Crypto prices continue to drop and there seems to be no bottom in sight. The data shows that whales are intensifying sales on a cryptocurrency meanwhile.

Whales are moving away from this cryptocurrency

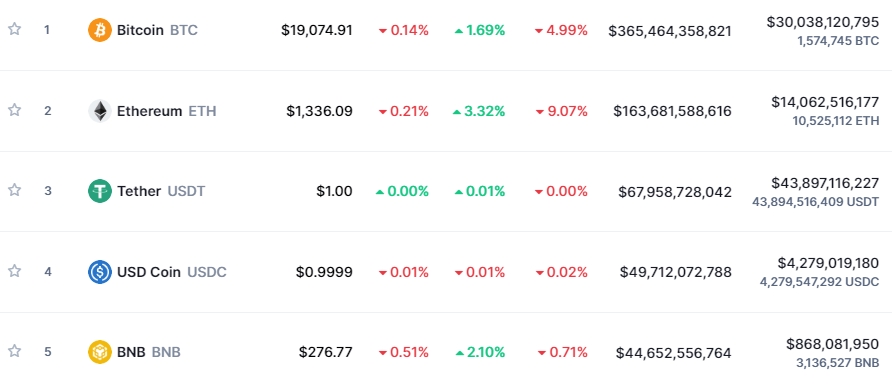

A crypto analyst claims that the second largest stablecoin, USDC, is in serious trouble. The entire crypto market experienced a sell-off as a result of the Fed’s hawkish stance. Analyst Geralt Davidson claims that Circle USDC is rapidly losing ground. Additionally, the USDC market cap has depreciated significantly. Worse still, it showed no signs of returning. The second largest stablecoin by market capitalization is backed by Circle. Its market cap is currently under $50 billion.

Why is USDC in danger?

Geralt Davidson highlights the steadily declining supply of USDC held by the top 1%. This highlights the fact that whales are selling USD Coins. According to Davidson, choosing Tornado Cash was a mistake for the company. cryptocoin.com As you follow, the US Treasury Department’s Office of Foreign Assets Control has penalized Tornado Cash for engaging in money laundering activities. All of Circle’s cryptocurrencies on Tornado Cash are currently suspended. Circle is the parent company of USDC, so the case directly concerns itself. Meanwhile, companies like Tether, unlike Circle, did not freeze USDT on Tornado Cash addresses. Davidson claims that because of Circle’s action, people no longer believe in the company.

USDC’s trading volume on exchanges was quite close to USDT volume in February 2022. By October 10, 2022, some experts predicted that USDC would overtake USDT as the leading stablecoin. The second largest stablecoin is currently not in a position to challenge USDT. USDT’s market cap is currently close to $68 billion, while USDC’s is $49.7 billion.

Recently, Binance removed USD Coin from its platform. It also dealt a serious blow to the cryptocurrency by stopping accepting deposits. Instead, the platform enabled users’ USD Coin to be converted to BUSD at a 1:1 ratio. WazirX, India’s largest cryptocurrency exchange, has removed USDC from the list after Binance. The lack of trust in USDC could cause problems for the stablecoin as long as the Fed continues to support hawkish policies.

The company’s work towards CBDCs

Critics claim that USDC will support central bank digital currencies as USDC complies with Tornado Cash. Similar views are made by Block Digital co-founder Santiago Velez. Also, without the support of CBDCs, the FDIC considers it impossible for the Federal Reserve and OCC to give USD Coin any competitive advantage.