The altcoin market, which has had the opportunity to recover since October 13, is still at risk of falling. However, new data shows that Binance traders are looking for long positions.

These 2 important indicators point to traders opening long positions

Ethereum has not been able to rise above $1,400 for the past 29 days. It is trading in a relatively narrow $150 range. Meanwhile, investors are calm as the June 18 low is trading 50% above $880. However, despite the most exciting upgrade in the network’s seven-year history, the price is still down 65%. Now, most investors look to Ethereum’s derivatives market data to understand how whales and market makers are positioned.

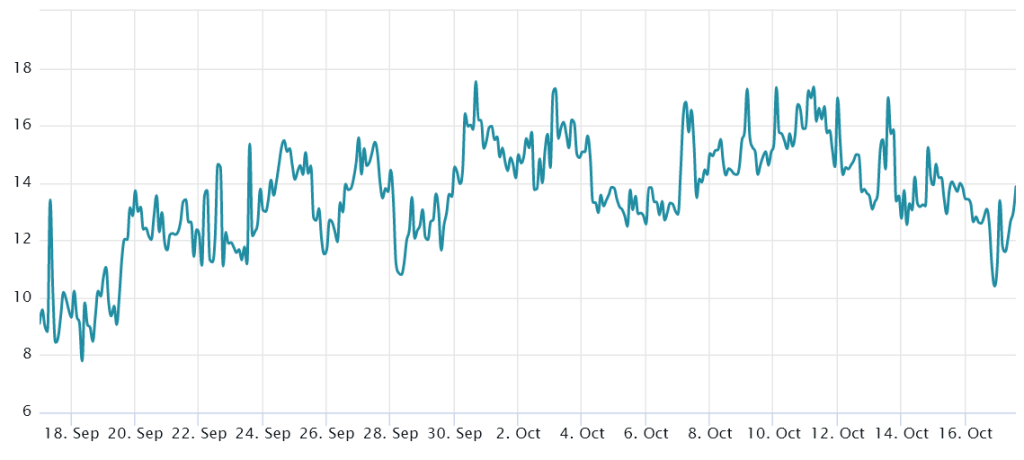

Options traders are moderately risk averse

The 25% delta skew is an important sign that occurs when professional traders overcharge for hedges. For example, if traders are expecting an ETH collapse, the options markets skewness indicator rises above 12%. On the other hand, generalized excitement reflects a negative 12% skewness.

In summary, the higher the index, the less inclined traders are to offer downside risk protection. The indicator has been signaling fear since September 19, when it last held below 10%. On that day, it became a temporary bottom of a 28% weekly correction as the $1,250 support strengthened after such a test.

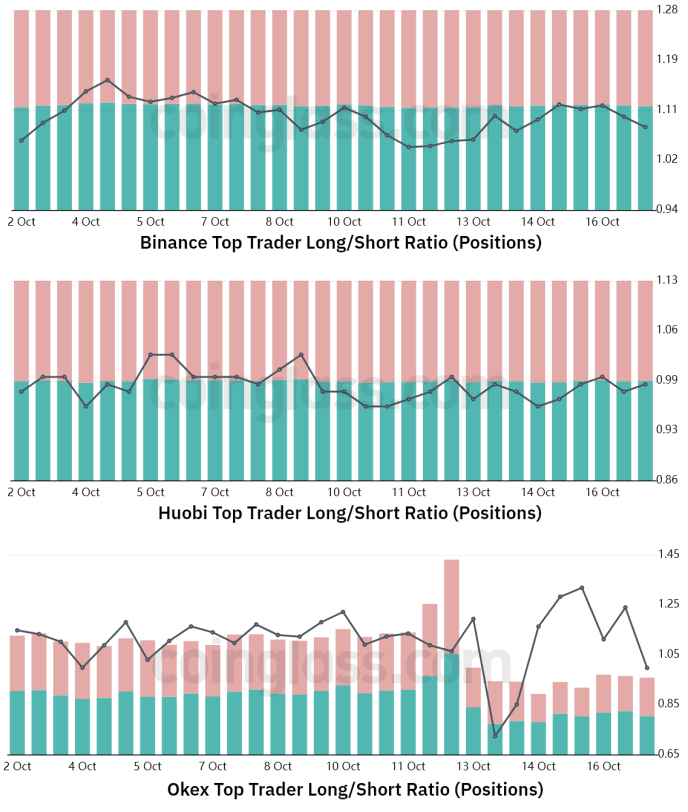

Data shows Bitcoin traders taking long positions

The long-short rate may differ methodologically from time to time between different exchanges. Therefore, it should track changes rather than absolute numbers. For example, Binance showed a modest increase in its long-short rate between October 13 and 17 as the indicator moved from 1.04 to 1.07 in these four days. Thus, these traders increased their bullish positions a little more.

On the other hand, the Huobi data shows a stable pattern as it stayed around 0.98 for the entire time. Finally, on the OKX exchange, the metric dropped to 0.72 on Oct. Thus, it only reverted to the current 1.00, largely preferring short positions. On average, the top traders across these three exchanges have been increasing long positions since the $1,200 support test on Oct.

Skewness and leverage are critical to sustain $1,250 support

Derivatives positions of professional traders were stable despite Ethereum gaining 12% since the October 13 crash. Also, options traders fear that a move below $1,250 is possible given the indicator remains above the 10% threshold.

If these whales and market makers had firm convictions of a sharp price correction, this could be reflected in the long-short rate of the biggest traders. In summary, the 25% delta skewness must remain at 18% for Ethereum to maintain the $1,250 support strength. It should also keep the long-short ratio above 0.80. These indicators are a revealing sign of whether the downtrend from the biggest traders is gaining momentum. cryptocoin.comAs you follow, Ethereum is currently trading above this zone at $1,300.