Gold price finished the week at its lowest point since April 2020. So there is a lot of doom and gloom in the gold market. But according to market analyst Neils Christensen, no matter how gloomy the gold price may seem, a small ray of light is leaking from the dark clouds. Technical analyst Christopher Lewis points out that gold fell quite hard and broke the $1,680 level. According to another technical analyst, Paul Robinson, there are more reasons for lower lows, he says.

Analysts say gold’s three-year uptrend is over

cryptocoin.com As you follow, the market gave up at $ 1,700. However, analyst Neils Christensen notes that it managed to hold the critical long-term support between $1,680 and $1,675. That doesn’t sound very good. However, if the support continues, the market will have established a solid foundation at a critical long-term level. For many analysts, a break below $1,675 is a sign that gold’s three-year uptrend is over.

After markets were baffled by persistent inflation in the US, the gold market found itself in another life-or-death scenario. However, inflation data paints a much tougher picture of the economy. Yes, energy prices fell in August. However, it was not enough for the increase in food, shelter and health expenses. For the year, the US CPI increased 8.3% last month, against expectations for an 8.1% increase. The data showed that inflation has become more entrenched. He also underscored expectations that the Fed should be even more aggressive.

“A small sliver of hope for gold investors”

Following the CPI data, markets started pricing in the possibility that the Federal Reserve will raise interest rates by 100 bps next week. Entering the weekend, markets saw a 16% chance of this happening. But beyond the September meeting, markets are seeing a much higher terminal rate for the Fed Funds rate. Before the CPI, economists had expected rate hikes to exceed 4% by the end of the year. Markets now expect the terminal interest rate to rise to at least 4.50% by March. This gave the US dollar more momentum. Thus, it pushed 10-year yields to their highest level since April 2019. The analyst makes the following assessment:

This is bad news. However, there is some good news before you get discouraged. A sliver of hope for gold investors. Investors expect the central bank to be pretty hawkish next week. However, if Jerome Powell fails to meet these high expectations, some profit-taking in the US dollar is possible. It is possible that this will increase the price of gold. Of course, as gray-haired traders have said many times before: If your trading strategy is based on hope, you need to change your strategy.

In terms of investment, the trading outlook for gold is rather bleak, according to the analyst. However, the precious metal continues to play an important role as a safe-haven asset in a portfolio. “If you think gold has had a bad week, I hope you’re not in the stock markets,” the analyst says. That’s because fears of inflation caused U.S. stock markets to see their biggest one-day sales since June 2020.

Gold price weekly technical analysis: Rise is difficult!

Analyst Christopher Lewis makes the following analysis of the technical outlook for gold. Gold markets fell pretty hard during the trading week. It broke the $1,680 level late Thursday in an attempt to recapture it on Friday. However, interest rates in the US and the strengthening US dollar continue to hold up against the value of gold in general. If we break below the candlestick bottom, I think new selling will open. Maybe up to the $1,500 level.

The candlestick is much larger than the others. That is why it is worth paying close attention to the fact that the acceleration is increasing. Interest rates in America continue to rise. It is therefore worth noting that the interest rate market will continue to operate against the value of gold in general. Also, the dollar continues to rise. So you will need less than that dollar to buy gold.

As long as the Federal Reserve continues to be very tight in monetary policy, I don’t see a situation where gold markets will rise easily. That doesn’t mean there won’t be the occasional bounce. But the truth is, at the first signs of trouble, we will fade rallies. In the longer term, a drop to the $1,500 level is possible. However, it will probably take some time to land there. The $1,500 level course has a lot of psychology attached to it. So don’t be surprised to see a big fight there too. All in all, we broke below the 200-Week EMA, which is also a very negative technical event.

Gold price prediction: Continue the bear market!

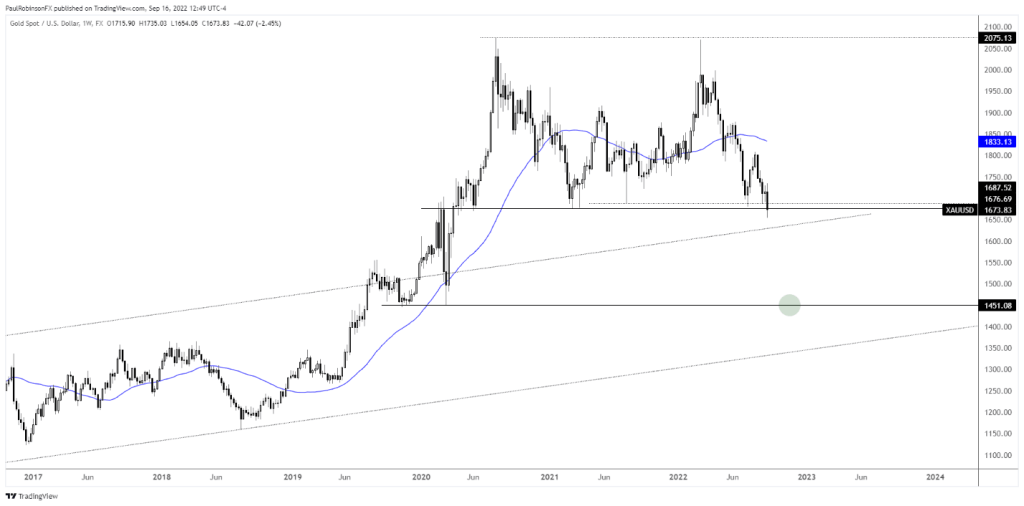

Analyst Paul Robinson draws the technical picture of gold as follows. The gold price continues to drop due to the same factors that have dragged it down this entire cycle. Higher rates and the dollar theme are weighing on almost every major asset class, not just gold.

This is a theme that doesn’t seem to give up in the coming days or weeks. Next week is the quarterly FOMC meeting that could ignite a short-term rally. It would likely be nothing more than a relief rally, as pessimism reached its extremes in the near term.

Gold price weekly chart

Gold price weekly chartRight now the Fed’s focus is on inflation, not calming the markets. So it’s unlikely to turn things around for risky assets. However, it is possible that this stance will change if things get too risky soon. But until they change, I will continue to stick to the same general themes and trends.

Any bounce will be seen as temporary until we see upward price action from here as spot gold tries to break below the 1.680 level. Technically speaking, gold is likely to retain legacy support below 1.680. It is seen as a source of resistance until the losses are reclaimed.