Equity markets are witnessing aggressive selling due to increasingly bearish macroeconomic factors. This adds selling pressure to altcoin prices, including Bitcoin and DOGE. Crypto analyst Rakesh Upadhyay examines the charts of the 8 biggest cryptocurrencies.

An overview of the crypto market

The World Bank warned of a possible global recession in 2023. In a press release on September 15, the bank said the current rate of rate hikes and policy decisions are unlikely to be sufficient to bring inflation down to pre-pandemic levels.

Ray Dalio, billionaire founder of Bridgewater Associates, said in a September 13 blog post that if rates rise to about 4.5% in the US, it will have a “negative impact on stock prices of about 20%.” The negative outlook for equity markets does not bode well for crypto markets as both are closely related in 2022.

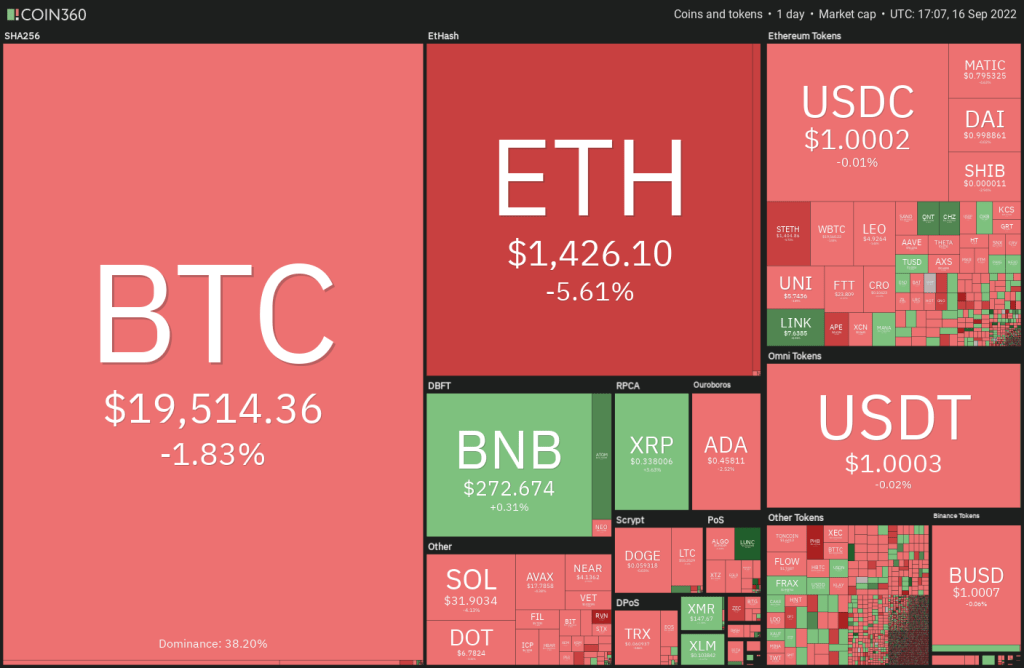

Daily cryptocurrency market performance / Source: Coin360

Daily cryptocurrency market performance / Source: Coin360Macroeconomic developments are worrying crypto investors, who sent 236,000 Bitcoin (BTC) to major cryptocurrency exchanges on Sept. 14, according to Glassnode data. cryptocoin.com As you follow, stock market entry was at its highest level since March 2020. Now it’s time for analysis…

