Bitcoin has not only seen significant declines, but has also reached its initial recovery level target. The recovery rally was as quick as it was surprise. Crypto analyst Akash Girimath sees a minor pullback likely to get the next leg up. While the short-term outlook is bullish depending on the time frame, the bigger picture for BTC is largely bearish with the possibility of brewing another disastrous crash. We have prepared Akash Girimath’s Bitcoin forecast and analysis for our readers.

Bitcoin forecast and macro view

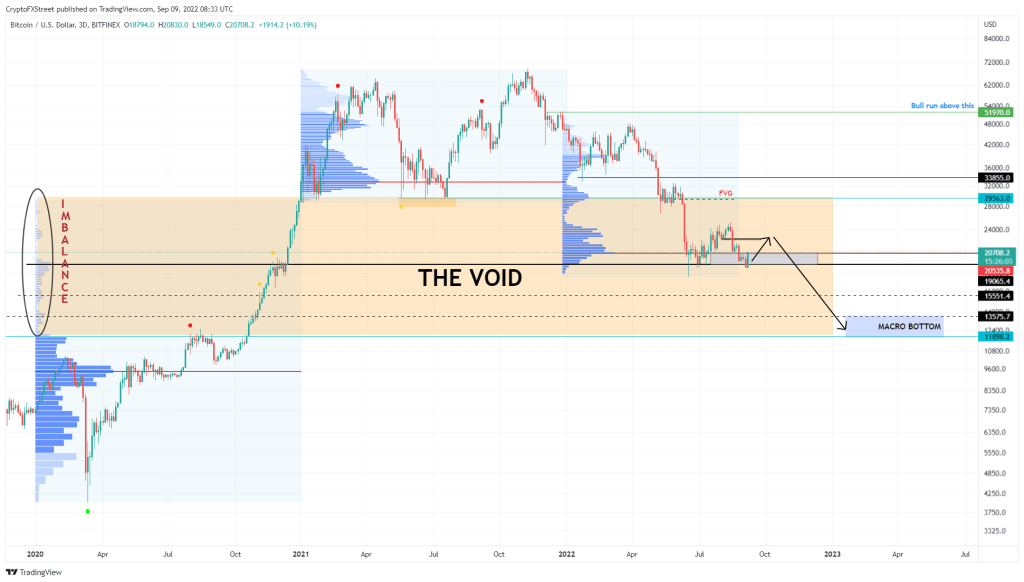

cryptocoin.com As you follow, Bitcoin continues to fill the gap from $ 29,563 to $ 11,989. BTC increased by 145% between October 18, 2020 and December 29, 2020, creating inefficiencies. For this, very little volume traded in this area. Therefore, the recent drop in Bitcoin price was a corrective move to fill the imbalance.

Bitcoin price tagged the $20,562 support area at $19,087. So, this area is notable as it coincides with the highest trading volume level at the 2022 Point of Control (POC) or $20,562. But there is an obvious bull reaction. Market participants are racing for a recovery rally. In this environment, investors can expect this bounce to go a little higher. However, the larger outlook is bearish. Accordingly, a break of the $19,087 level will trigger the next leg.

What do the metrics show for BTC?

In this drop, Bitcoin is likely to potentially lose 42% of its current value. It is also possible to push it to $11,989 or the psychological level of $12,000, which could be a macro bottom for the leading crypto and the entire market. Investors should keep in mind that this big drop is unlikely to happen in the next two or three weeks. But keep in mind that it may happen in December 2022 or in the first quarter of 2023.

