Gold struggled last week and managed to close above $1,700. However, the Fed’s interest rate decision is approaching. This continues to put pressure on precious metals. In this context, Phillip Streible, chief market strategist and expert at Blue Line Futures, shares that chart you should watch.

Chart you should watch: Gold / silver ratio

Last week, the order flow from the trading desk gave me an insider’s view of how traders perceive the economic environment. When commodities such as Energy or Agriculture markets fall, inflation expectations fall. Accordingly, expectations for interest rate hikes decrease. The US dollar then falls. Thus, it causes gold, silver and US Stocks to rise along with the bullish sentiment. cryptocoin.com As you follow, we had three US Dollar days. With risk resuming in the markets after that, I wonder how long this party will last?

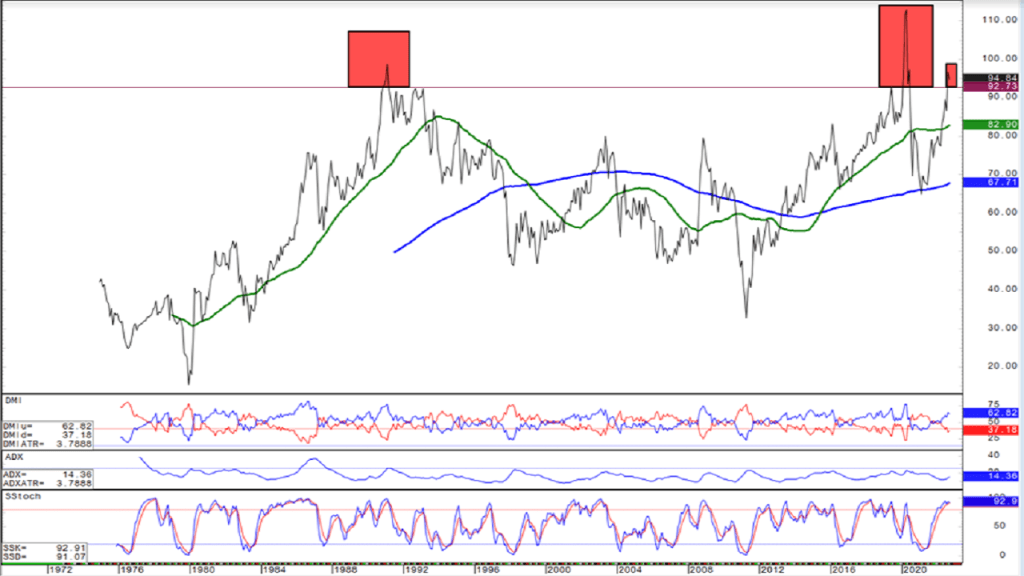

Monthly gold / silver ratio

Monthly gold / silver ratioBy connecting the dots on how traders will redistribute their capital, it becomes advantageous to try to identify low-value commodities. One of the ratios we publish in our daily Tactical Insights report is the Gold/Silver ratio. The ratio measures the amount of silver needed to buy one ounce of gold. Looking at the above Gold/Silver ratio since 1980, it is possible to quickly identify extremes and similarities.

The ratio has risen above 95:1 only three times since it was published. History has shown that every time an investor buys silver and holds it for more than six months, it results in silver prices gaining an advantage over gold.

Silver options strategy

In the past, I have found it best to use a calculated risk strategy in oversold markets that have not fully consolidated a technical base. An options bull call spread is a trading strategy that seeks to take advantage of a rise in the price of a particular market or asset during times of high volatility or for counter trend trades.

The option strategy consists of two call options that create a range that determines a lower strike point and an upper strike point. The bull call spread strategy helps you cover your maximum loss if the price of an asset drops. But the strategy also limits potential gains in the event of a price increase. Bull traders often use it when trading futures as a calculated risk margin.

In this bullish call spread example, we are using the December silver futures contract. 1 December Silver We take the $ 18.50 call as a long call at 75 cents. Then we simultaneously sell the 1st December silver $19.00 call at 60 cents short. This transaction creates our premium of 15. Next, we take into account the multiplier of silver. We multiply this by $50 to calculate $750, or our total premium paid.

Knowing our premium paid, we take the difference in our strike prices ($19.00 – $18.50), which in this case is 50 cents. Thus, we calculate our potential maximum profit. Then we multiply $50 by $50 since this is a futures contract. This gives us a total of $2500, minus our $750 premium as our maximum gross profit. It leaves us a maximum net profit of $1,750.