Terra’s LUNA has rallied 3x in 24 hours. Also, a $100 investment made two weeks ago is now worth $400. On the other hand, on the morning of September 9, it was worth $ 980. Meanwhile, an analyst named Tony M. expects a bigger rise for the altcoin. Here are the details…

Terra’s LUNA price shows its strength

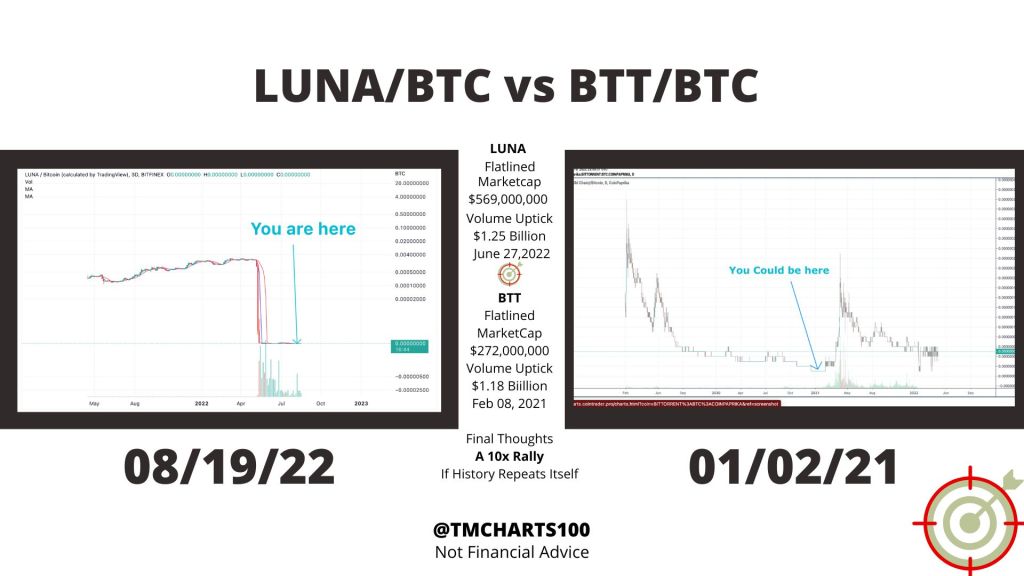

Terra LUNA price produced a 200 percent rally, with the bulls coming forward and erasing all previous summer highs. Last month, Tony M. proposed an ascension thesis. He informed investors that a 10X bull run for the controversial crypto token could happen. The sudden 3.1-fold increase increased Terra’s power and was a surprisingly optimistic gesture.

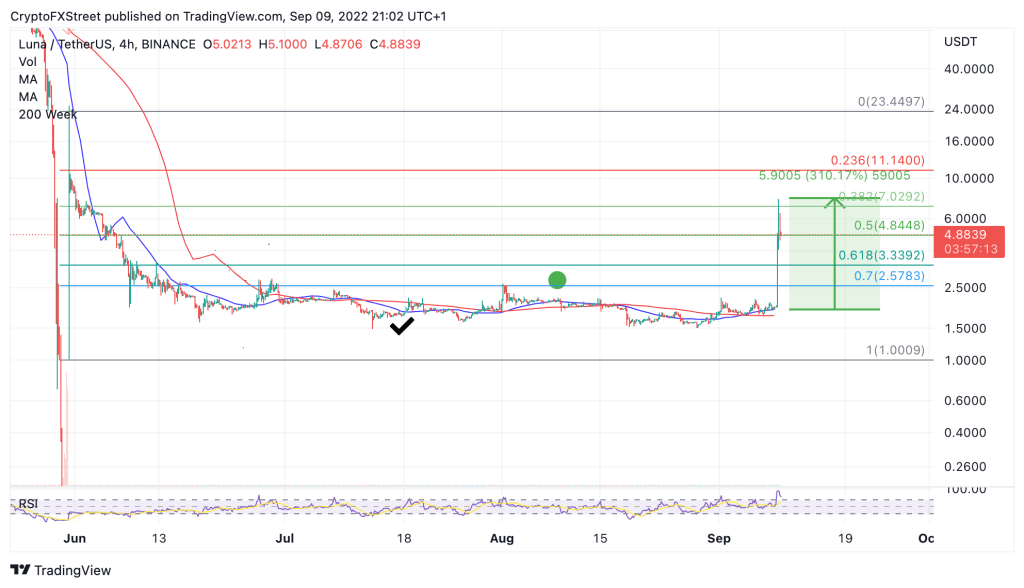

LUNA price is currently auctioning at $4.86 as an expected take-profit consolidation emerges. The 8-day exponential and 21-day simple moving averages are trading around $1.75 on LUNA on Sept. 3, pointing to a “golden cross”. This seems to have catalyzed the bull run. Additionally, the Relative Strength Index produced a Positive RSI Reversal Signal. According to the analyst, this gave confidence to marginal investors to participate in the market.

A “selling frenzy” may come for altcoin

A Fibonacci Retracement tool surrounding LUNA’s initial rise from $1.00 to $22.45 on May 31 shows the current market cap declined near the 50 percent and 61.8% retracement levels. LUNA price should close above these levels on higher timeframes to confirm this move is the start of the expected 10x bull run.

Against BTC, Terra Classic produced an increase above the 0.00000002 satoshi level. According to the analyst, this is the bullish signal to look for in the 10x thesis. A drop to 0.00000001 satoshi could be early evidence of a weakening trend. If the 0.000000001 SATS level is tagged, then the LUNA could be in a bearish trend. The bears could create a sell spree targeting the $1 low, which will ultimately mark an 80 percent drop from the current market cap.