Crypto whales have exhibited a major shift in their behavior over the past week. The Shiba Inu (SHIB) has been popular with whales in recent months. Then after supporting the world’s second largest crypto Ethereum (ETH) prior to Merge, they are now focusing on Ripple’s XRP. Here are the details…

Whales SHIB give up ETH

cryptocoin.com As we have also reported, a “merge” took place in the ETH network last week. After the Merge, ETH price experienced a serious correction, losing more than 20 percent in a week. As of writing, ETH is trading at $1,260 with a market cap of $154 billion. ETH has lost 5.6 percent in the last 24 hours. Santiment, the company that provides on-chain data, shared interesting data. According to Santiment, larger addresses holding Ethereum, namely whale addresses; Significantly reduced his holdings after the Merge upgrade. Santiment says the following:

The Ethereum merge on September 15 caused a shift in major investors. In the 6 days since the transition to proof-of-stake, addresses holding a thousand to ten thousand ETH have dropped 2.24 percent of their cumulative holdings. Addresses holding 100 to thousand ETH, their holdings fell by 1.41 percent.

🐳 The #Ethereum #merge on 9/15 has brought on a shift in large address behavior. In the past 6 days since the shift to #proofofstake, addresses holding 1k to 10k $ETH have dropped 2.24% of their cumulative holdings. 100 to 1k addresses have dropped 1.41%. https://t.co/qdOVcdDjgC pic.twitter.com/fcFy8hTUGD

— Santiment (@santimentfeed) September 21, 2022

Selling in ETH continues to be fierce in the broader crypto market. ETH fell more than 20 percent, while other altcoins posted single-digit weekly losses on a percentage basis. However, there is one altcoin that is traded upstream and that is Ripple’s XRP.

Whales turn their attention to Ripple’s XRP

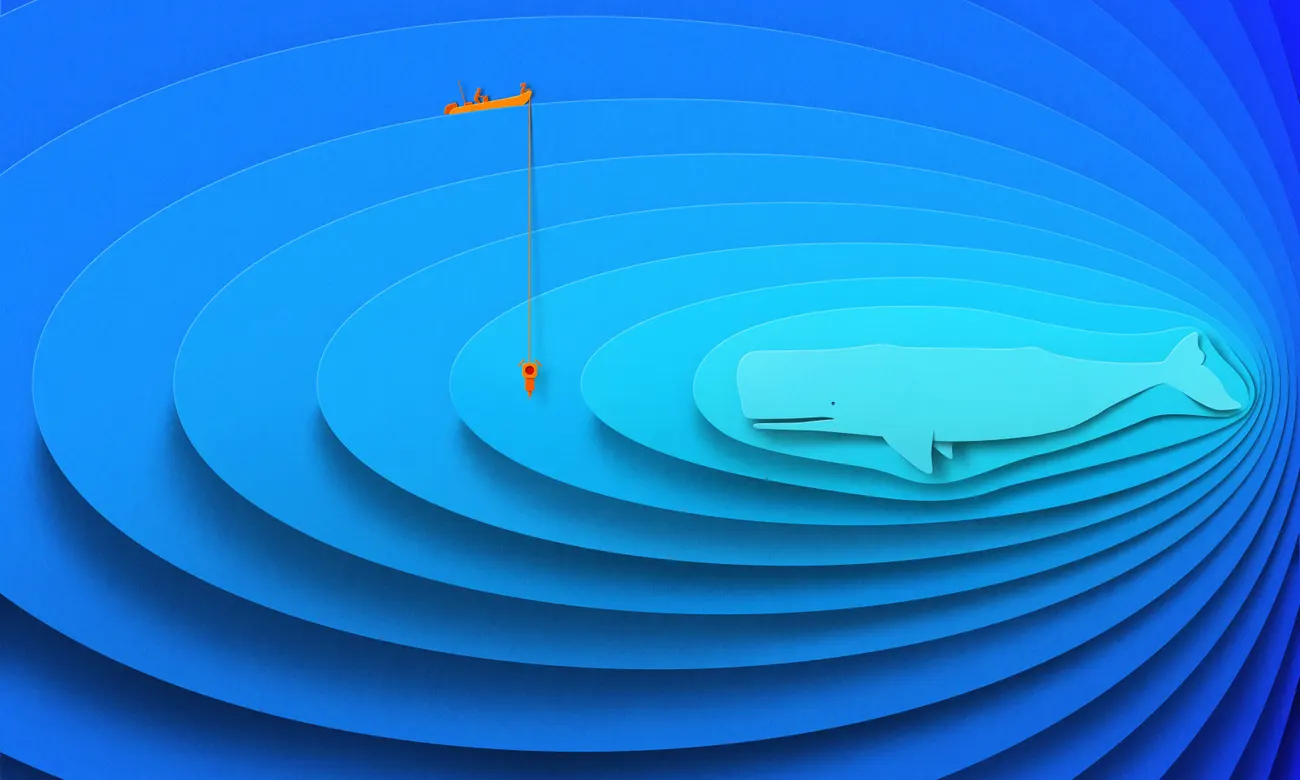

Over the past week, strong buying has been seen in Ripple XRP, which is up 20 percent on the weekly charts. As of now, XRP is trading at $0.40 with a market cap of $20.2 billion. The recent price surge is linked to the development rumors of Ripple’s legal battle behind XRP. There are reports that Ripple has reached a settlement with the US Securities and Exchange Commission (SEC). On-chain data provider Santiment shares the data on the subject as follows:

XRP rose 17 percent last week, while Bitcoin fell 5 percent, Ethereum 16 percent. Most of the cryptocurrencies also fell. The ongoing battles over regulation between Ripple and the SEC have mainly led to increased trader optimism and high whale action.

Alongside altcoins, Bitcoin also fell 7 percent last week. It is facing strong selling pressure. On Wednesday, the Fed announced a 75 basis point rate hike to combat rising inflation. Immediately after, the BTC price dropped below $19,000.