Philip Swift, co-founder of LookIntoBitcoin, said that we will be in a bear market for a while. Bitcoin, which has dropped roughly 70% from its peak price, is having a hard time stopping sellers. Here are the expected dates…

Bitcoin bear market will last ‘2-3 months at most’

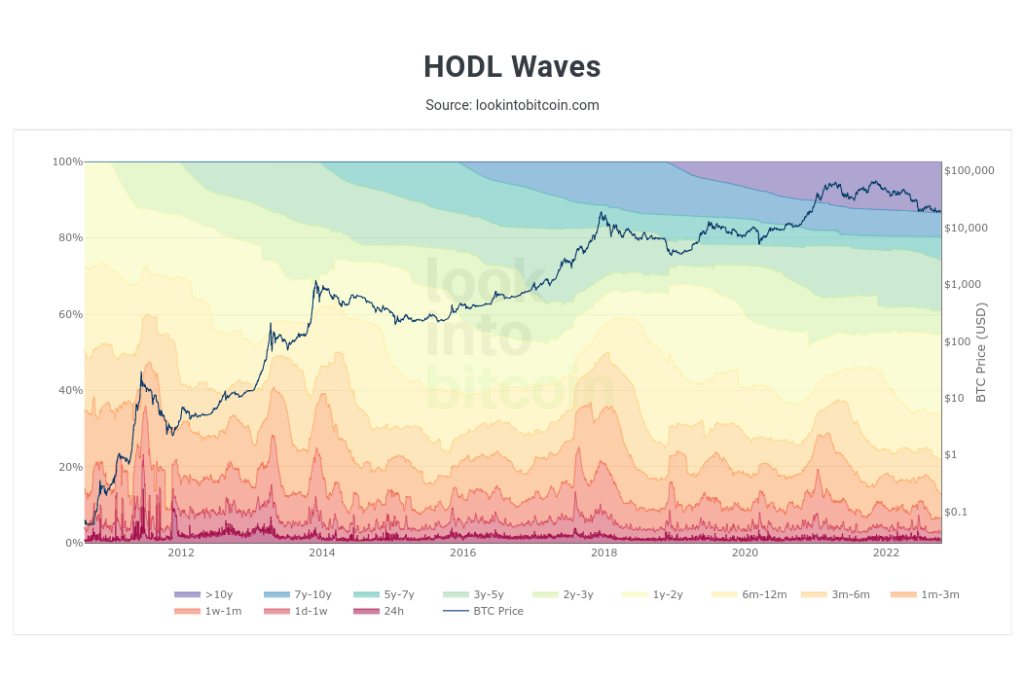

Philip Swift said that in his latest analysis, metrics like HODL Waves and RHODL Ratio show BTC’s bottom. Looking at these on-chain metrics, the analyst said, “there is a lot of important metric data showing that we are in big cycle drops.”

How is this bear market different from previous BTC cycles?

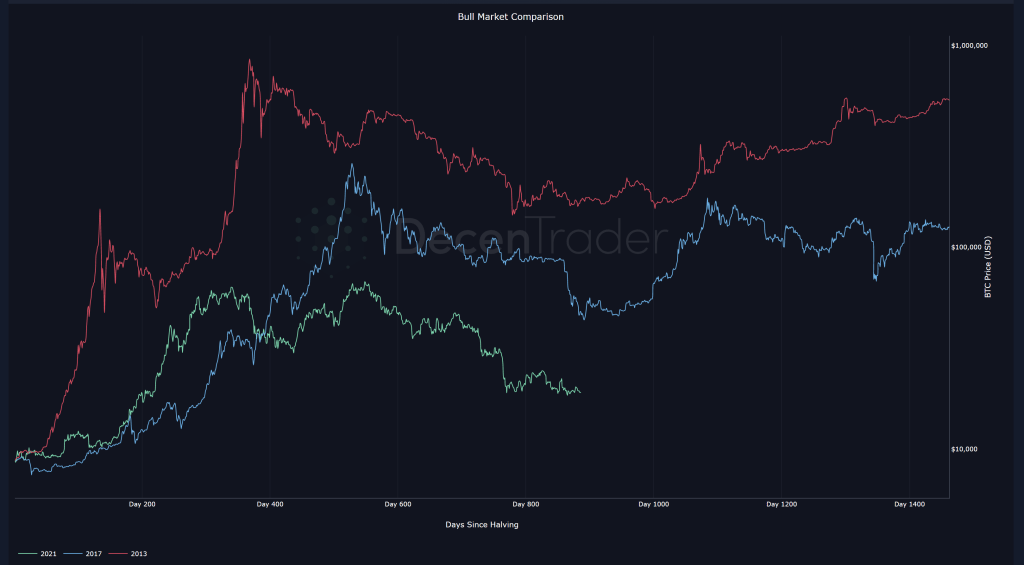

According to Swift, the current price of Bitcoin exhibits similar moves to the 2018/19 bear market. BTC price has returned to the lows of the last year after rallying in this period as well. According to the analyst, the market stays away from leveraged transactions for a while; It will benefit the next bull. The chart below shared by Swift shows Bitcoin performance in every cycle since halving. We are now at the capitulation points of the previous two cycles.

As for the timing of the rally, there will be a number of factors triggering it, according to the analyst. One of them is global cryptocurrency adoption.

