The crypto bear market is teaching the still-in-its-infancy decentralized finance (DeFi) industry that banking can be a tough business.

On Oct. 9, TrueFi, a DeFi protocol where institutional investors can take out loans without collateral, issued a “notice of default” for the first time since its start in 2020. The borrower was Blockwater, a Korean crypto investment firm, which allegedly missed payment on a $3.4 million loan.

And that’s not the only troublesome loan on the protocol’s balance sheet. On the same day, TrueFi officials warned in a Twitter post that another borrower, Invictus Capital, might not repay a $1 million loan due Oct. 30; Invictus filed for voluntary liquidation earlier this summer.

TrueFi already is dealing with the fallout from the news last month that crypto market maker Wintermute fell into a precarious financial position after it lost $160 million in a hack. Wintermute is the single largest borrower on TrueFi with $92 million debt outstanding at press time, which is due to mature on Oct. 15. On Sept. 21, TrueFi said its “credit team has held multiple constructive discussions” with Wintermute, and that it could come up with a short-term loan if needed.

Unlike on DeFi protocols like Aave or Maker – where loans are secured by more assets than the loan’s value and a default prompts an automatic liquidation of the collateral – lenders on TrueFi have no other choice than to trust the protocol’s due diligence on borrowers taking out unsecured loans, because there’s no collateral to seize in a default.

“This is not too much different from the centralized model,” Dustin Teander, analyst at crypto intelligence platform Messari, told CoinDesk. “You kind of have to trust the people.”

TrueFi says its credit group “believes that the loan book continues to remain in strong standing.” But the recent disclosures call into question the sustainability of the undercollateralized crypto lending business model and its level of decentralization. Borrowers and loans once deemed safe might be riskier than previously thought.

Bad crypto loans

Decentralized finance is a novel concept – enabled by fast-developing blockchain technology – that attempts to create a banking system without the need for bureaucracy and trust in the middlemen by deploying computer-coded smart contracts.

This year, automated DeFi lending protocols including Maker and Aave stood out by weathering the crypto market crash – even as several centralized crypto lenders, such as Celsius Network and Voyager Digital, became insolvent after making risky loans with customer deposits to crypto firms. The DeFi platforms’ requirement of ample collateral proved crucial in their ability to avoid losses.

TrueFi is one of the most prominent practitioners of undercollateralized lending in DeFi. The protocol, backed by big-time crypto investors such as Andreessen Horowitz (a16z) and Alameda Research, creates lending pools where any investor can deposit crypto to earn yield; professional investors – ostensibly reputable crypto firms – comprise the bulk of borrowers; they can take out loans, at interest.

These loans are uncollateralized, meaning that borrowers do not pledge any of their own assets to secure the loan. The likelihood of the loan getting repaid is based on the protocol’s review of the borrowers’ creditworthiness – essentially an article of faith.

Hence, would-be borrowers have to go through TrueFi’s credit and know-your-customer (KYC) checks and pass the capital requirements to apply for a loan. Those who hold TRU, the platform’s governance token, vote to approve or deny the application.

“Defaults are ordinary course in this asset class and critically important to refining risk parameters and pricing over time,” Roshan Dharia, head of lending at Archblock, a core TrueFi contributor which oversees borrower relationships on the protocol, told CoinDesk. “We have historically been heavily focused on borrower counterparty risk, asset composition and liquidity profile. These diligence items remain the highest priority as we face continued macro headwinds and a protracted bear market.”

TRU’s price dropped 15% in digital-asset markets since Blockwater’s default, though the decline was mostly in sync with a retreat in broader crypto markets. Currently, the token trades at 4.4 cents, close to an all-time low and down 90% over the past year, according to data by crypto price tracker CoinGecko.

Centralized solutions for DeFi’s problems

Undercollateralized lenders like TrueFi made loans when crypto prices and yields were high; it’s sort of like when subprime mortgage lenders issued oodles of loans during the home-price boom of the mid-2000s – just before the housing market crashed.

