Bitcoin continues to experience monthly and weekly declines. According to some, what could be an interesting weekend in the crypto market. So, what levels should you watch? Here are the details…

Fractals and buy signals in the Bitcoin bear market

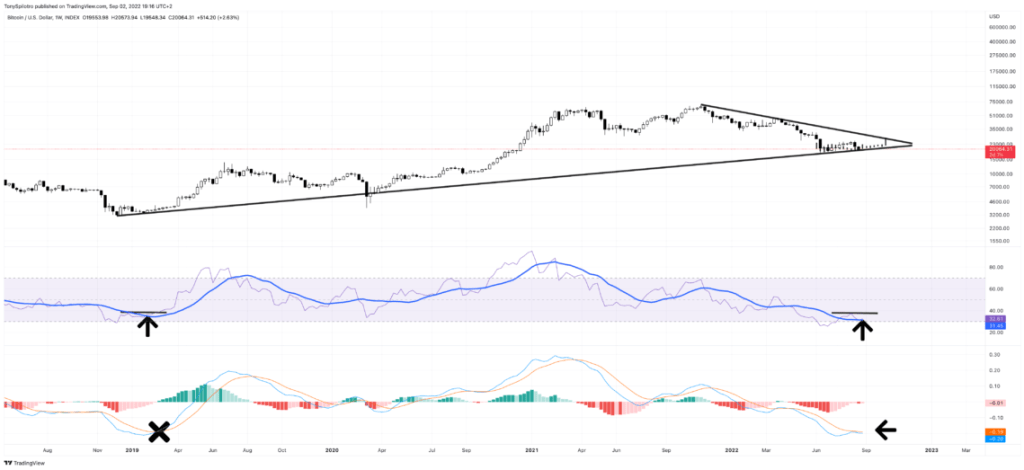

According to analyst Tony Spilotro, Bitcoin price is watching a fractal from the bottom of the bear market. Interestingly, the Relative Strength Index has a similar structure to what it was then. Meanwhile, momentum behaves very differently to LMACD. For a buy signal to appear in the Relative Strength Index, the RSI must top higher and break past the black drawn line. The RSI moving average also held up after a retest, just like the last crypto winter.

He also said that he expects a bullish crossover in the weekly LMACD. Momentum has leveled off with the bottom of the last bear market. However, it continues to trend horizontally. Price and both indicators are approaching the break of the bearish resistance resistance, which could potentially produce a bullish move.

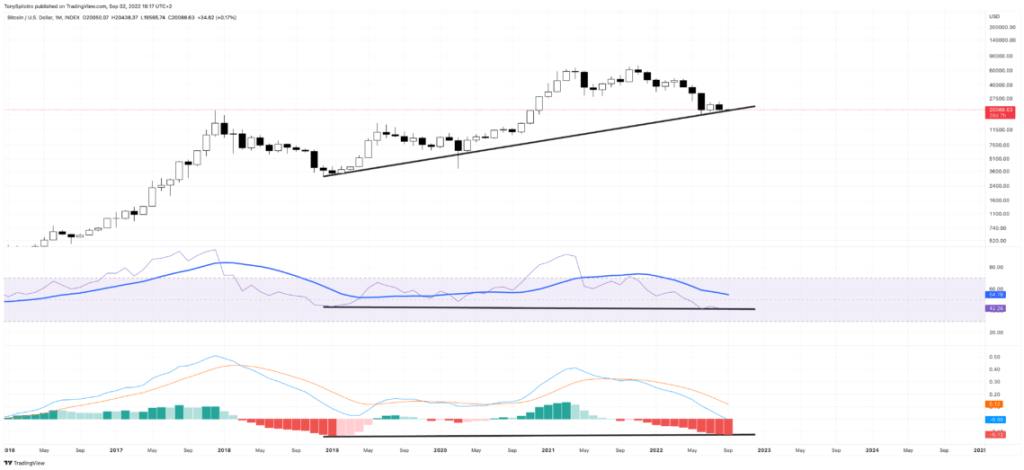

If a bottom is formed here, there is potential to hold a significant trendline. The trendline doesn’t seem very important until you zoom out the monthly timeframes. On a monthly basis, it currently supports the entire trend since 2018 on a candle close basis. The trendline will give us a potential hidden bullish divergence in both the RSI and the LMACD.