BTC, ETH, BNB and XRP analysis

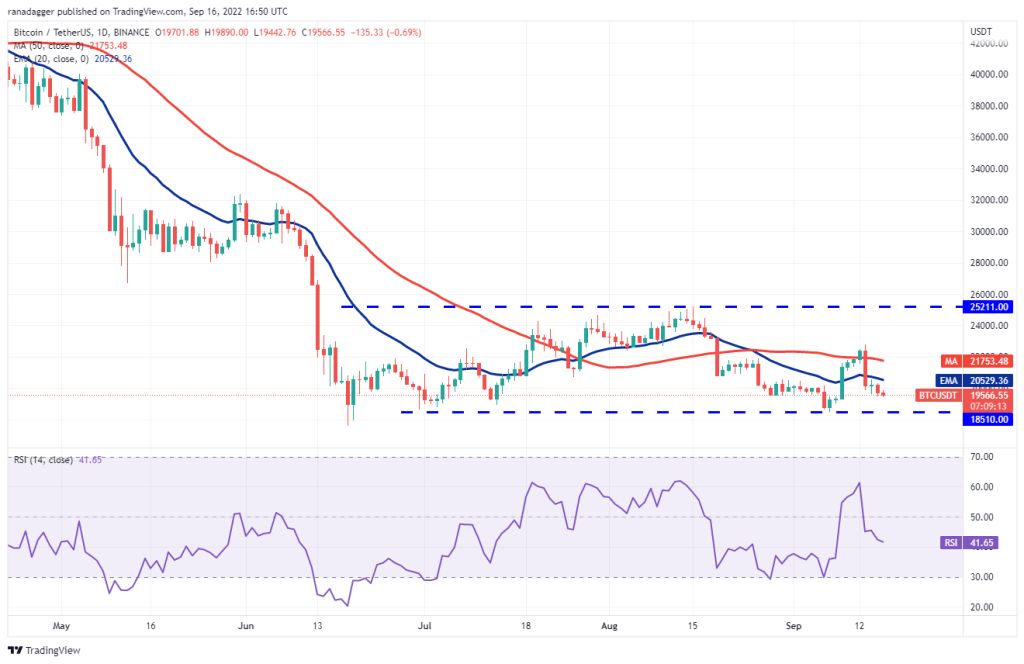

Bitcoin (BTC)

Bitcoin formed a Doji candlestick pattern on Sept. 14, showing the indecision between the bulls and bears. Uncertainty was resolved negatively on September 15. But the bears could not develop this advantage. This indicates that selling pressure is decreasing at lower levels.

Buyers will try to recover the situation by pushing the price above the 20-day EMA ($20,529). If this happens, it is possible for BTC to rally to the overhead resistance at $22,799. Bears will aggressively defend this level. However, if the bulls rise above this, BTC is likely to rise to $25,211.

On the contrary, if the price drops from the current level or the 20-day EMA, it will indicate that the sentiment will remain negative and that traders view the rally as a selling opportunity. It is possible that this will bring BCT down to the strong support at $18,510. The zone between $18,510 and $17,622 is likely to witness aggressive buying from the bulls. Because not being able to defend this zone starts the next leg of the downtrend.

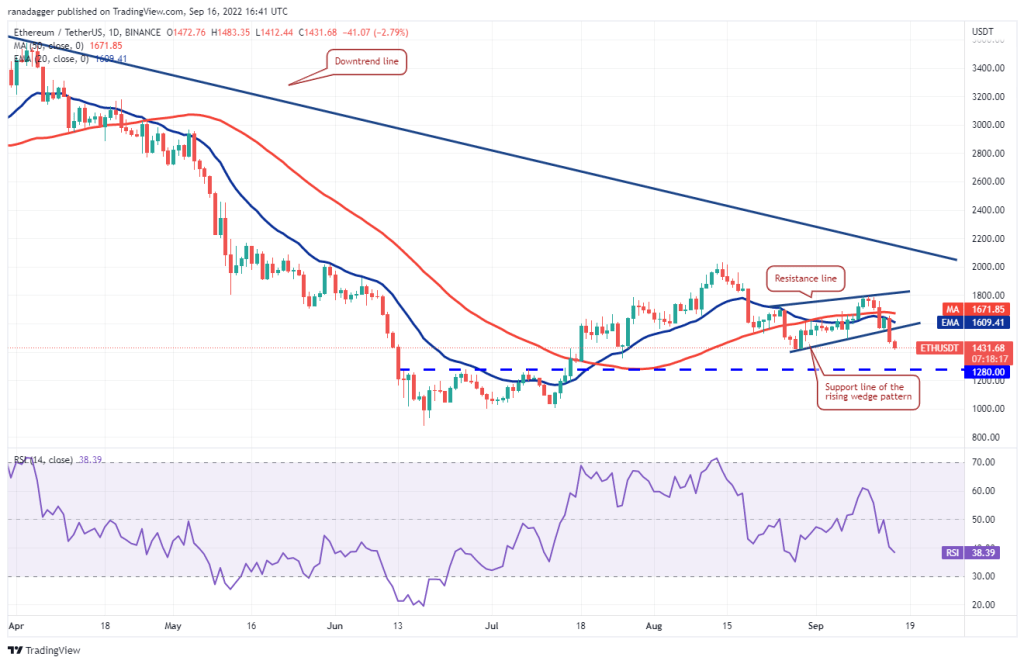

Ethereum (ETH)

ETH bounced off the support line on Sept. 14. But the bulls’ rejoicing was short-lived. The price has fallen sharply from the 20-day EMA ($1,609). Thus, it fell below the support line on September 15.

