According to crypto analyst Filip L, Cardano (ADA) did what was expected after rising pressure. Analyst Tonu M says the dual scenario for Solana (SOL) will create a nice profit or a ton of pain. Another analyst, John Isige, assesses Merge’s news engagement as the price of the leading altcoin Ethereum collapses. We have compiled the analysts’ ADA, SOL and ETH analyzes for our readers.

“If the bottom gives way, ADA price is on the way to 10% down”

Cardano is seeing traders and investors struggling over what to do with the fast-moving components that are rattling the markets. After Tuesday’s big drop, it was pretty normal. It was also expected to see some buying that triggered a smooth recovery but not fully recouped the losses incurred. Asian traders began to experience difficulties with China’s easing measures. Meanwhile, the BOJ (Bank of Japan) is poised to trigger a mass market intervention to support the falling yen. Driven by these, price action took another step back during the ASIA PAC session this morning.

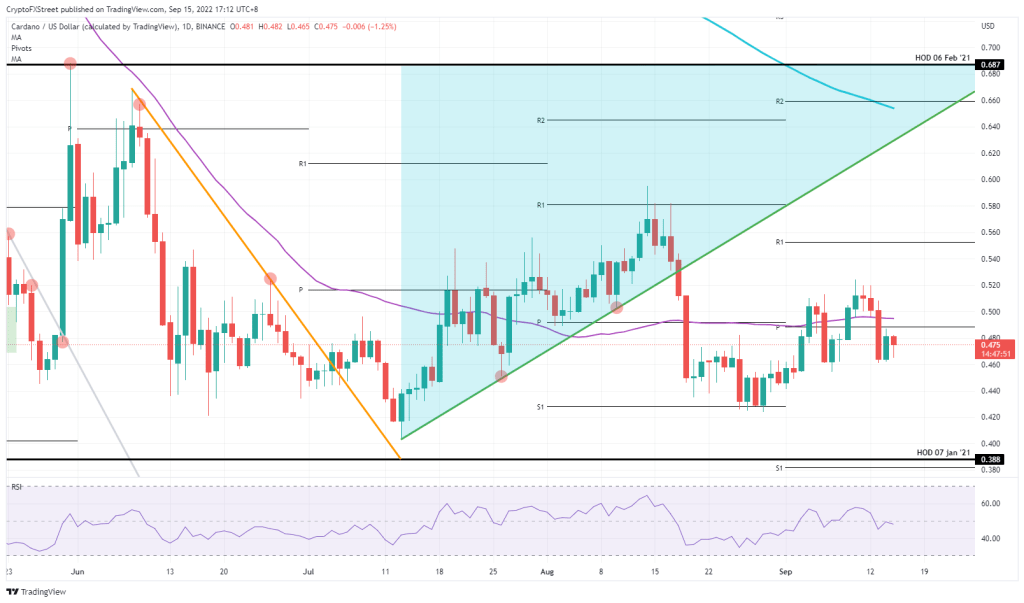

Therefore, ADA is likely to stay between the monthly pivot of $0.488 and the base of $0.460, which seems to be this week’s low. The downside risk comes with equity markets poised for another drop if individual selling remains strong. This is confirmation that the Fed will step up its game and tighten it further. This will trigger the ADA drop to $0.4200.

ADA daily chart

Alternatively, sentiment is likely to begin to shift once the US session begins. Because stocks are slightly on the upside and it’s likely to push the cryptocurrencies up together. Again, pay attention to the 55-day Simple Moving Average and the area around $0.5000, where the bulls have burned their fingers once this week. Because you have to trade far enough from the area to see it in the rear view mirror. This will require a sharp rally. Instead, look for a close near $0.5200 as confirmation to withstand any dips or pullbacks by Friday.

Binary scenario for Solana (SOL)

cryptocoin.com As you follow, Solana bears the brunt of US post-CPI sales. Since August, the altcoin has been following a steep trend. The bulls launched their first retaliation since September 7. However, Tuesday’s CPI data shook all cryptocurrencies in the ecosystem.

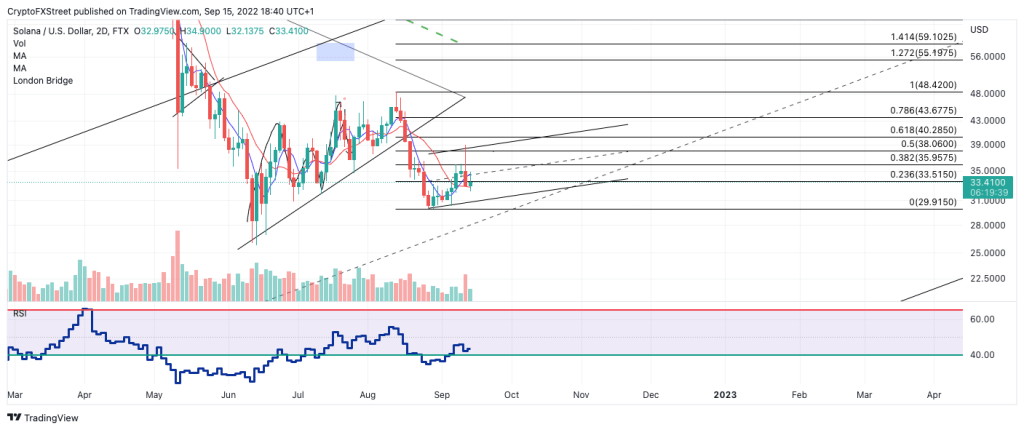

The bulls and bears are negotiating between the 8-day exponential and 21-day simple moving averages. Solana, on the other hand, is currently auctioning for $33. Squeezing two moving averages around price is a common occurrence before sharp volatile moves. Traders need to be careful about the next direction of altcoin price.

