The world of cryptocurrencies is definitely a profitable one. The downside, however, is the high level of risk involved. Due to the volatile price movements of cryptocurrencies like Bitcoin, Ether and Dogecoin, more investors are now buying stablecoins like Terra to diversify their portfolios.

According to Decrypt, UST has surpassed DAI to become the most valuable decentralized stablecoin by market cap. In March 2022, the market capitalization for UST and DAI was $15.3 billion and $9.8 billion, respectively.

The growing popularity of TerraUSD has benefited Terraform Labs, which oversees the Terra cryptocurrency project. As reported by Analytics Steps, investors such as Lightspeed Venture Partners, Arrington Capital, and Pantera Capital have invested $150 million to help Terra develop various cryptocurrency projects.

What is Terra?

Terraform Labs has developed Terra, a blockchain platform that powers startups’ cryptocurrencies and financial applications. TerraUSD (UST), pegged to the US dollar, is among these cryptocurrencies.

Do Kwon, a former software developer at Apple and Microsoft, and entrepreneur-economist Daniel Shin founded Terra (LUNA) in April 2019. The company launched TerraUSD on Bittrex Global in September 2020.

Terra is a stablecoin designed to reduce the volatility of cryptocurrencies like Bitcoin. Terra, the native blockchain of TerraUSD, is the brainchild of Terraform Labs. The latter is a subsidiary of Terra Alliance, which consists of 16 e-commerce companies in East Asia.

Terra protocol uses native token LUNA to stabilize the TerraUSD price. LUNA token holders can also vote on governance proposals by giving the functionality of the governance token.

A portion of Luna, another digital token and reserve asset, was “burned” as demand for Terra cryptocurrencies (UST) increased with increased adoption. As more Lunas are burned and diverted to the community pool, this acts as a counterbalance to the price.

What is TerraUSD (UST)?

TerraUSD (UST) is Terra’s algorithmic, decentralized stablecoin. With a price pegged to the US dollar, TerraUSD is the first decentralized stablecoin to be scalable and yielding.

With TerraUSD, Terra hopes to create value for the Terra community and provide a scalable alternative to the scaling issues faced by other stablecoins like DAI. Besides promising users higher scalability, TerraUSD also promises higher accuracy in interest rates and cross-chain usage.

TerraUSD’s mintage mechanism allows UST to be scalable without sacrificing security while meeting the requirements of the DeFi protocols it uses. Users can easily integrate the TerraUSD payment method into their crypto wallet. Currently TerraUSD hosts more than 90 DeFi applications such as Mirror Protocol and has proven its strength in DApps.

How Does TerraUSD Work?

Terra combines a set of simple principles and protocols and uses pre-existing technology and innovations to ensure users have a great experience.

Stablecoins are backed by holding an equivalent amount of fiat currency in reserves. LUNA is used as the reserve asset of TerraUSD and the native cryptocurrency. Therefore, if you want to mint a TerraUSD, only $1 worth of Terra’s LUNA token will be burned from the system.

TerraUSD also connects and enables blockchain ecosystems using Dropship, a bridging protocol. Dropship allows TerraUSD to be integrated into DeFi platforms and DEXs and move across blockchains.

Additionally, it ensures the stability of TerraUSD as the demand and supply of LUNA determines the value of TerraUSD. Miners allocate Terra’s native LUNA token using a proof-of-stake (PoS) system to mine Terra transactions.

Main Features

TerraUSD leverages existing technology and innovations to provide users with the best possible experience. Its key features include:

Enhanced Scalability

TerraUSD is a stablecoin whose value is equal to the face value of minted stablecoins. Burning a LUNA reserve asset will issue one TerraUSD. TerraUSD’s monetary policy scales almost unlimitedly, helping DeFi projects reach their full potential.

Easy Exchange

In the Terra ecosystem, all stablecoins share liquidity, so you can convert TerraUSD to TerraKRW (Korean Won pegged stablecoin) with minimal fee.

Passive Income Potential

TerraUSD allows users to earn passive income with fixed interest rates of Anchor Protocol. Anchor, a lending protocol, promises a 20% return on UST savings.

Rewards in stable PoS chains through commissions and inflation provide additional fixed income. This nuance provides a predictable interest rate.

Interoperability

Terra stablecoins combine blockchain ecosystems with the Dropship bridge protocol. With the help of Dropship, TerraUSD integrates with various DeFi and DEX trading platforms and most importantly moves assets from one chain to another. The supply and demand of LUNA determines the value of TerraUSD. The Dropship protocol helps maintain scalability by guaranteeing a stable UST cost.

UST Tokenomics

TerraUSD (UST) is a stablecoin built on the Terra blockchain. Burning LUNA tokens creates UST. The value of the UST fluctuates as it is driven by the supply-demand relationship between the asset and the value of the US dollar. If the value of UST exceeds one dollar, LUNA holders can sell the token for UST.

Who is TerraUSD For?

TerraUSD offers crypto investors an alternative to the extreme volatility of other cryptocurrencies. By shifting their investments to the UST, investors can reduce their exposure to cryptocurrency price spikes. Having

UST (rather than US dollars) also reduces transaction time delays because it takes less time to transfer bitcoins to TerraUSD than to transfer dollars.

Another use for UST is DApps. For example, Mirror Protocol, a platform that allows the printing of affordable “synthetic assets”, currently tracks the prices of real-life assets and uses UST as a bare asset.

TerraUSD Pros (UST)

TerraUSD accelerates various financial processes. Because UST operates independently of any central agency that determines its working hours, payment and banking can occur at any time.

Many small businesses charge higher fees or no longer accept credit cards because the average price for processing credit cards is about two percent. By using TerraUSD, high transaction costs can be avoided, providing value for businesses and customers.

Millions of people rely on cryptocurrencies as an anonymous, unlimited source of store of value. With UST, payments abroad are eligible as they are not subject to speculative markets or wild inflation.

Cons of TerraUSD (UST)

At the request of law enforcement, tokens can be frozen at addresses by the central agencies that issue them. Law enforcement can even freeze tokens during money laundering investigations or illegal activities.

TerraUSD has a lower return on investment (ROI) and less profit because it is a stable coin. Its value is set to $1.00. If you invest $100 and its price rises to $1.01, the profit from your investment will be $1 or 1%; this is much less than the increase in ROI we’ve seen with some other cryptocurrencies. Market fluctuations or the absence of controls can also result in risk premiums. Risk premiums are additional compensation that investors receive for investing in a riskier asset (such as altcoins). Stablecoins lose value against their pegs due to the risk premium, so buying cryptocurrencies with stablecoins becomes more expensive than fiat currencies.

TerraUSD (UST) Is it a Good Investment?

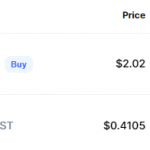

The high volatility of the crypto market causes prices to change drastically in a short period of time. However, TerraUSD is a stablecoin, so ideally its price should remain stable (around $1).

You will need to deploy large capital to make a substantial profit because UST is variable on a small scale. Due to pegged at

USD, Terra’s token has a market cap of over $15 billion and a similar amount of circulating supply. Currently, UST is one of the most scalable and cross-chain stablecoins on the market.

Terra blockchain protocol is an open source system that supports algorithmic stablecoins and an expanding network of financial applications. Overall, TerraUSD offers a wide range of features and applications that are perfect for DeFi applications and meets the growing demand for a scalable, functional stablecoin.