The 20-day EMA has started to drop and the RSI has dropped below 39. This shows that it is under the control of bears. Sellers pulled the price to $1,422 and if this support is broken, a drop to $1,280 is possible. If the price rises from the current level, ETH is likely to return to the moving averages, which will act as a strong resistance. The bulls will need to break through this hurdle to suggest selling pressure drops.

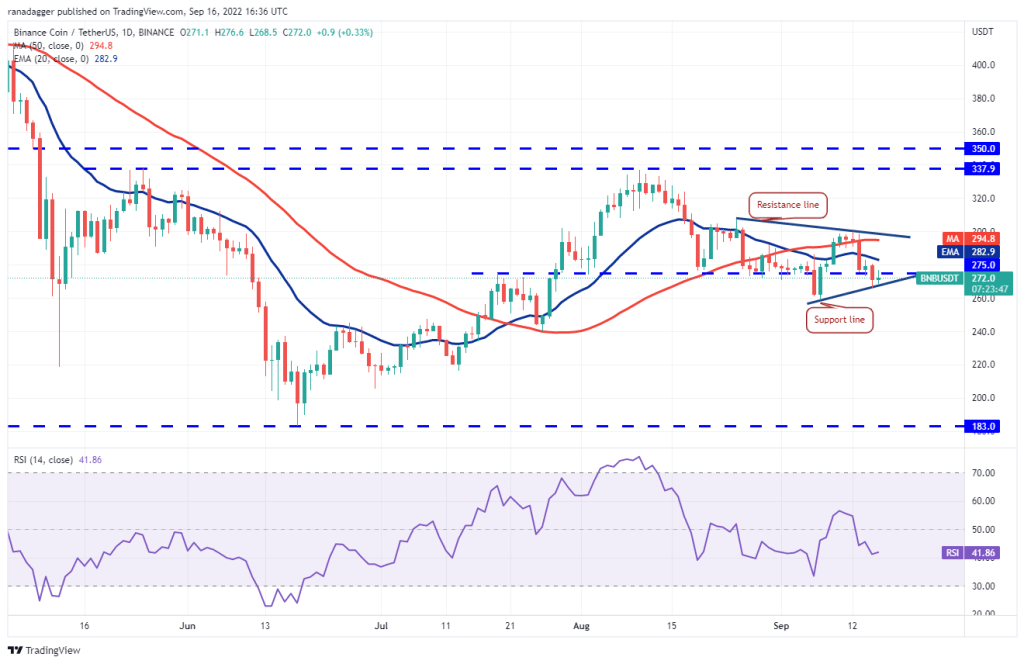

Binance Coin (BNB)

The bears dragged BNB below the $275 close support. However, they are struggling to keep the price low. This suggests that lower levels are attracting buyers.

If the price stays above $275, it is possible for BNB to be in the early stages of forming a symmetrical triangle. This indicates uncertainty about the next directional move between the bulls and bears. This is likely to keep the price inside the triangle for a while. If the price rises above the 20-day EMA ($283), a rise to the resistance line of the triangle is possible for BNB. However, a break above the triangle is likely to push BNB towards $338. Another possibility is for the price to drop from the 20-day EMA and slide below the support line of the triangle. In this case, BNB is likely to drop to $258 and then $239.

