The cryptocurrency market is struggling to find direction under the influence of macro winds. Investors and traders await data that will dampen or strengthen this headwind. An economist says the leading altcoin Ethereum (ETH) and the rest of the crypto market will likely witness wild price swings in the coming weeks.

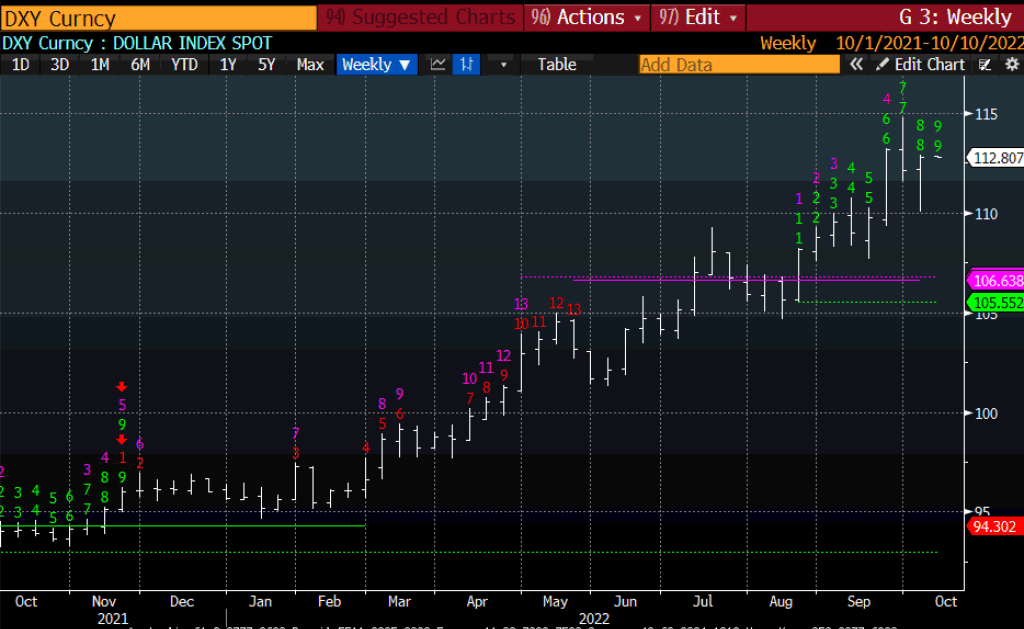

“Ready for trend reversal this week on DXY”

Economist Raoul Pal says that the Tom DeMark technical indicator gives upside signals for a number of asset classes. The indicator tries to detect the directional trend of an asset by comparing the latest maximum and minimum prices with the price of the previous period.

Raoul Pal first looks at the US dollar index (DXY), an important indicator for all markets. According to the economist, DXY printed a DeMark nine, which indicates a selling pattern in a bullish trend. This week, the trend is ready for a reversal. Pal makes the following statement:

I like DeMark technical indicators for market timing. Over the next three weeks, there are some very important signals. This week on DXY, her nine weekly spins.

