Cryptocurrency investors are used to volatile periods, and they even love these periods. However, something other than the Ethereum merge will cause this in the near future…

September 13 is important for the cryptocurrency market, but not because of the merge

The Merge update is an important event that will definitely increase the volatility of the cryptocurrency market. It should therefore be considered by any crypto investor. But in addition to the update, another event may soon cause tension.

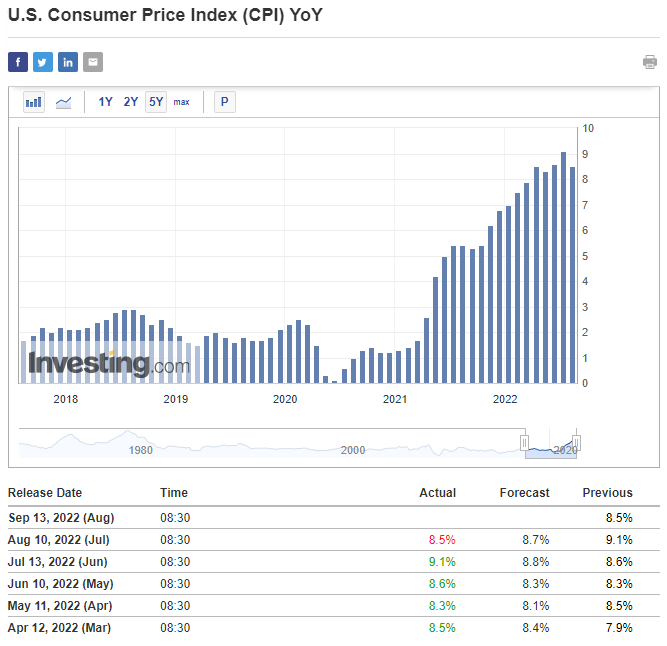

US CPI Data

September 13 will be the day when consumer price index data will be released in the public domain. It will also help investors understand what’s going on with US inflation.

For the last two times, inflation data has caused a huge spike in market volatility. The figure announced for the first time was much higher than expected. But now, July data has softened inflation, bringing a pleasant surprise to investors.

On August 10, Bitcoin hit a local high of $25,000 after the data. As a result, the market has seen an increase in trading volume and volatility. Despite the short-term enthusiasm, however, the markets failed to enter full recovery mode. Therefore, it was withdrawn after a short time.

Ethereum merge starts next week

With the Ethereum merge happening in less than 10 days, almost every crypto expert is focusing on the upcoming volatility, liquidity and potential security issues that the merge could cause. In one of our recent Merge articles, we talked about how the core update will cause a crisis in the DeFi industry. Accordingly, some will want to maximize their profits by borrowing ETH from platforms like AAVE or Compound. Others may withdraw their ETH from liquidity contracts, creating a potential liquidity crisis ahead of the network’s snapshot.

What should I pay attention to in the cryptocurrency market as Merge approaches?

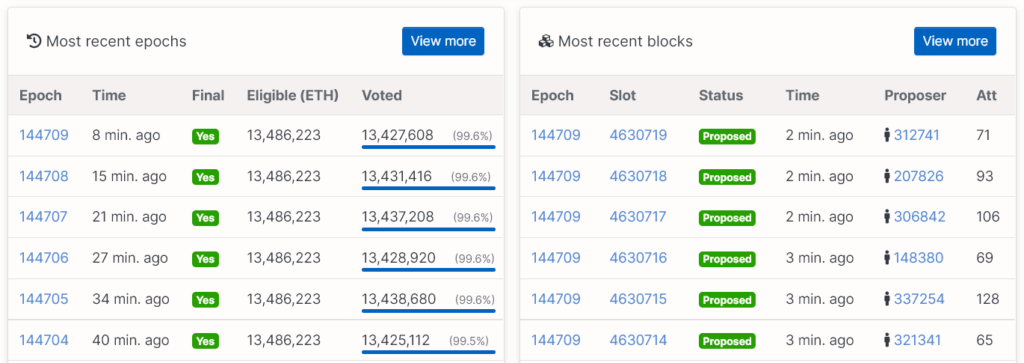

The Ethereum merge is fast approaching and it will be important to keep a close eye on the following data sources. The first is to actively monitor the Eth2 Beacon Chain mainnet from reputable sources such as BeaconScan by Etherscan and Ethscan ETH2 Explorer by Redot.

Red flags on this monitor would be low voting turnout in periods, lack of precision after thirteen minutes (2 periods), or grinding stops on proposed blocks.

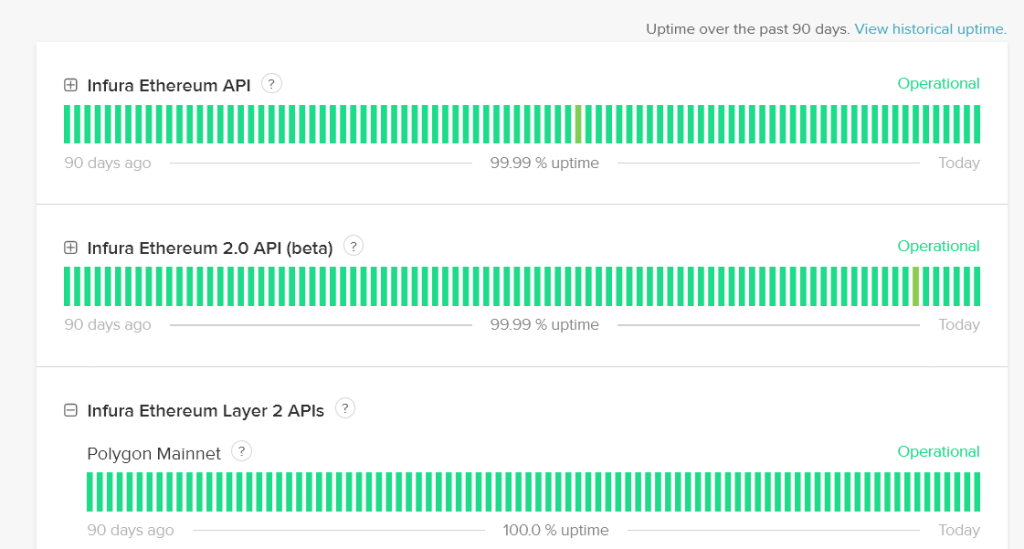

Infura’s Ethereum 2.0 API Monitoring

Infura provides the infrastructure to build decentralized applications, allowing developers to deploy their solutions without hosting their own full Ethereum node operators. The company is wholly owned by Ethereum venture capital group ConsenSys, controlled by Joseph Lubin.

According to Infura’s website, projects based on its infrastructure include Uniswap, Compound, Maker, Gnosis, Brave, Decentraland and Web3 wallet provider MetaMask.

Therefore, monitoring Infura’s API is a good starting point for evaluating the performance of DApps. Additionally, considering how closely linked Infura is to the Ethereum ecosystem, their status page should reliably display real-time updates.

cryptocoin.comYou can take a look at the detailed merge guide we have prepared here.