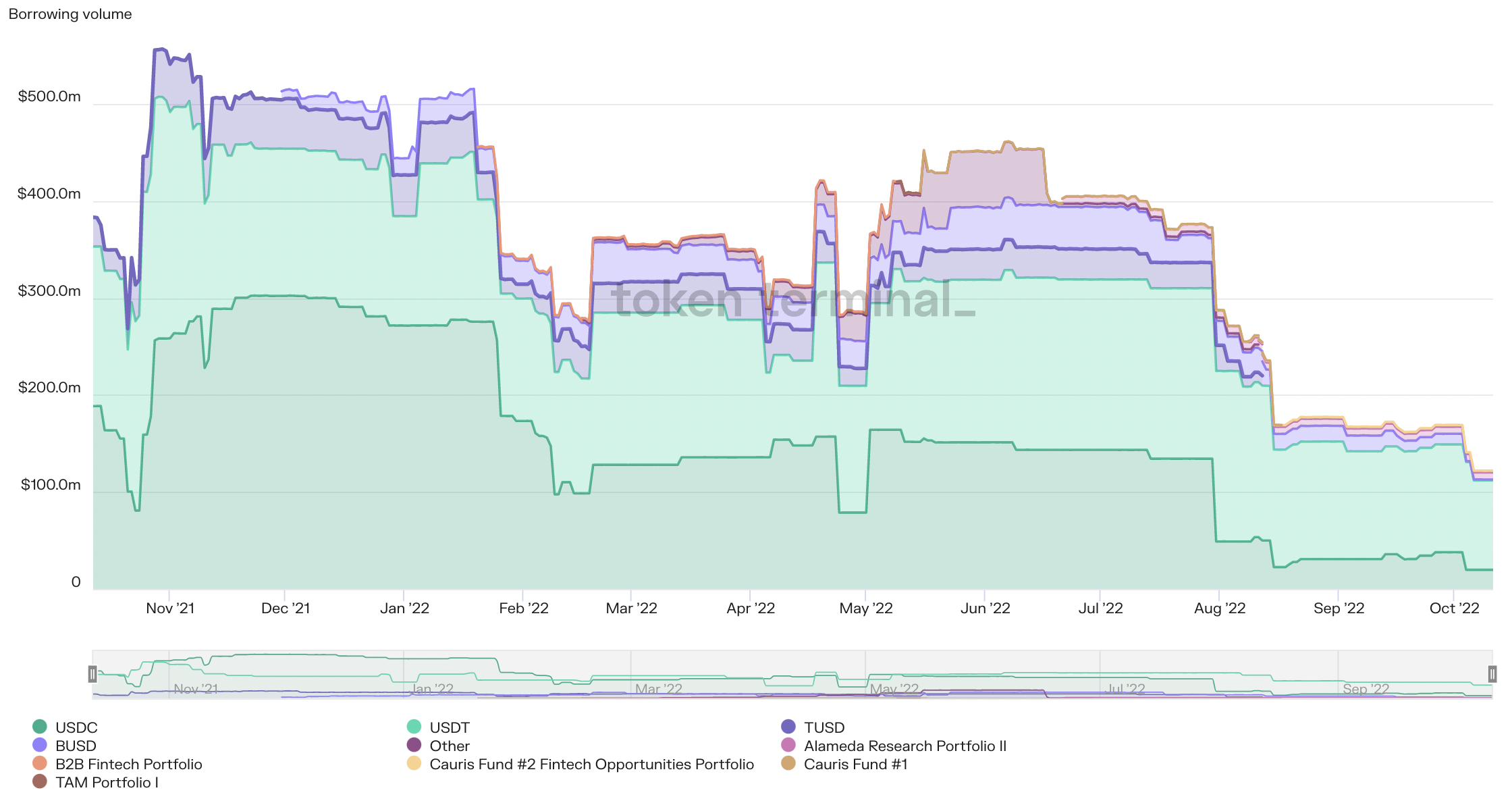

Borrowing declined on TrueFi in the last year. (TokenTerminal)

Experiencing the bear market for the first time, these crypto lenders have had to adjust to a new reality, where yields are lower but with bigger perceived risks. Yields in crypto lending depend on trading volumes rather than risks and central bank-set interest rates, and trading volumes on exchanges declined after a lot of traders left the market.

“It’s really hard to make long-term loans in a volatile market and expect a consistent payback,” Messari’s Teander said. “I think the undercollateralized lending model is going to stick around,” but “folks have to improve the pricing of the risks.”

TrueFi, in anticipation of a non-zero amount of loan defaults, built in a “default protection” as a backstop insurance for lenders. The protocol slashes up to 10% of all staked (locked up) TRU tokens to compensate affected lenders.

The default protection, however, currently stands at $1.36 million, TrueFi’s dashboard shows. That’s only about a third of the outstanding bad debt on the platform, not enough to make lenders whole.

The process is not automatic, and the resolution of the Blockwater loan is “working its way through the internal checks,” Michael Bland, a senior counsel of Archblock, told CoinDesk.

Lenders seeking to recover their assets fully are left with traditional recourse, not automated at all – hoping that the protocol can negotiate with borrowers to restructure and repay the bad debt or go to court to liquidate the assets to get them back. Legal fees can add up.

According to a TrueFi blog post about the default notice on the Blockwater debt, “a potential court-supervised administrative proceeding would lead to a better outcome for stakeholders given the complexity around the sudden insolvency.”

Possible loan losses

If history is any indication, depositors of the TrueFi lending pool may have to stomach losses.

Maple Finance, a rival undercollateralized DeFi lending protocol, had reported on June 21 that it might face short-term liquidity challenges and have insufficient cash after Babel Finance, a crypto lending firm, became insolvent and defaulted on a $10 million loan. After liquidating the loan, depositors of the lending pool suffered $7.9 million in losses, which represented a 3.2% haircut on the $244 million total deposits in the pool.

TrueFi’s $4 million bad debt represents a fraction of the $117 million loans outstanding. What may worry lenders is that the bad loans to Blockwater and Invictus are both from the same lending pool potentially non-performing loans represent almost half of the pool’s $8.4 million in assets.

TrueFi’s credit team added in a tweet that “as result of active negotiations expected recovery value will be maximized on these distressed loans.”

What comes next is that TRU token holders, who govern the protocol, will discuss and vote on how to proceed with recovering the assets to mitigate the hit on lenders affected by the default.

How long that could take and how much assets could be recovered remains an open question.