Bitcoin (BTC) has lost more than 50% since the start of the year. Billionaire investor Jeffrey Gundlach said he wouldn’t be surprised to see the leading crypto halve again.

Jeffrey Gundlach agrees that the Bitcoin drop may not be over

The billionaire investor warned in June that the Bitcoin decline may not be over. On CNBC’s “Closing Bell: Overtime”, he made statements about Bitcoin “seems to be liquidated”. BTC price has melted 50% since Gundlach’s statements. The last answer of the leading crypto to the bears was the 15% rally of the last day. BTC gained strong momentum from September 9 to September 10, accompanied by the overall market. The billionaire, nicknamed the bond king, said the next levels in CNBC participation would be around $10,000:

So I’m not bullish on $20,000 or $21,000 in Bitcoin. I wouldn’t be surprised if it goes up to $10,000.

“The trend in crypto is clearly not positive”

This is how Gundlach sums up his sentiment towards cryptocurrencies. “Once Bitcoin fell below $30,000, it looked like it would drop to $20,000 pretty quickly, and it did,” CNBC said in attendance. The billionaire now says another collapse is imminent.

Last year, in an interview with CNBC, Gundlach described the Bitcoin chart as “scary”. Gundlach says that when the world’s oldest cryptocurrency reaches the level of $ 60,000, it runs out. He pointed out that at the time, the Bitcoin chart formed a major head-and-shoulder top. He told CNBC that during this November period, investors will likely have the opportunity to buy Bitcoin again at the $23,000 level. The billionaire has made successful predictions so far.

Why is Bitcoin rising?

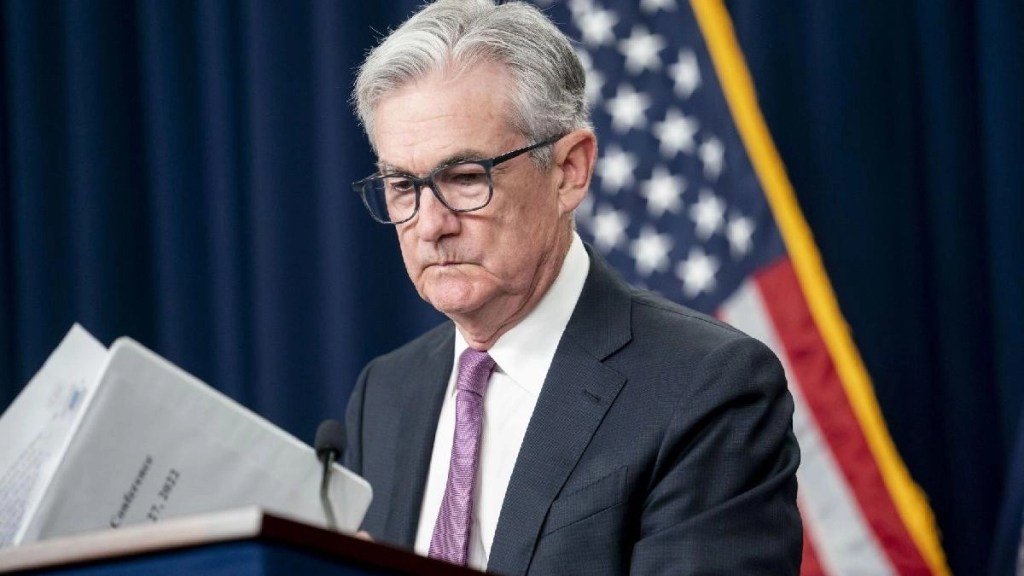

cryptocoin.com As you follow, Fed chairman Powell said in his last speech to the Cato Institute that the Fed is responsible for price stability in the US. He announced that the Fed is ready to take an aggressive stance to combat sparring inflation. The possibility of an unusually high rate hike from the Fed increased after Powell’s speech. Powell says inflation doesn’t just need to be brought under control, it also needs to be brought under control quickly. Otherwise, people may accept high prices as the new normal. The Fed may consider such a scenario as the worst case scenario.

The CME Fed Watch tool shows an 85% probability of a 75bps increase. It is also important to note that the Fed is unlikely to return from its stance after the increase. In a recent speech, Cleveland Federal Reserve CEO Loretta Mester believes the Fed will need a target rate of over 400 basis points to fight inflation. The current target rate is 225-250 bps.