The altcoin market has returned all the gains of recent months in just 48 hours. Terra (LUNA) has lost more than 97.24% in the last 24 hours. Despite all the crash, LUNA will recover from its current crash according to several analysts…

Ran Neuner believes altcoin price will recover despite the crash

Terra (LUNA) and TerraUSD (UST) explain the reasons for the crash we covered in this article. At the time of writing, LUNA price is trading below $1.

Hasu, a crypto researcher who previously warned that unsecured stablecoins “cannot function”, said the moral decision as a stablecoin issuer is to UST by preserving the treasury even if it means LUNA drops to zero. He argued that it would protect A few analysts claim that LUNA will recover from its current collapse. CNBC’s crypto trader Ran Neuner is one of them.

In a recent tweet, CNBC’s crypto analyst Ran Neuner hinted that the LUNA price could recover despite the crash:

Every attack, LUNA makes it stronger. The early days of Bitcoin were full of examples like this. You cannot avoid it; It is a necessary step.

Every attack makes $LUNA more resilient. It happened to $BITCOIN many times in the early days. It’s part of the process!

— Ran Neuner (@cryptomanran) May 8, 2022

Do Kwon has not lost faith in Terra

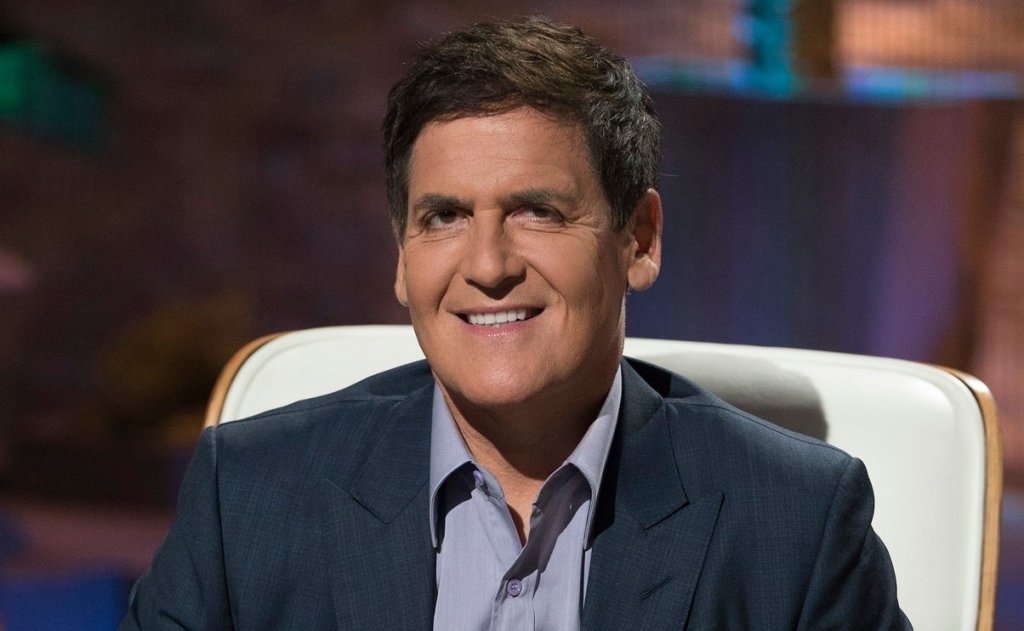

Terra (LUNA), which provides liquidity to UST and has managed to attract the attention of analysts since last year, is now not getting out of trouble because of the stablecoin UST, according to many analysts. Lack of reserves and the inability of complex algorithms to guarantee market efficiency are the main reasons for this. Billionaire Dallas Mavericks owner Mark Cuban said he lost a large amount of money after the IRON algorithmic stablecoin lost its price stability following a massive sell-off by major investors. Kwon, on the other hand, seems unaffected by these events.

TerraUSD has been under a lot of stress lately as a result of recent market developments. As analysts expected, the worst of the worst happened. Not one, but two major de-pegging incidents occurred. According to critics, contingency plans can add to the current selling pressure of the market and lower the price. Kwon, on the other hand, retweeted Jose Macedo’s tweet that “LFG has made the UST more robust but also momentarily more centralized,” and he believes this to be true.