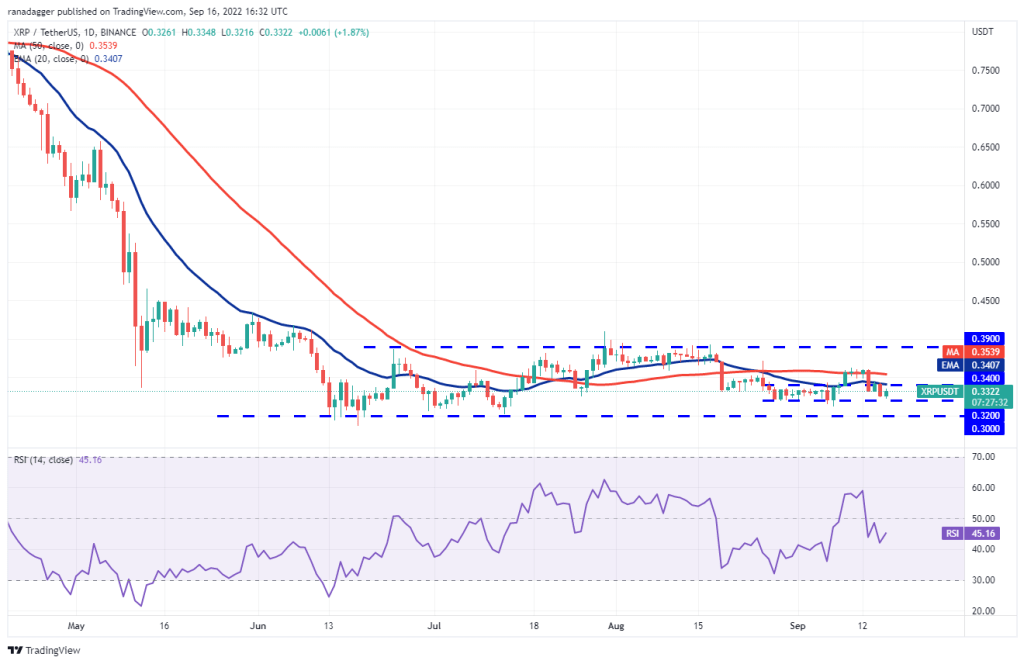

Ripple (XRP)

XRP has been range-bound between $0.30 and $0.39 for the past few weeks. Over the past few days, the range has narrowed further as bulls take the dips to $0.32 and bears sell the recovery to the 50-day SMA ($0.35).

Price action within a range is often volatile and difficult to search. Still, buyers successfully defend the $0.32 support between August 28 and September 7. So they will try to do it again. If the price rebounds from the current level, XRP is likely to rise to the 20-day EMA ($0.34) and then to the 50-day SMA. If the bulls push the price above the 50-day SMA, the probability of a rally to $0.39 increases. The bears will likely defend this level aggressively. On the downside, if the price drops below $0.32, it is possible for XRP to retest the critical support of $0.30.

ADA, SOL, DOGE and DOT analysis

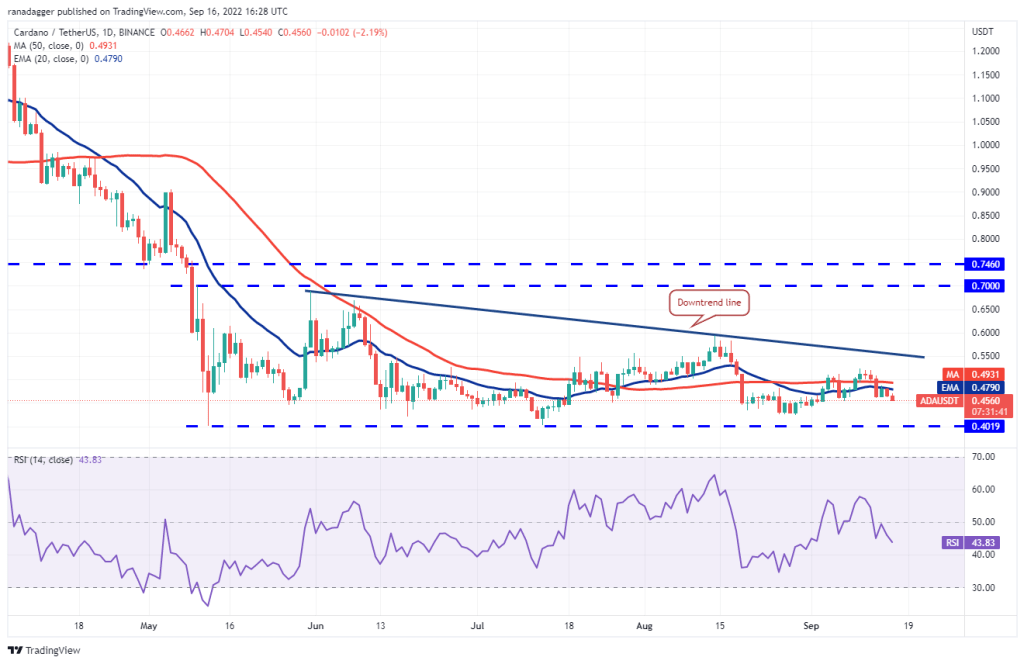

Cardano (ADA)

The bears are trying to improve their advantage in Cardano. They sold the recovery to the 20-day EMA ($0.48) on Sept. 14 and are trying to push the price below the close support at $0.45.

