Gold prices extend their rise from monthly lows ($1,851) as the Federal Reserve sets a predetermined path for monetary policy. But the update to the US Consumer Price Index (CPI) could undermine the recent recovery in bullion as inflation is expected to slow for the first time since August, according to Market strategist David Song. We have prepared David Song’s analysis with his own narration for our readers.

Basic forecast for gold prices: Neutral

The bearish at the start of the month does not push the Relative Strength Index (RSI) into the oversold region and the precious metal may see a larger recovery For this, gold prices seem to have reversed course ahead of the 200-Day SMA ($1,836). In the coming days, the Federal Open Market Committee (FOMC) does not appear to be in any hurry to reduce the balance sheet to pre-pandemic levels.

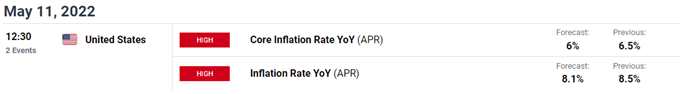

However, as major central banks normalize monetary policy, anti-inflation efforts may produce headwinds for bullion, and new data pressures from the US show CPI’s annualized % CPI in March. It may drag the gold price as it is expected to drop from 8.5 to 8.1%.

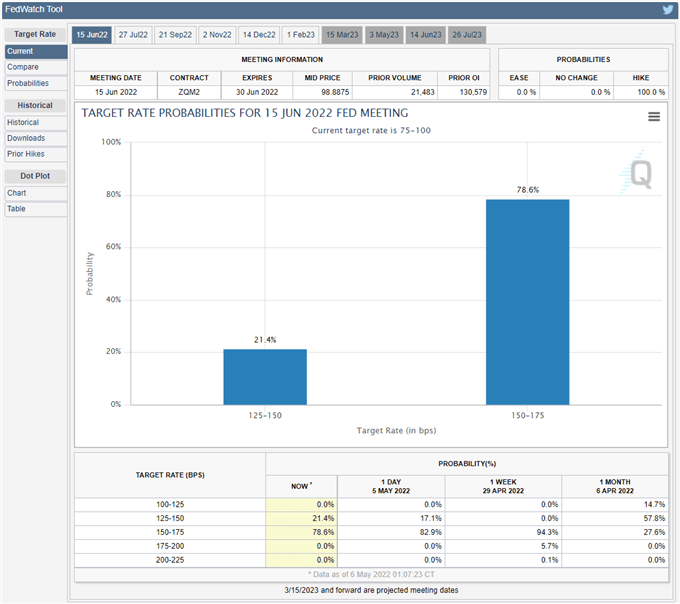

The FOMC is expected to continue on its way to providing higher interest rates in the coming months. Since the Central Bank is determined to take the necessary measures to ensure price stability, the Central Bank seems to be on the way to increase the interest rate by 50 basis points in the next interest rate decision on June 15th.

“A slowdown in US CPI could drag nugget”

Meanwhile, the CME FedWatch Tool shows the FOMC’s current 0% rate of Fed Funds despite Chairman Jerome It reflects a greater than 70% probability that it will increase from the threshold of .75 to 1.00% to 1.50% to 1.75%. Powell insists that “a 75 basis point increase is not something the committee is actively considering.”

Meanwhile, the CME FedWatch Tool has shown the FOMC’s Fed Funds rate to its current 0.75% to 1%, despite Chairman Jerome Powell’s insistence that the “75 basis points” increase is not something the committee is actively considering. It reflects a greater than 70% probability that it will increase from the .00 threshold to 1.50% to 1.75%. Speculation about further changes in the central bank’s exit strategy could limit gold prices as the committee more quickly normalizes monetary policy.

Source: CME

Source: CME However, gold prices may see a larger recovery in the coming days as it seems to reverse course ahead of the 200-Day SMA ($1,836). But a slowdown in the US CPI could drag bullion as major central banks step up their efforts to curb inflation.