Terra’s stablecoin UST has yet to come close to $1 despite all efforts. Although the LUNA price is trading at a 99.98% discount from the $119.18 ATH level, it cannot find investors. Coindesk analysts Sam Kessler and Sage D. Young illuminate the LUNA and UST crash with 5 charts. Why did Terra (LUNA) and UST crash? Will Terra recover?..

Why did LUNA and UST crash? Let’s answer with 5 graphs

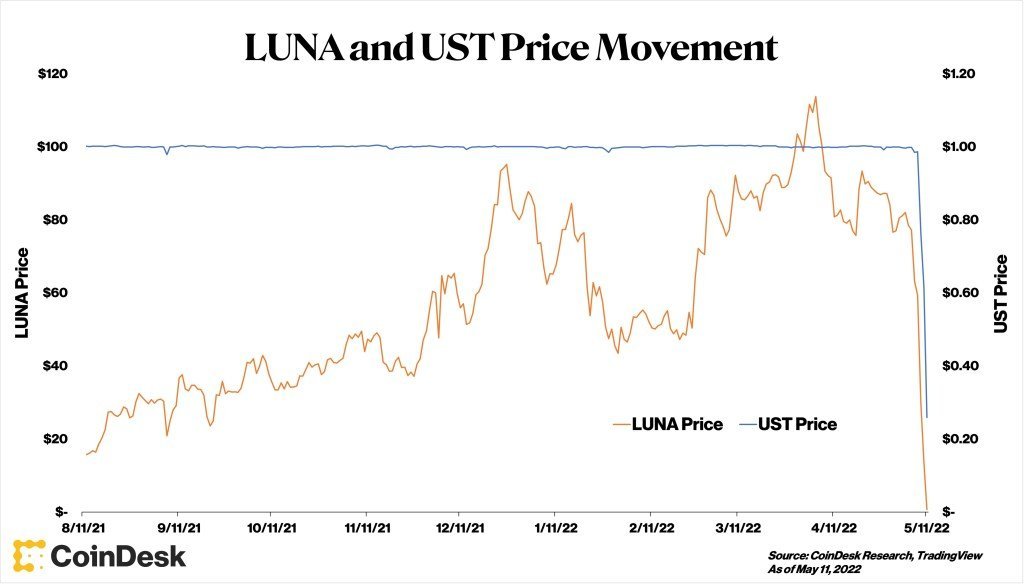

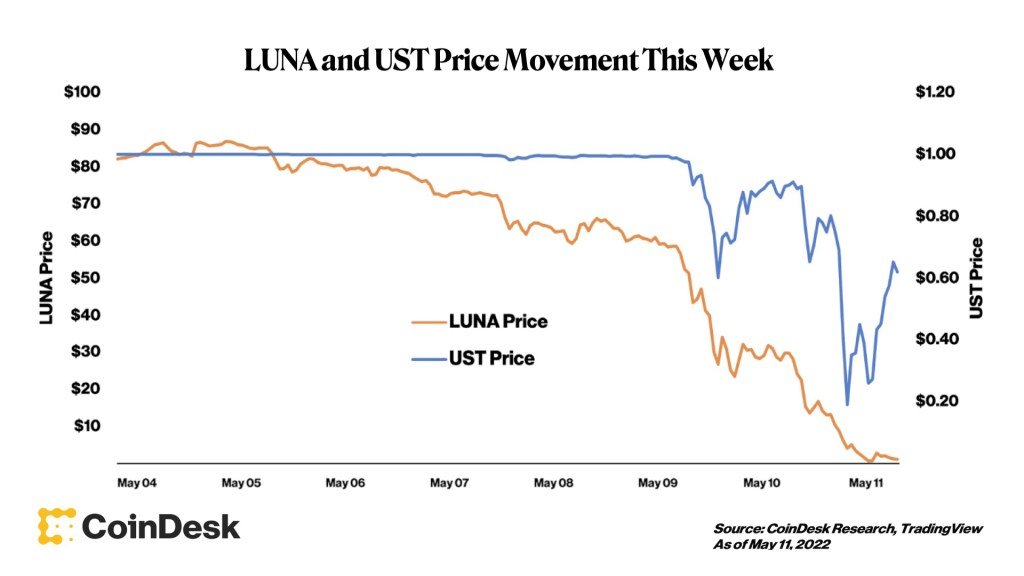

Terra (LUNA) almost completely crashed today. The UST stablecoin has remained below $1 for the past three days, and LUNA, which supports price stability, is down almost 99.96% from its 2022 peak price.

