Analysts continue to share their plugins for altcoin projects. In this article, we will convey the comments of Solana (SOL), Avalanche (AVAX) and Shiba Inu (SHIB)…

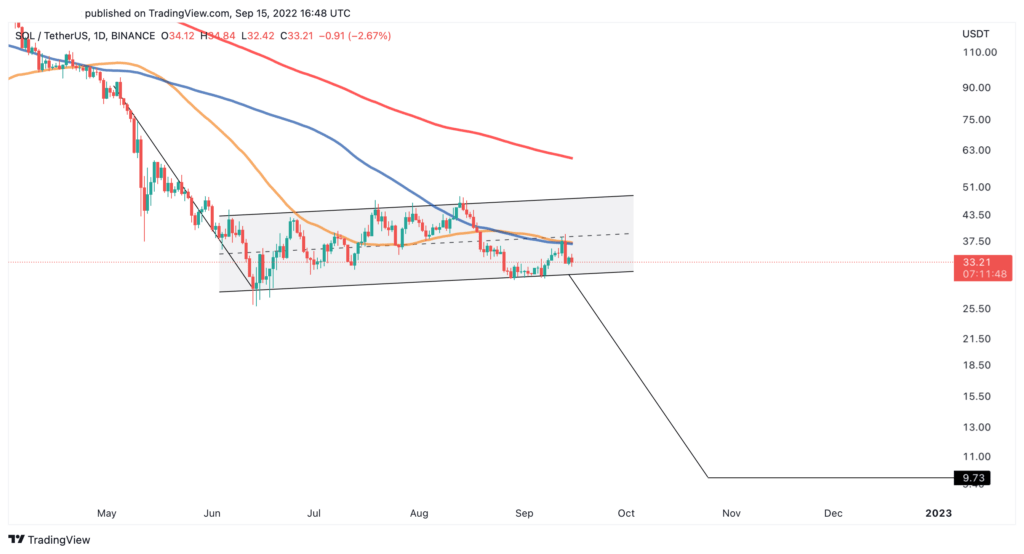

Can Solana go under $10?

Solana and Avalanche have experienced a 2 percent correction over the past few hours, which is linked to Ethereum’s successful transition to Proof-of-Stake. As the hype around Merge wanes, Solana appears to be forming a bear flag on its daily chart, according to Financial Insane analysts. This technical formation predicts that a break of the $30 support level could trigger a 70 percent correction. If this decline is confirmed, an increase in selling pressure could push SOL below $10.

Despite her pessimistic outlook, there are also good factors for Solana. According to analysts, the layer-1 Blockchain token needs to retrace its 50-day moving average as support to have any chance of a rebound. Breaking this resistance level could help the SOL rise to $48 or even the 200-day moving average to $60.