Source: Raoul Pal/Twitter

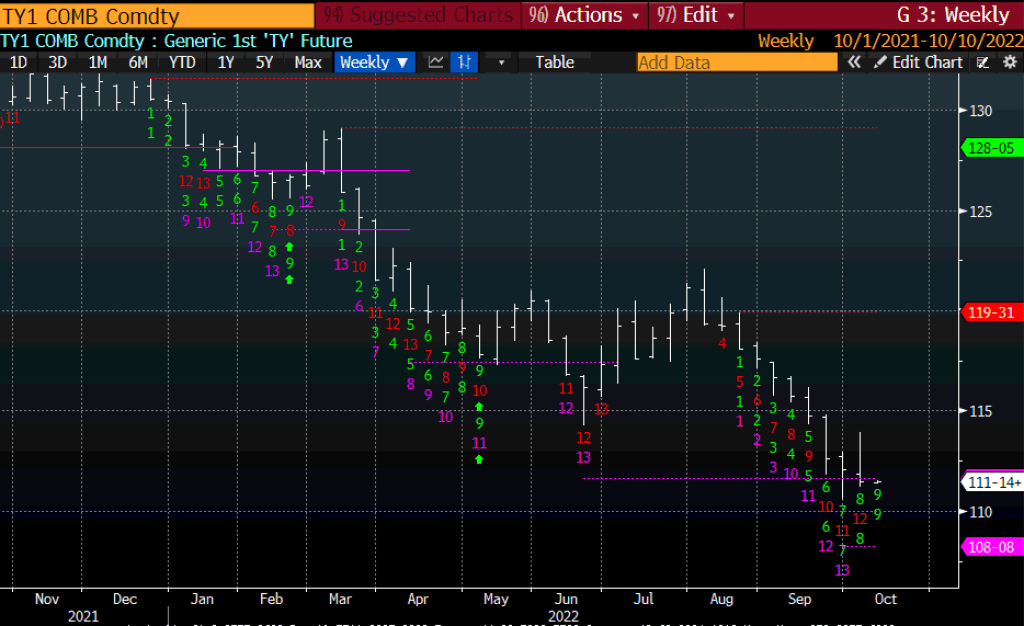

Source: Raoul Pal/TwitterWeakness in the index tends to turn into strength for risky assets like Ethereum and crypto. Therefore, traders follow DXY closely. With DXY showing signs of a potential trend change, Pal says the bond market is poised to signal multiple reversals. In this context, the analyst notes:

The next week is even more important with bonds set to a low level. Nine this week and a second 13 next week.

Source: Raoul Pal/Twitter

Source: Raoul Pal/TwitterMeanwhile, a DeMark 13 issue is often associated with the more pronounced market response.

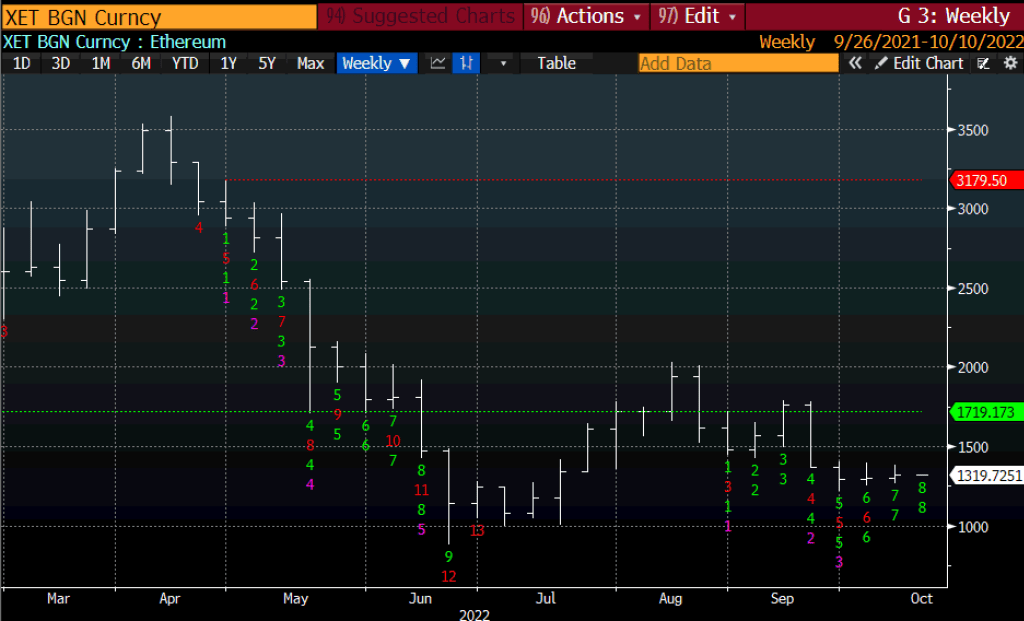

“DeMark signals reversal for leading altcoin”

Raoul Pal then looks at the leading altcoin Ethereum. He says that Ethereum is also on the verge of signaling a DeMark reversal. He uses the following expressions for this view:

ETH will hit nine in a week.

Source: Raoul Pal/Twitter

Source: Raoul Pal/TwitterImportance of US CPI data for Bitcoin and altcoin traders

According to Pal, DeMark signals across multiple asset classes tell him a meaningful drop is coming this month. But he warns his followers that this week’s Consumer Price Index (CPI) could trigger a sell-off before risky assets like crypto make returns. cryptocoin.com As you can follow, the US CPI is at its historical peaks. Therefore, the CPI gives an idea whether the Fed will continue to follow tight monetary policies. Therefore, traders also follow this data closely. The famous economist makes the following assessment:

Daily DeMark shows more downside first. Maybe it’s been flushing for a few weeks? I do not know. Not open. But full attention/focus is required. If there’s one thing that will speed up the current narrative, it’s the CPI and bond market response. If bonds break foreign bond markets, it’s possible the Fed will take note. It’s very, very unstable because the liquidity in the bonds is super low. Fed and Treasury import deflation. That’s why he likes a strong dollar. But other countries are struggling. This week’s IMF/WB meetings will reinforce the view that the Fed should slow it down.