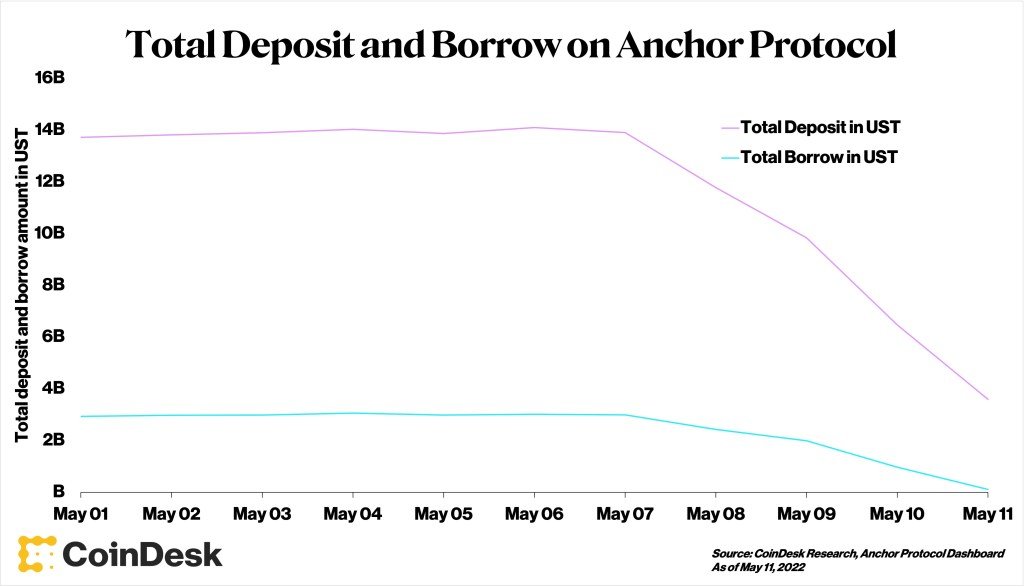

It’s important to understand why Terra crashed last week. One of the first signs that things were going wrong for Terra came when UST deposits in Anchor began to fall on Saturday. Anchor offers annual returns of up to 20% to users who deposit their UST on the platform. Before UST began its decline late Saturday, Anchor was home to 75% of UST’s entire circulating supply. That is to the UST of 14 billion dollars of the total circulating supply of 18 billion dollars.

It turns out that with so many USTs locked in Anchor, most investors are buying the stablecoin solely for the purpose of reaping Anchor returns. Anchor’s high returns were also said to be unsustainable. Terra developers were allegedly artificially supported by Terraform Labs (TFL) and its major backers. Instead of lesser returns, inflated Anchor returns were used to attract investors to the Terra ecosystem. The experts’ problem is that Terra and its partners only have reserves that can subsidize investors for so long

Why is UST collapsing?

While Anchor has never had to cut its rates of return that much, UST deposits fell sharply from $14 billion to $3 billion earlier this week. Too much money flowing from the UST’s primary center marked a major loss of confidence in the entire UST protocol. Most withdrawals from the platform likely resulted in the open market, along with a few other use cases for UST beyond Anchor.

As might be expected, the massive migration from Anchor to the open market has put huge selling pressure on the Terra ecosystem. UST, an algorithmic stablecoin, works with its reserve LUNA to stabilize around $1 using a series of on-chain mint and burn mechanics. In theory, these mechanics should ensure that $1 of UST can be used to print $1 of LUNA.

Enormous selling pressure led to sharp declines in both LUNA and UST prices

Finally, LUNA’s market cap surpassed that of UST for the first time. With no more $1 of LUNA for every $1 of UST, some cautious investors feared that the entire system would go bankrupt (as there would be no clear way to “withdraw” money into LUNA if UST holders were a full-scale bank).

