Global banks’ altcoin investments are still relatively low. However, these financial institutions are slowly opening their doors with a new report from the Bank for International Settlements (BIS) listing the most popular cryptos.

7 most popular altcoin projects among banks

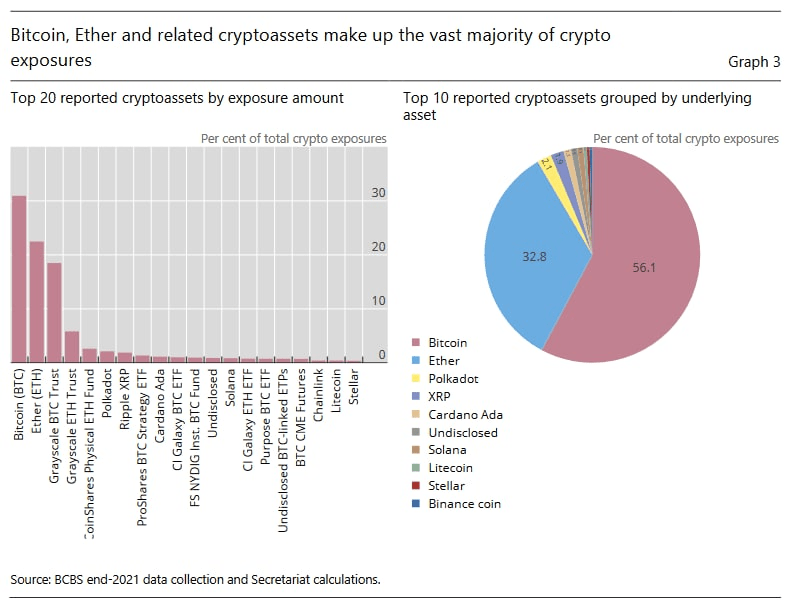

According to the report, Bitcoin and Ethereum “make up almost 90% of investments”. 2% of other popular altcoin investments among banks are on Polkadot (DOT). Another 2% is reserved for Ripple (XRP). Likewise, he owns a 2% stake in Cardano (ADA). Finally, Solana (SOL) has 1%, Litecoin (LTC) and Stellar (XLM) 0.4%.

The BIS explains the investment behavior of banks as follows:

These risks will likely be classified as Group 2 cryptoassets under the Basel Committee’s current advisory recommendation. Banks also reported smaller amounts of a stablecoin (USD Coin) and tokenized assets.

BIS’s skeptical approach

As a reminder, in late June, BCBS recommended that banks allocate 1% of their capital to invest in cryptocurrencies. At the same time, the institution takes a skeptical stance towards cryptocurrencies, stating that “money cannot fulfill its social role.” However, DeFi warns that crypto sell-offs show that its predictions about the dangers come true. Meanwhile, data from the BIS shows that global banks have allocated approximately $9.18 billion to cryptocurrencies.

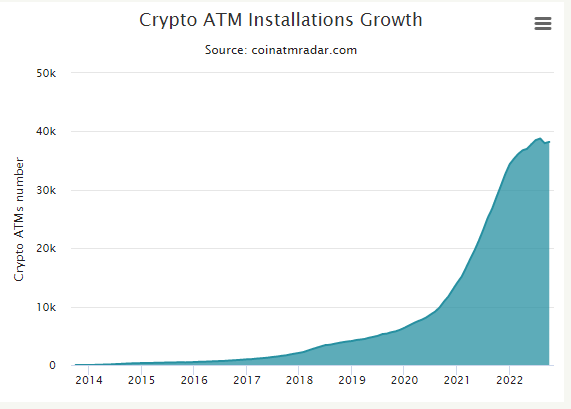

Bitcoin installation worldwide has been on the rise since 2017

cryptocoin.com Another data on the banking industry you follow from , shows that the number of Bitcoin ATMs worldwide has been on the rise since 2017. According to Coin ATM Radar data, at the beginning of 2017 there were close to a thousand Bitcoin ATMs worldwide. Also, about half of these ATMs were in the United States. Recent figures, however, showed the number had dropped to 38,195.

Also, the total number of Bitcoin ATMs installed actually decreased after August 2022. The month started with 38,777 ATMs worldwide and ended at 37,980, down 2% in a month. While that number has since dropped to 38,185, the bearish trend on the chart may be cause for concern, given that past performance has been expressed by a sustained uptrend that has continued for the better part of five years.

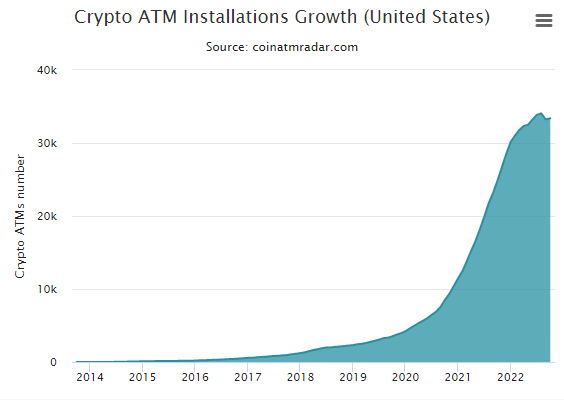

Focus on regional performance

A closer look at the numbers reveals that the US accounts for the majority of ATMs, with more than 87% in the country. However, at the beginning of August, the number of ATMs in the US dropped to 33,235. The figure rose slightly to 33,385 as of October.

In the European sample, there were no significant signs of decline. The region managed to increase the number of ATMs gradually as well as maintaining it. Surprisingly, even during the peak of crypto sales, Europe has witnessed 0.75% of new ATM installations per month since June.

The UK experienced the worst performance ever in this sector. The number of ATMs in the UK actually started to decline long before the current bear market. Also, this number was surprisingly falling even in the middle of the 2021 bull run. At its peak, the UK had 283 ATMs in February 2020. That number dropped to almost 100 at the start of 2022 and currently stands at 19.