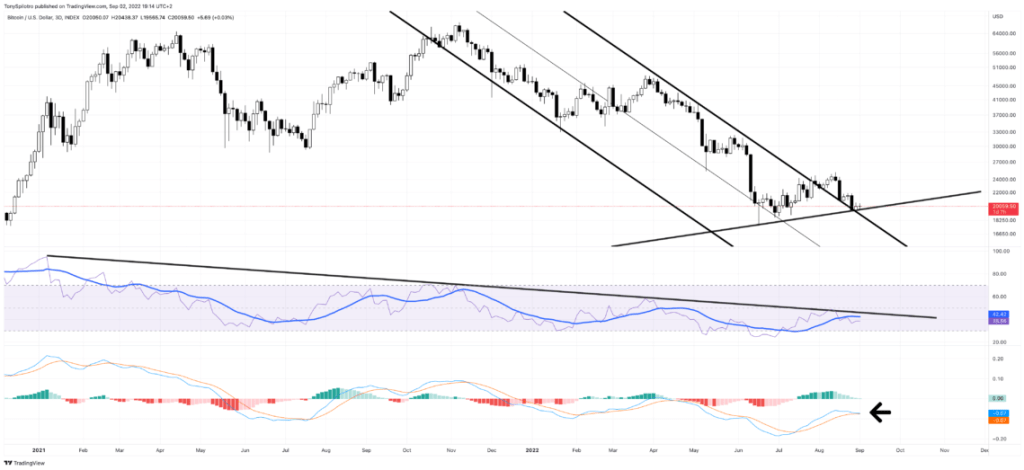

Has Powell’s downtrend been broken?

According to the analyst, who talked about how the next three days, including today and our weekend, will perform, the chart below can give us an idea. It also looks set to diverge upwards according to the 3-day LMACD. RSI downtrend resistance continues to narrow. This gives the indicator a slight but downward movement. A subjectively drawn downtrend channel may indicate that we have exited the downtrend, retested it and are ready to go up.

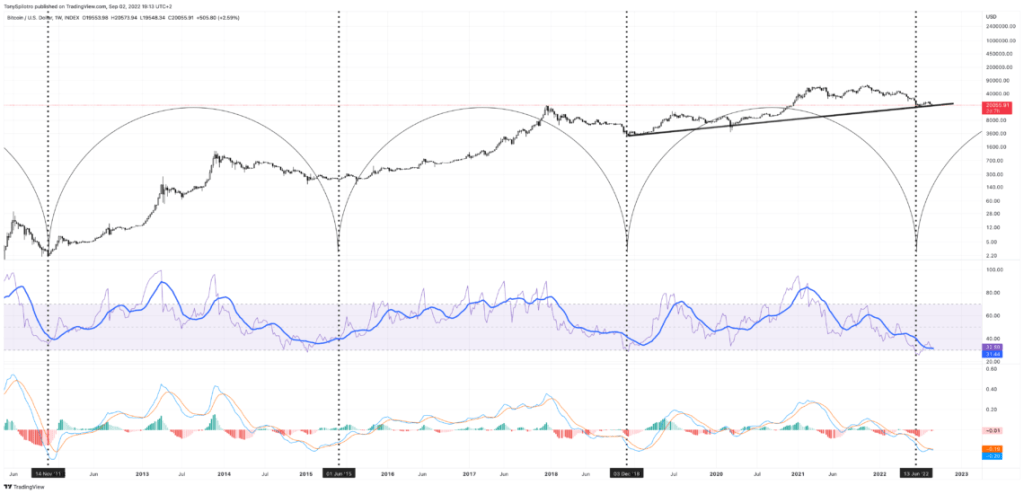

At times like these, we may turn to cyclical instruments to see if there is any “rhythm” or “similarity” to where the market has bottomed in the past. “Across price, RSI and LMACD, there is no denying the apparent cyclical behavior,” Spilotro says. Bitcoin is facing its riskiest environment ever. However, according to the analyst, we may be looking at one of the best setups in terms of reward in a very long time.

cryptocoin.com As we have also reported, BTC is losing momentum again after the latest price drops. It is currently changing hands at $19,900, down 0.8 percent. The largest cryptocurrency with its market value displayed its downward momentum about 10 days ago, after the speech of the FED Chairman.