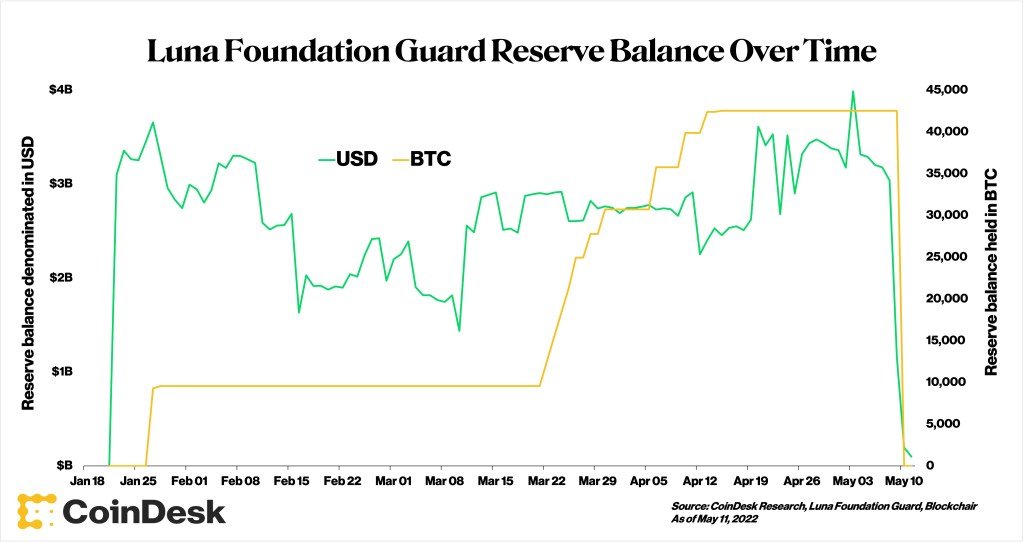

All reserve is put up for sale for support

Luna Foundation Guard, official stabilizer defenders of Terra, to support the price of UST (LFG) has deployed over $2 billion in newly created Bitcoin reserves. Co-founder Do Kwon has started sweeping BTC off the market in recent months to stop Terra in case Terra needs defense.

In the first (and perhaps final) test of this mechanism, the Luna team “lend” billions of dollars worth of reserve assets to professional market makers, virtually emptying LFG’s wallets in the process. Now, as LFG struggles to replenish its empty reserves with new investors, market makers are seeking to actively defend Terra’s stabilizer by allocating bailout capital to exchanges and liquidity pools.

Recovery capital from Terra’s reserves had modest success raising the prices of UST and Luna on Tuesday, while the prices of both tokens were extremely volatile until the early hours of Wednesday morning. .

At this point, all avenues to a smooth UST recovery seemed to be closed. As reported on Cryptokoin.com , although Do Kwon announced on Twitter that a Terra rescue plan is in progress, market confidence in the project has reached bottom. At one point, the LUNA, which was priced at over $120 earlier this year, has dropped below a dollar. The UST briefly dropped below $0.03, raising questions about whether the “stable” stablecon can regain its stability.

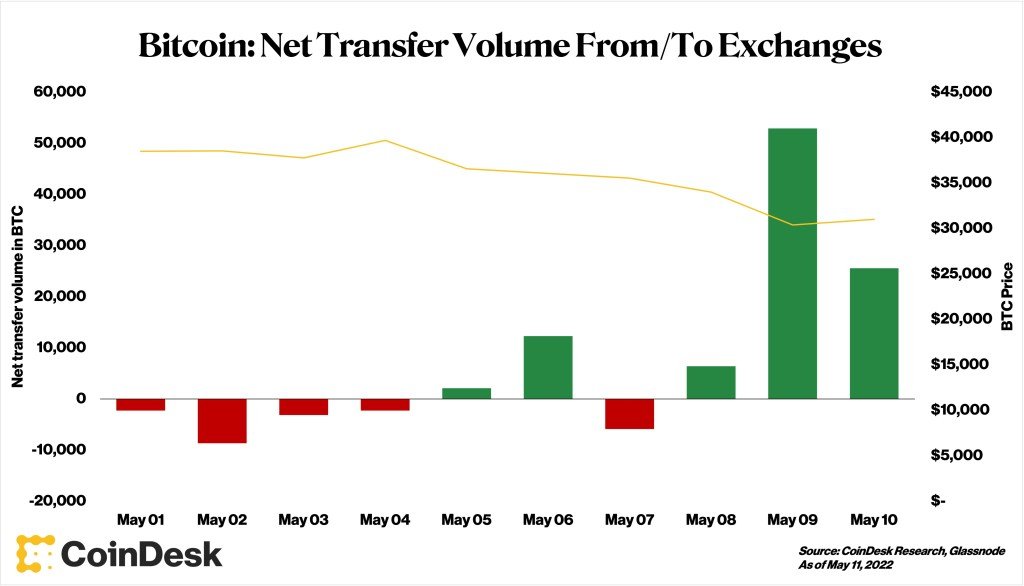

Most of the hundreds of millions of dollars of Bitcoin used to save UST were probably sold directly to the market earlier this week. Cash outs to non-BTC currencies were necessary for investors hoping to defend the stabilization of Terra.

BTC net transfer volumes charts tell this story and show massive volume spikes when Terra’s reserves were first deployed on May 9 and 10. While Terra didn’t account for all of these increases, the billions of dollars in Terra reserves released would definitely have an impact.

Terra’s (LUNA) BTC reserve possibly triggered selling pressure

The impact of the UST on the market is an important footnote amid all the chaos this week. He reminds us why stablecoins that underpin decentralized finance not only pose a risk to individual investors, but also a systemic risk to the entire crypto ecosystem if not managed responsibly.