Moving averages are not a valuable tool in a changing market. However, it tends to help identify the short-term trend. The 20-day EMA has started to drop and the RSI is in the negative territory. This shows an advantage for the bears. If the price continues below $0.45, a drop to $0.42 is possible for ADA. If the bulls want to gain the upper hand, they will have to stop the decline and push the price above the moving averages. This is likely to clear the way for a rally to the downtrend line. A break above this resistance likely indicates the bulls are back in the driver’s seat.

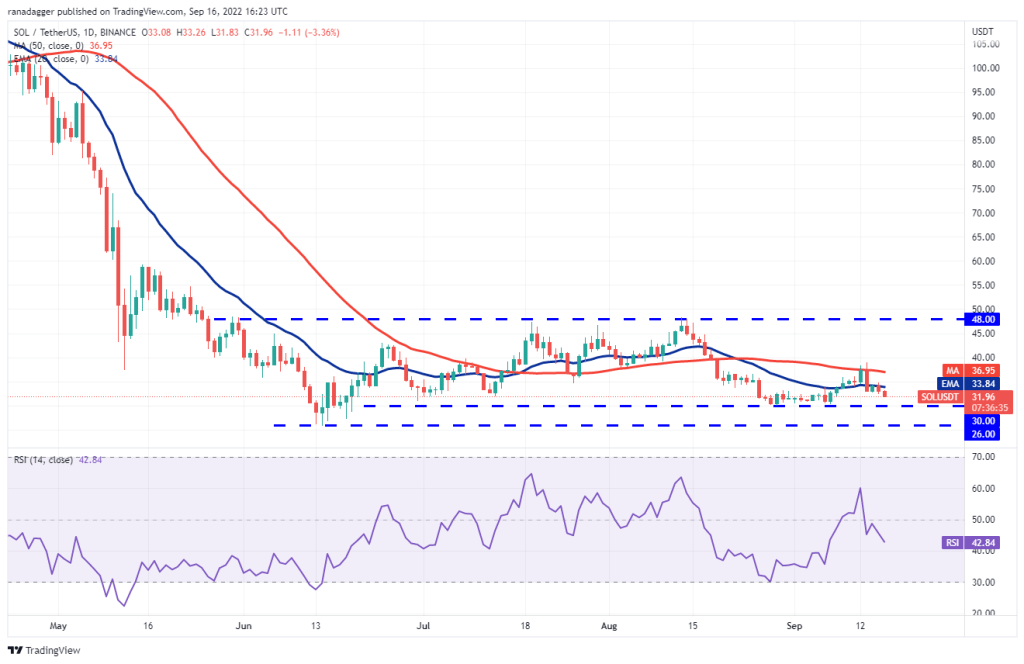

Left (LEFT)

SOL bounced back from the 20-day EMA ($33.84) on Sept. 15. This shows that the mood is negative and the bears are selling on small rallies.

SOL is likely to drop to strong support at $30. This level was resilient during the offensive between 28 August and 7 September. It also jumped to $39 on September 13. Short-term traders are likely to expect a bounce at $30 again. They will probably buy lows at this level. A return to support may continue to face hurdles at the 20-day EMA followed by the 50-day SMA ($36.95). If the price closes above this resistance, it will likely open the doors for a possible upward move to $48. Conversely, if the $30 level is broken, it is possible for the SOL to slide to the vital support at $26.

