 20 percent. The four cryptoassets that took second place with a weight of 22 percent were the leading smart contract platform Ethereum, the native token of the popular cryptocurrency exchange Binance BNB, the sports fan token network Chiliz (CHZ) and Bitcoin. Currently, the bot is stated to be in “risk-off mode”. You can view the portfolio as follows:

- USDC 33 percent

- Ethereum 22%

- Binance 22 percent

- Chiliz 22 percent

- Bitcoin 22%

What were the other altcoins in the portfolio?

Hedera Hashgraph (HBAR), a decentralized application creation protocol, is in sixth place, up 20 percent. Then came the layer-2 scaling solution Polygon (MATIC). The following leading digital assets all received 11 percent “overweight” allocations:

- Decentraland (MANA)

- Cosmos (ATOM)

- Enjin Coin (ENJ)

- Left (LEFT)

The last altcoin pair to receive a hefty 10 percent allocation was FTX cryptocurrency exchange FTX Token (FTT) and enterprise-grade interoperability solution provider Quant Network (QNT). The latest exchange portfolio breakdown based on the survey is led by USDC, with 23.4 percent. This is followed by Polygon with 18.8 percent, Binance and Chiliz with 15.6 percent, Cosmos and Hedera Hashgraph with 9.38 percent each, and finally FTX Token with 7.81 percent.

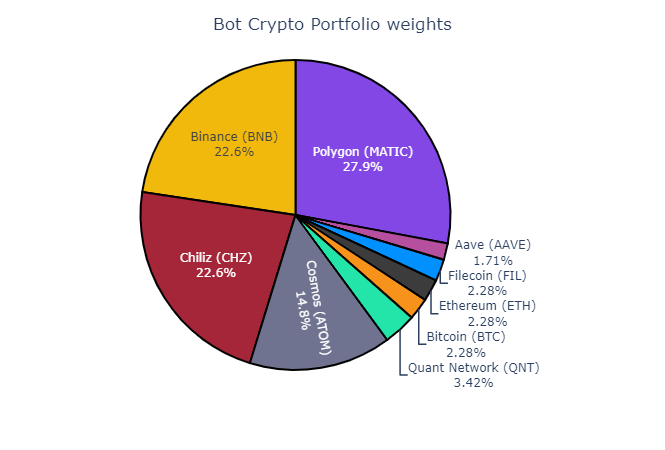

What’s in the bot’s special portfolio?

The bot itself also compiles a custom portfolio. Real Vision reports that MATIC is the leader with 27.9 percent, followed by BNB and CHZ with 22.6 percent and ATOM with 14.8 percent. Five digital assets between 1.5 percent and 3.5 percent were acquired, including QNT, BTC, ETH, the decentralized storage network Filecoin (FIL) and lending and borrowing protocol Aave (AAVE).

cryptocoin.com As we reported, Real Vision Bot was jointly developed by quantitative analyst and hedge fund CEO Moritz Seibert and statistician Moritz Heiden. Real Vision founder and macroeconomics expert Raoul Pal described the bot’s historic performance as “astonishing”. He said that it outperformed the top 20 cryptoassets in the market by 20% combined.