The crypto market saw sharp drops today. So much so that even the leading crypto Bitcoin (BTC) has lost more than 10% on a daily basis. It was a nightmare day for altcoin projects. However, billionaire businessman Mike Novogratz, CEO of Galaxy Digital, predicts more ‘falls’ when speaking of the market.

“Do not expect recovery before 2 months for BTC and altcoin projects!”

The crypto billionaire believes that crypto will remain highly linearly correlated with the Nasdaq 100 Index. So Mike Novogratz seems ‘pretty confident’ that Bitcoin (BTC) will bounce back once stocks find ‘some kind of bottom’. On the other hand, stating that crypto money investors should not expect a rapid recovery, Mike Novogratz says, “I don’t think it will happen in the next two months,” he says. Galaxy Digital reported a loss of $111.7 million in the first quarter due to falling cryptocurrency prices.

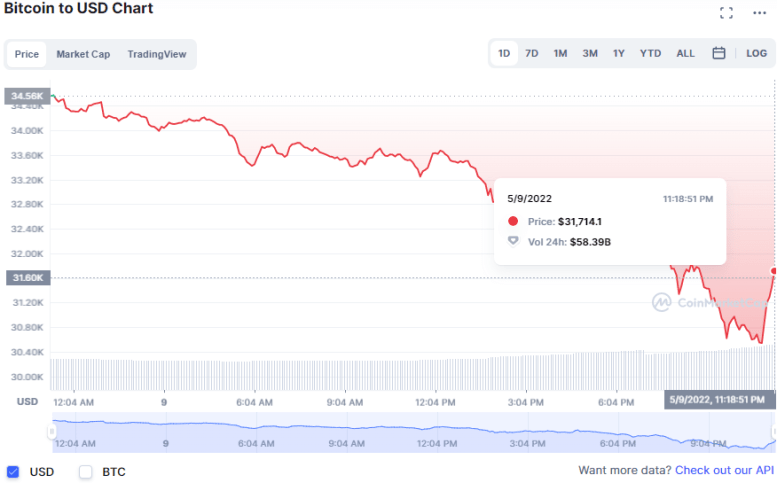

Bitcoin closed the quarter down 2%, but the largest cryptocurrency is in worse shape than in the second quarter of 2022. Earlier today, the crypto leader dropped to a 52-week low of $30,516. The leading cryptocurrency, which was trading at $31,714 with a slight recovery at the time of writing, is 54.41% away from the all-time high of $69,044.77 recorded on November 10.

Bitcoin daily price chart / Source: CoinMarketCap

Bitcoin daily price chart / Source: CoinMarketCap Percentage of Bitcoin addresses in profit at historical lows

Bitcoin in profits, according to data provided by IntoTheBlock The percentage of addresses dropped below 50% for the first time since the pandemic-induced collapse in March 2020.

Source: IntotheBlock

Source: IntotheBlock Meanwhile, the stock market had a tough start to the week as the Dow lost more than 400 points. The stock market closed in red on Friday. As you can follow from Cryptokoin.com news, the Federal Reserve’s hawk policy continues to be the biggest concern among investors. While Fed Chairman Jerome Powell has rejected 75 basis points hikes for now, interest rates are expected to continue to rise this year, making borrowing more expensive.