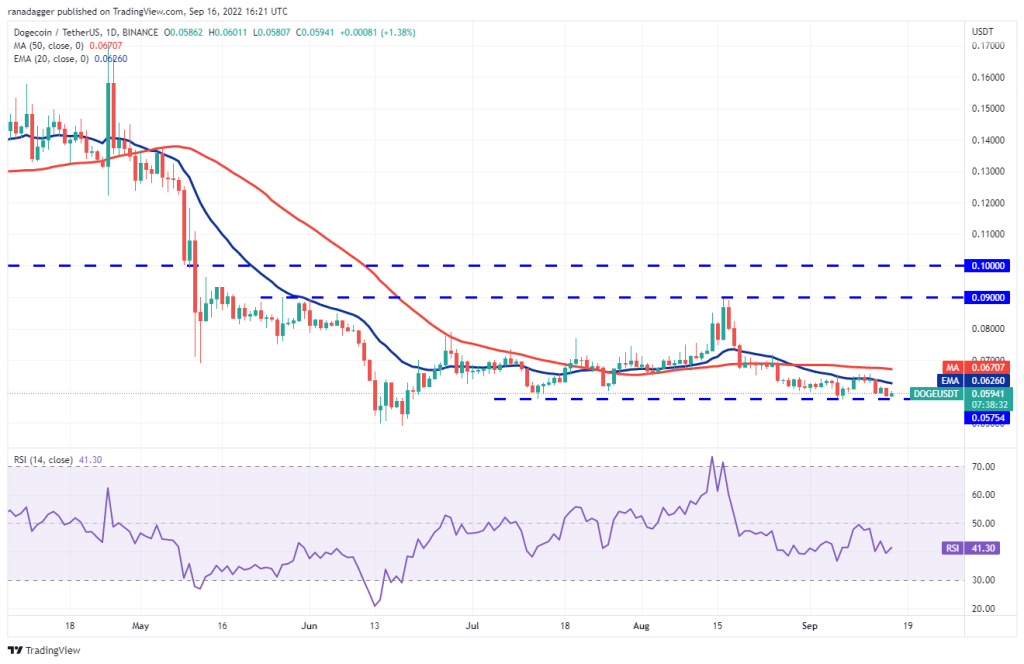

Dogecoin (DOGE)

DOGE continued its decline and is close to the strong support at $0.06. The price bounced back from this level on September 7th. Therefore, it is likely to attract repeat buyers.

A break and close above the 20-day EMA ($0.06) will be the first sign of increasing demand at higher levels. DOGE could rally to $0.07 later. This level is likely to act as a resistance again. However, if the bulls push the price above this, it is possible for Dogecoin (DOGE) to rally to $0.08 and then to $0.09. If the price breaks below the close support at $0.06, the DOGE could slide to the June lows around $0.05. The bears will have to push and sustain the price below this level to signal the start of the next leg of the downtrend. Dogecoin (DOGE) is likely to extend the decline to $0.04 later.

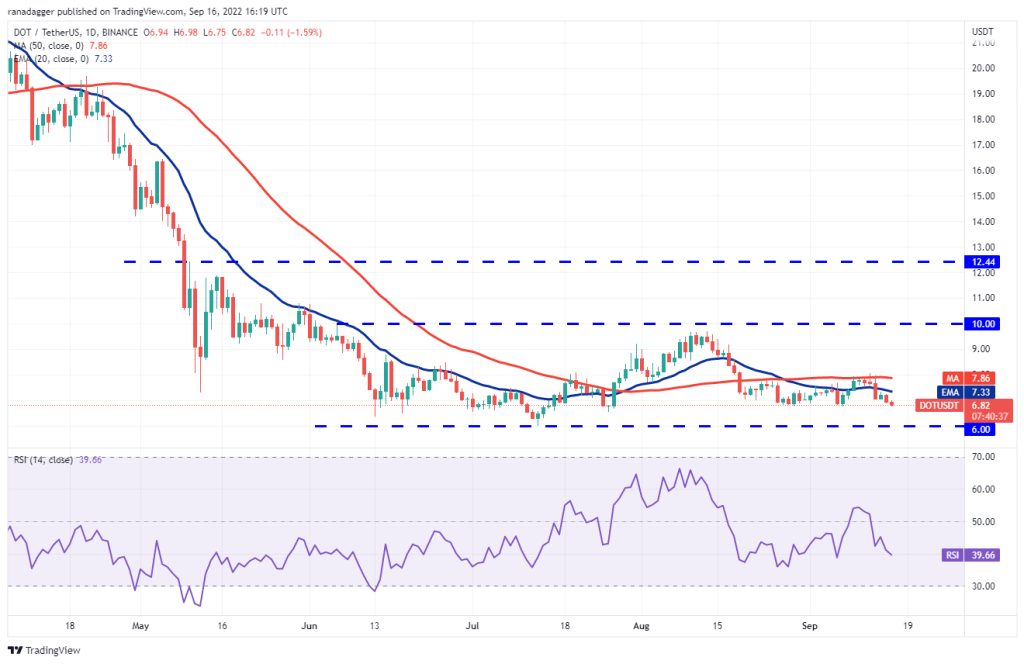

Polkadot (DOT)

The bulls tried to start the recovery on Sept. 14. However, higher levels have attracted bears to sell. Polkadot turned bears on Sept. 15 and the bears are attempting to push the price below the immediate support at $6.75.

Buyers had successfully defended the $6.75 level in the previous two events. Therefore, a break below this and a close is possible to intensify the sale. DOT is likely to drop to the critical support at $6.50 and then to the critical support at $6. The upside remains the key level to watch out for, as the previous three recoveries have dropped from the 50-day SMA ($7.86). The bulls will need to break through this hurdle to start a rally to $9.17 and then $10.