Strong US jobs data on Friday raised expectations that the Federal Reserve will continue to raise interest rates at an exorbitant rate, which strengthens the dollar. As a result, gold prices fell to a one-week low on Monday. We have compiled analysts’ gold forecasts and market comments for our readers.

Gold predictions: locked in downtrend for now

Spot gold hit its lowest level since October 3 at $1,677. At the time of writing, it was trading at $1,680, down 0.87% daily. U.S. gold futures fell 1.35% to $1,686. Meanwhile, the dollar index (DXY) rose 0.2%. Thus, it made gold more expensive for buyers holding other currencies. IG market strategist Yeap Jun Rong has this to say about his gold predictions:

Gold prices are taking cues from last week’s rise in rate hike expectations, driven by the warmer-than-expected US jobs report. The yellow metal is locked in a downtrend for now.

Gold forecasts: Spot gold will drop to $1,660 to $1,674 range

Gold is generally accepted as a hedge against inflation. However, rising US interest rates increase the opportunity cost of holding non-yielding gold. cryptocoin.comGold prices have dropped more than $350 since it crossed $2,000 in March amid aggressive monetary policy tightening by the United States.

Reuters technical analyst Wang Tao expects spot gold to fall in the $1,660 to $1,674 range. Meanwhile, SPDR Gold Trust Holdings, the world’s largest gold-backed exchange-traded fund, posted its biggest exit since the end of September, down 2.03 tons on Friday.

“Gold crumbles at critical support, eyes await strong breakout”