BTC 1-day chart

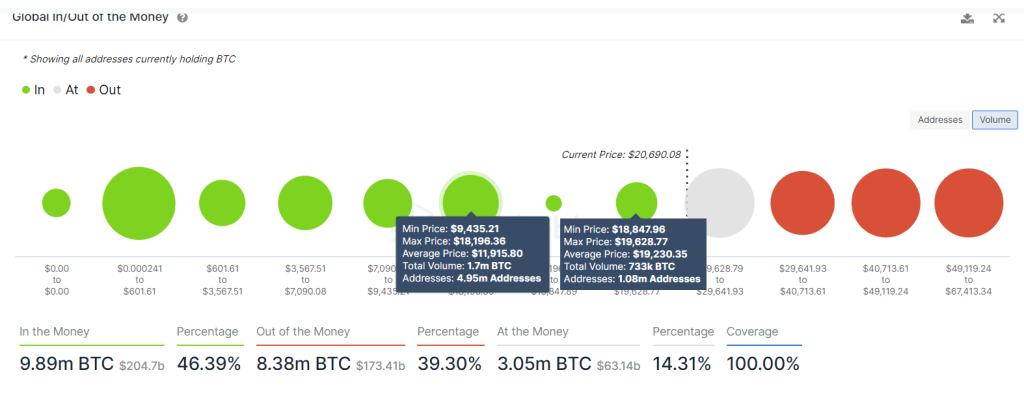

BTC 1-day chartIntoTheBlock’s Global In/Out of the Money (GIOM) model supports this downtrend and the critical support areas described above for Bitcoin price. This on-chain index shows that the close support level of $19,230 is weak. It also signals that a breakout could bring BTC down to the next cluster of support, stretching from $19,435 to $18,196. Here, approximately 4.95 million addresses that bought 1.7 million BTC at an average price of $11,915 are at a loss.

Interestingly, this level fits perfectly with what would be predicted from a technical view. It also adds confidence to the macro bottom occurring anywhere between $11,989 and $13,500.

BTC GIOM

BTC GIOMBitcoin forecast: BTC stays in a general bear trend

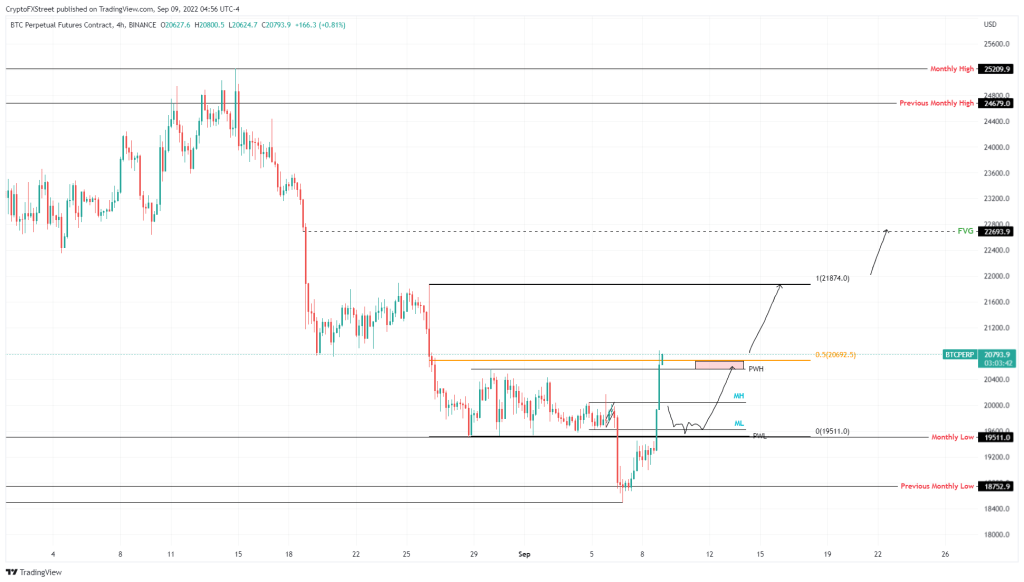

On a lower time frame, Bitcoin is likely to retrace to $20,000 or $19,511 before making the next move. The rationale for this retracement is to replenish the bullish momentum before the next upsurge to higher levels equal to $21,874. Sweeping this level will likely create a local peak here. However, Bitcoin is likely to revisit the $22,693 barrier in a highly optimistic situation.

BTC 4-hour chart

BTC 4-hour chartBitcoin price remains in an overall bear trend. In this environment, a daily and weekly candlestick above $25,000 will invalidate the bearish view. It will also suggest an early reversal of the bear trend.

In such a case, traders need to wait for secondary confirmations such as higher lows and higher highs before jumping into the bull run majority that could potentially revisit the $30,000 psychological level.