While it is painful for bulls to see Bitcoin and crypto being so closely associated with traditional markets, I believe we will soon see a bid for Bitcoin as trust in (major) governments has eroded beyond the point of no return. I believe this lack of trust in governments and currencies will create a rush towards private “hard” assets, with Bitcoin being the biggest beneficiary of this trend in 2023.

According to the analyst, weakening fiat currencies will bring Bitcoin more to the fore. However, the market is still detecting lower lows dominated by bears. Swift monitors the price data on this issue.

“It shows we are close to a major low cycle for Bitcoin”

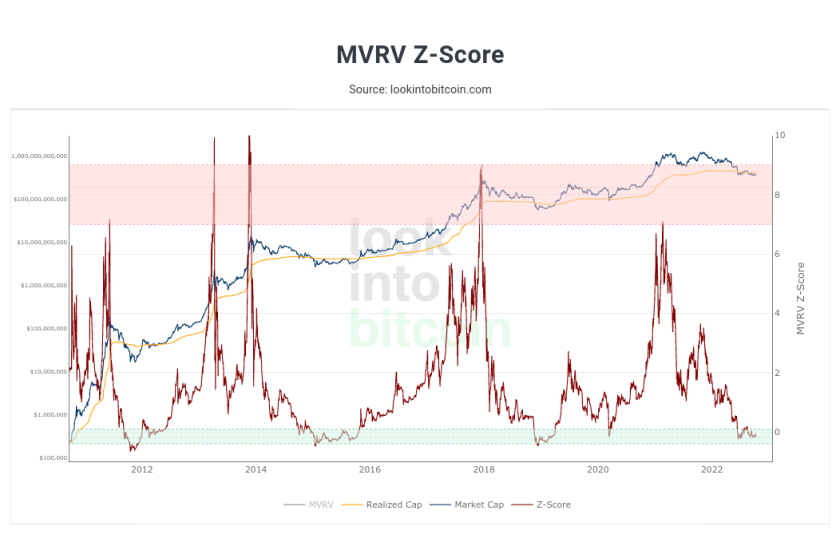

The MVRV Z-score is an important and widely used metric for Bitcoin. It indicates whether the Bitcoin price is moving above or below its actual price. The actual price is the average cost basis of all Bitcoins purchased. Therefore, it can be considered as an approximate break-even level for the market. The price drops below this level only in extreme bear market conditions. Bitcoin is currently inside this zone. According to the analyst, this presents an opportunity for accumulation:

This shows that these could be very good levels for the strategic long-term investor to accumulate more Bitcoin.

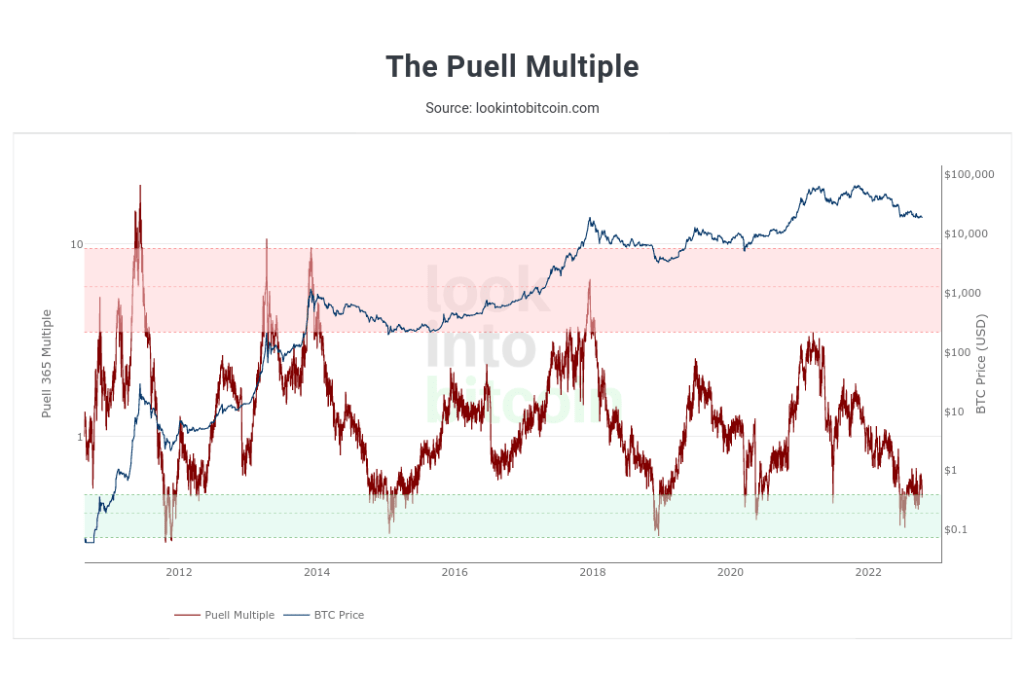

Another metric; Puell Multiple looks at miner revenues versus historical norms. When the indicator falls into the green accumulation band as it is now, it indicates that many miners are under significant stress. This often occurs at major cycle lows for Bitcoin. This indicator shows that we are close to a major low cycle for BTC if we haven’t bottomed yet.

When will the bear market end?

On when to reverse course, the analyst said:

I think traditional markets will probably start to decline a bit more in early 2023. Worst of all, I see crypto having a hard time by then, so probably 2-3 more months at most. But I think most of the fear will soon turn to governments and currencies – rightly so. Therefore, I expect private assets like Bitcoin to outperform in 2023, surprising many of the doomers who say Bitcoin fails and goes to zero.