On Friday, US jobs data came in broadly in line with expectations. After that, with the withdrawal of the dollar, the gold price rose. However, it still recorded its third consecutive weekly decline amid pressure from the high interest rate environment. Analysts interpret the market and share their forecasts.

Carsten Menke: Some bargain hunting possible in the market

Spot gold rose 0.85% to $1,711.67 on Friday, closing the week at this level. The yellow metal is down 1.8% to date, touching a six-week low of $1,687.60 on Thursday. U.S. gold futures, on the other hand, were last up 0.78% at $1,722.50. Julius Baer analyst Carsten Menke comments:

The dollar fell a little more this morning. This helps gold regain the ground it lost after yesterday’s drop. Some bargain hunting is also possible in the market after prices drop to $1,700.

Carlo Alberto De Casa: Gold doesn’t have much room for recovery

Commenting on the latest market data, Kinesis Money analyst Carlo Alberto De Casa makes the following statement:

Markets priced in the massive rise in interest rates. For that, gold doesn’t have much room for recovery. Investors want to understand how hawkish the Fed can be, and that solid employment data will put more pressure on the central bank to raise interest rates, which are negative for gold.

Jim Wyckoff: Gold sees some kind of shorting rally

In its closely watched employment report, the U.S. Department of Labor announced that nonfarm payrolls rose 315,000 jobs last month. Economists polled by Reuters had predicted payrolls would increase by 300,000. Jim Wyckoff, senior analyst at Kitco Metals, comments:

Job numbers were very close to market expectations. The market sees this as a goldilocks trick as it shows no weakness. However, it is not strong enough to prompt a more aggressive Fed. Gold is seeing a kind of relief (short closing) rally.

Piero Cingari: The downward trend in gold prices has not changed

By the way cryptocoin.com As you follow, the dollar index (DXY) fell around 0.1%. This made gold cheaper for offshore buyers. In addition, US Treasury rates also decreased on a daily basis. Capital analyst Piero Cingari says the following about the developments:

A slightly weaker US dollar and US short-term Treasury yields have given gold some relief recently. However, this did not change the downward trend in gold prices.

Ole Hansen: Above this level is needed for a recovery

Gold has come under pressure of late as global central banks raise interest rates to combat rising inflation. Higher interest rates increase the opportunity cost of holding a non-yielding asset. Saxo Bank analyst Ole Hansen points out this technical level in a note:

On the technical front, the yellow metal must climb above the trendline at the current March high of $1,770 before signaling a rebound.

TDS: Gold will start melting below $1,675

With each fall, the risk of capitulation of gold increases. TD Securities economists expect the yellow metal to drop below the $1,675 level. Economists note that the top players in the Shanghai markets continue to increase their gold despite the depreciating CNY. These flows, along with central bank demand, likely prevented gold from melting in a liquidity vacuum amid a hawkish Fed narrative, according to economists. Based on this, economists make the following assessment:

However, as we approach the pandemic entry levels of this group, with each tick drop in prices, the risk of inflated prop-shop positions to capitulate increases. Technical short signals continue to solidify, while the downtrend below is gaining momentum. It is possible that the risk of a breakout in the broad DXY will coincide with a meltdown of gold below the $1,675 range.

Pablo Piovano: For gold, the door is open for further decline

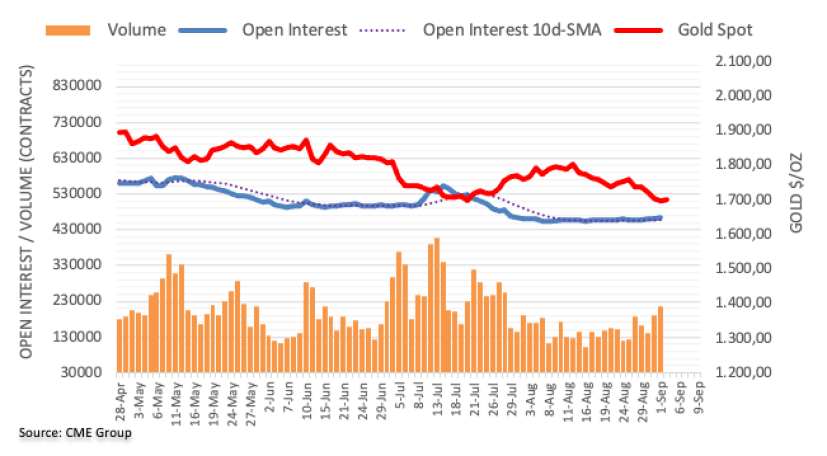

Open interest on gold futures markets has increased by about 3.8 thousand contracts this time, according to preliminary data from CME Group. Thus, he extended the uptrend for another session on Thursday. Meanwhile, volume followed suit. Volume rose by around 25.3k contracts in the second consecutive session.

Gold fell below the key $1,700 support on Thursday for the first time since July. The analyst notes that the daily correction is behind the rising open interest and volume. In this context, the 2022 low at $1,680 (July 21) indicates extra losses in the near term.