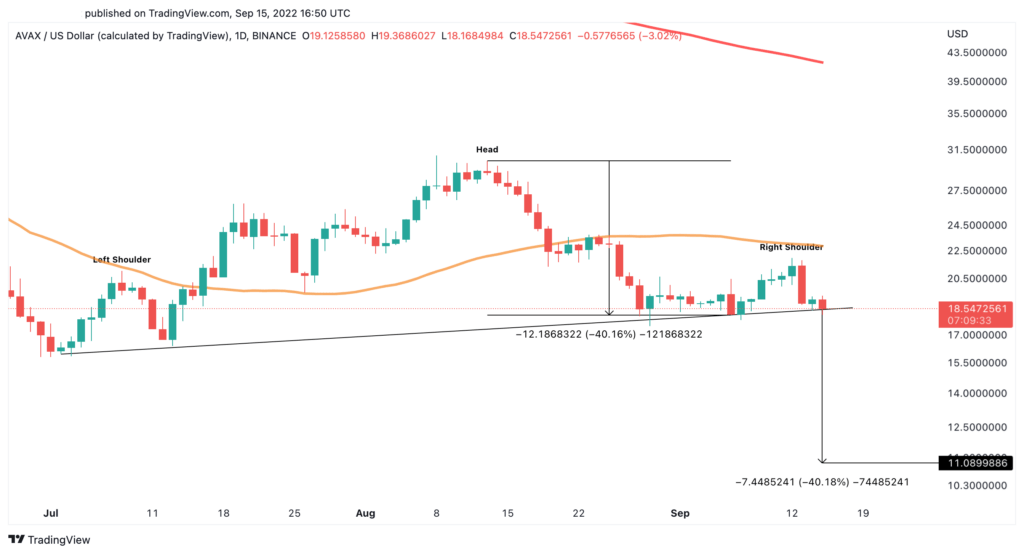

$17 level is important for Avalanche

Avalanche also appears to be developing a bearish technical pattern on its daily chart. According to analysts, AVAX may be forming the right shoulder of a head-and-shoulder model. A sustained daily close below $17 could increase the possibility of a steep correction. If this happens and AVAX falls below the neckline of the pattern, a 40 percent correction to $11 becomes a strong possibility.

AVAX needs to break higher, break the 50-day moving average to invalidate this bearish thesis. Doing so could result in an increase in its 200-day moving average at $42. Given the bearish scenarios of Solana and Avalanche, it is imperative to wait for a decisive close below support or above resistance before attempting to time the next big price action.

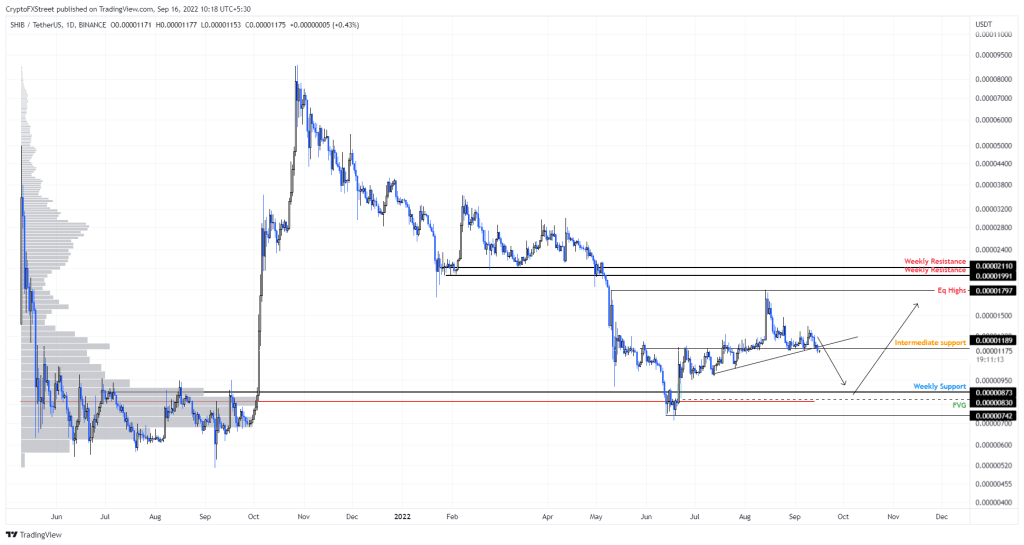

Analyst: SHIB approves 25 percent collapse

Finally, we’ll cover analyst Akash Girimath’s analysis of SHIB. Shiba Inu price has been waiting to find a perfect support level for months after its latest explosive move. Despite reclaiming the gains of the last rally, SHIB failed to reach a steady footing. Shiba Inu price has been hovering above the $0.000118 support level for over a month. It triggered a 50 percent rally after changing that level on August 5.

Although Shiba Inu price retraces these gains in the next few days, it is still above the trendline. So, it traded above the horizontal support at $0.0000118. However, on September 15, SHIB broke this intersection, confirming the start of the downtrend, according to Girimath. “If this trend continues, the Shiba Inu price will likely crash by 25%,” the analyst says.

According to the analyst, this move indicates a bearish trend from a short-term perspective. But it will provide a foundation for long-term bullishness. This support level promises a 120% rebound rally for Shiba Inu price. However, if Shiba Inu price makes a U-turn and produces a daily candlestick above the $0.000118 barrier, the situation could indicate weakness among the bears. If this hurdle turns into a support level, it will invalidate the bearish view. This development could trigger the Shiba Inu price rally to $0.0000179.