LEFT daily chart

LEFT daily chartThe last 50% Fibonacci level rejected the bulls at the $38 area. So it is possible that the directional trend is in favor of the bears as it provides an increase in bearish volume. A breakout of the swing low at $29.91 is likely to lead to further declines, equaling the August downtrend. Such a move would result in a 40% drop.

Conversely, a daily close above $35 is possible to redirect the mentioned downward move of the SOL to the 61.8% Fib level at $40. In this case, the bullish move will result in a 20% increase from the current Solana price.

What will be the leading altcoin price in the post-merge turmoil?

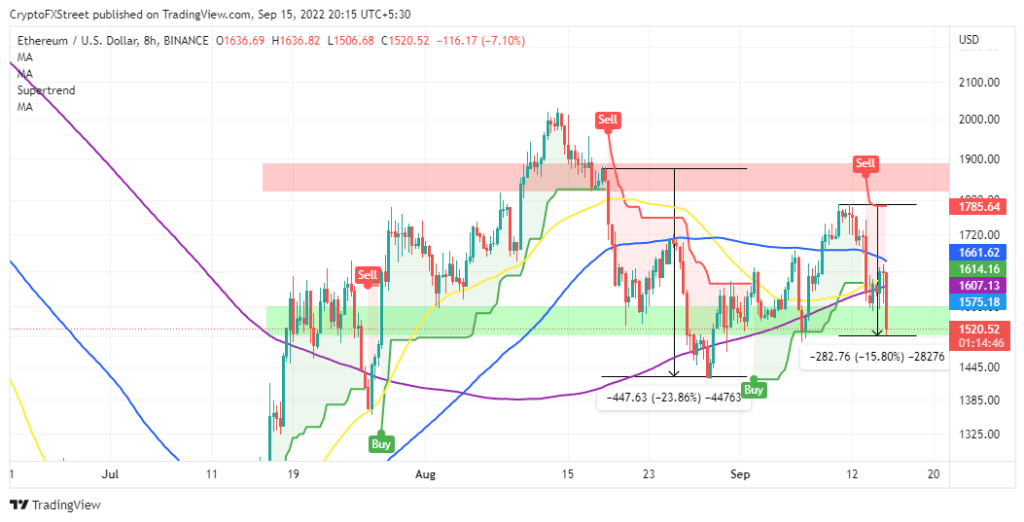

The Ethereum community celebrates Merge’s success. Investors preferred to sell the news. Therefore, they have put a huge general pressure on the Ethereum price. The support at $1,500 is critical for the resumption of the uptrend. But a sell signal from the Super Trend indicator signals more pain ahead.

When this indicator last broke above Ethereum price, ETH fell 24% from $1,876 to $1,428. In other words, traders need to be prepared for dips targeting $1,400 if support on the $1,500 cracks.

ETH eight hour chart

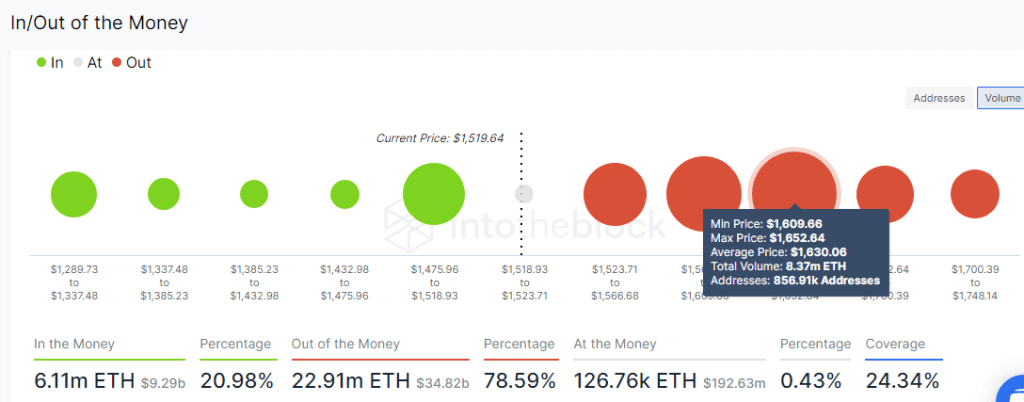

ETH eight hour chartOn the upside, the IOMAP on-chain model paints a grim picture for Ethereum price going forward. Seller congestion sits between $1,609 and $1,652. Meanwhile, 856,900 addresses previously collected 8.37 million tokens. It will likely be difficult to break through this range as investors buying at these levels are selling at breakeven.

Ethereum IOMAP model

Ethereum IOMAP modelOn the other hand, there is a medium-strong buyer congestion zone between $1,475 and $1,518. Other than that, areas of support remain unclear. If left unprotected, the apocalypse is likely. It is also possible that this will cause Ethereum price to drop below $1,400.