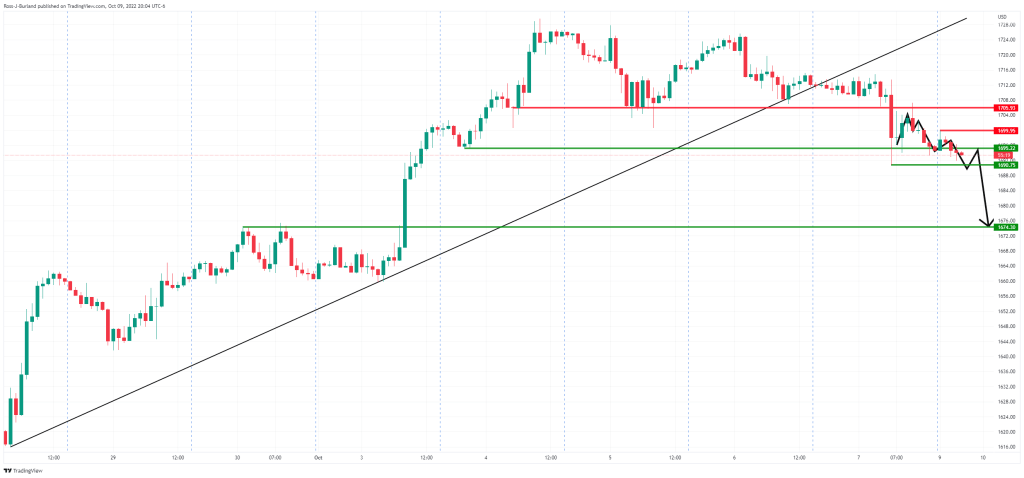

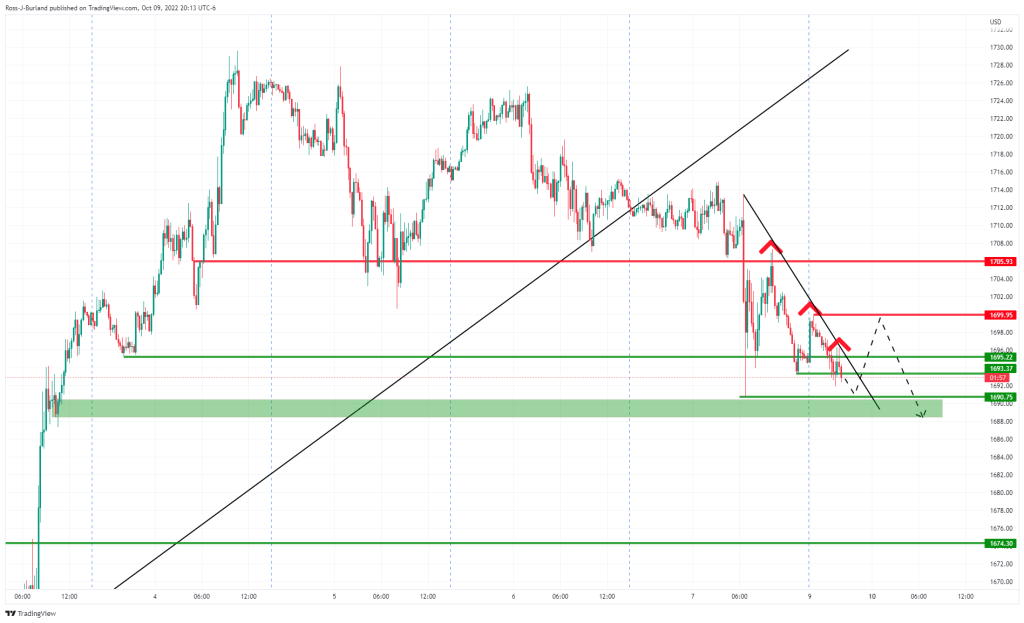

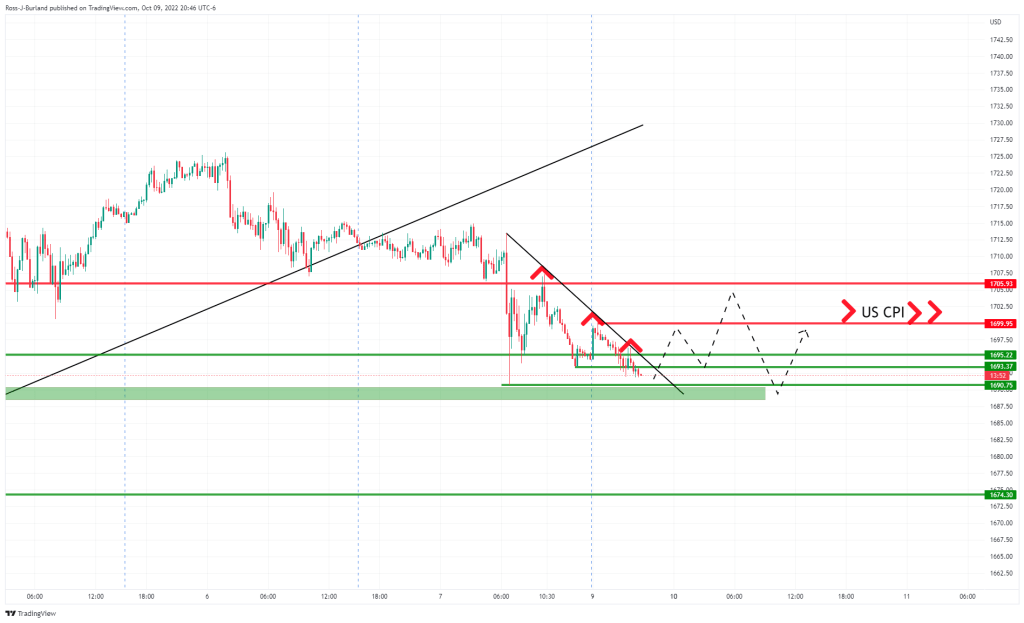

Gold forecasts and technical analysis by technical analyst Ross J Burland point to the following levels. Gold price is under pressure at the beginning of the week due to the strong US dollar at the open. A strong US labor market has strengthened bets on higher interest rates as traders prepare for data.

Gold is on the verge of a major break below $1,690. Hence, the bulls will emerge in the next day or face strong opposition. Therefore, traders considering $1,675 will need a breakout.

However, according to the 15-minute chart, it is possible for the bulls to push the price up along the trendline resistance for the bears’ recent attempt at $1,700 commitments. In this direction, peak formations are rising. Therefore, there will be liquidity above the highs as well. This will create a potential trapped market ahead of the US CPI.

“More fixes on cards for gold”

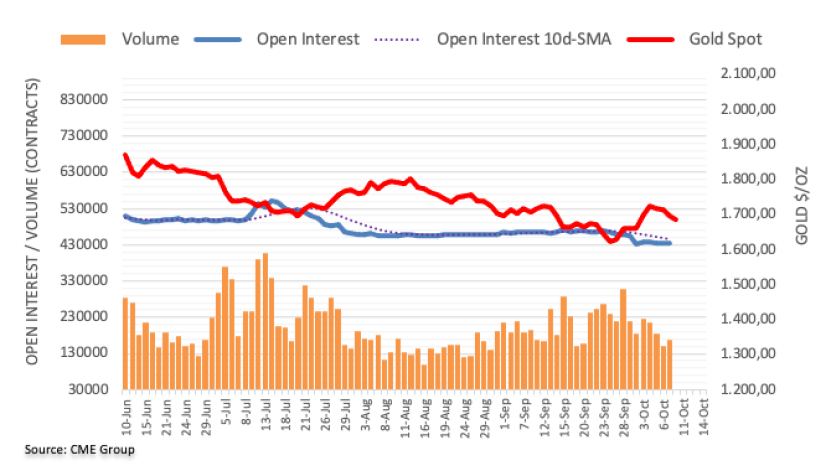

Flash data for CME Group’s gold futures markets posted a second straight session of open interest on Friday. However, this time there were only 756 contract increases. Volume followed suit. Thus, nearly 18.8k contracts rose after three consecutive days of decline.

Market analyst Pablo Piovano draws attention to the following points regarding the latest movement of gold.

Friday’s negative price action in gold prices was due to increased open interest and volume. This allows the downtrend to continue in the very near term. Meanwhile, the yellow metal risks extra weakness below recent highs in the $1,730 region.