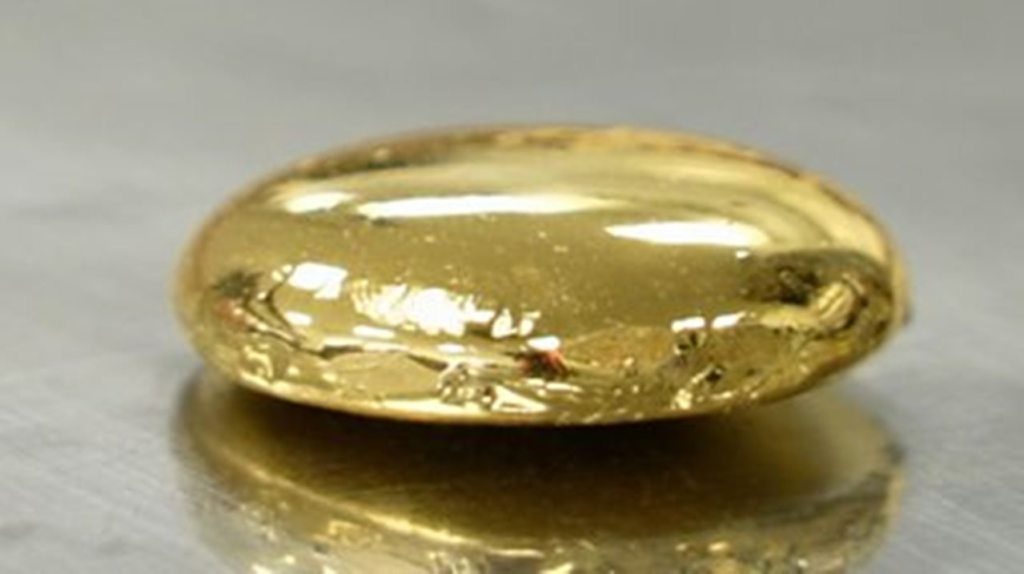

After a disappointing May start, the gold price may be on the verge of a major break above $2,000, according to Bloomberg Intelligence.

“Gold is near bottom and on the verge of a very important breakout”

Bloomberg Intelligence senior commodity strategist, known for his accurate predictions, Mike McGlone, said in a statement after falling 6.5% last month. He then says that gold is now near the bottom and $1,800 is the base for prices. You can check the strategist’s accurate predictions in this article ofKriptokoin.com . Investors are reevaluating their risky positions as the Federal Reserve struggles with inflation and tries to tighten 50 basis points in June and July. The strategist makes the following assessment:

Gold is near the bottom and on the verge of a very important breakout. Once it hits over $2,000 and it’s never going to look back. One day we will wake up and gold will rise above $2,000, which resistance will be turned into support and we will never look back.

“Other currencies gold performed well”

The $2,000 per ounce level is a critical psychological resistance point for gold and this precious metal did not seem to be able to break sustainably this year, despite approaching in March. Gold’s main hurdles in the second quarter were rising US interest rates and a strong US dollar. This is particularly evident when the USD performance of gold is compared to the yen or euro. Mike McGlone explains:

The strength of the dollar is putting pressure on the price of gold in US dollars. Gold rose 20% in yen terms. Gold rose 15% in euro terms. In terms of the US dollar, it’s flat. So people holding gold in Europe and Japan perform much better. It was a good protection against falling currencies. It’s only a matter of time before but it’s catching up in the US dollar. But once you get the wind down I think we’re at the top, gold should rise and it’s just based on past performance.

What will be the impetus to trigger the next rally?

One of the drivers that will trigger the next rally will be markets shifting gears to price the end of the Federal Reserve’s tightening cycle, according to the strategist. Mike McGlone says this is already starting to happen and comments:

This week was the first good sign I’ve seen in a while. I use the one-year federal funds future (FF13) for growth expectations. And they’re just starting to get some of that tightening. Why are they doing this? Because the stock market has reached a weak inflection point. I’m looking at bond yields potentially reaching 3% in 10 years and federal funds peaking around 3.4% and falling to 3%.

The Nasdaq is already down 23% year-on-year. And it’s helping the US stock market reach that inflection point where expectations for a Fed rate hike will falter. “The market is heading in that direction,” says Mike McGlone, emphasizing the following:

We are at the point where the stock market drop is enough to help stave off the Fed’s tightening of the market and ease inflation and shift us back into a deflationary environment. This has been one of the best fundamentals for gold over the past few years, when gold has bottomed out in 2015 and 2018.

“Fed wants the stock market to fall!”

According to Mike McGlone, the biggest problem facing the Fed in the long run is deflation, not inflation. The strategist says that a year from now, the April CPI will be much lower and even negative. Mike McGlone notes that this is an ‘if’ statement and adds:

The Fed wants the stock market to fall because they need to reduce people’s ability to buy things. And I think this is just starting to happen. Crude oil, for example, is very likely to drop to $50 instead of rising to $200. And if the US stock market continues to fall, it’s ‘almost a guarantee’ that inflation will be lower on a 12-month basis.

“Gold will be the primary asset to go to in this scenario”

“You want to measure inflation from a big perspective – 120 months. Here, we see that the bond yields are falling,” said the strategist, and the base effect of inflation will decrease. Mike McGlone states that in this scenario, gold will be the primary asset to go. However, when allocating gold in the portfolio, he states that it is best to pair it with Bitcoin. The strategist details his view as follows:

Looking at modern portfolios, gold is bare unless it is paired with Bitcoin in portfolios. Bitcoin is becoming a global digital collateral. It has a small share in almost all portfolios and is gaining momentum. I don’t understand what is stopping these trends. Bitcoin’s limited supply is a recipe for higher prices unless demand or adoption declines. And I see them rise