Gold prices continued their decline on Thursday after falling more than 1% in the previous session. Strengthening yellow metal, US dollar and Treasury yields drags amid continued unease over sharp Federal Reserve rate hikes. Analysts interpret the market and share their forecasts.

“These data will be the big inflection point for gold”

Spot gold was down 0.2% at $1,626.12 at the time of writing. Prices previously hit a new three-week low at $1,621.20. U.S. gold futures fell 0.3% to $1,629.70. Meanwhile, the dollar index (DXY) rose 0.1%. This, in turn, reduced gold’s attractiveness for holders of other currencies. Also, benchmark 10-year Treasury yields hit their highest level since mid-2008. DailyFX currency strategist Ilya Spivak comments:

The gold trend has been down overall. There was also a parallel rise in both the dollar and yields around the increasingly hawkish stance of the Fed, which was the catalyst. The US core personal consumption expenditure data, due next week, will be the next big inflection point. Thus, it is possible for gold to consolidate above $1,600.

“The gold market is responding to it”

The shiny metal is accepted as a hedge against inflation and economic turmoil. However, rising US interest rates are pushing the dollar higher and increasing the opportunity cost of holding zero-yield bullion. Gold has lost 11% since the beginning of the year.

In an indicator of sentiment, the holdings of SPDR Gold Trust, the world’s largest gold-backed exchange-traded fund, saw their biggest one-day exit since July 6 at 6.08t. Bart Melek, head of commodity strategy at TD Securities, comments on the latest developments as follows:

The market remains highly worried about aggressive Fed monetary tightening. We will experience a very steep rise in interest rates. It probably won’t be a very fast pivot. So the gold market is responding to it.

“The next target of the bears is $1,600”

By the way cryptocoin.com As you follow, several Fed officials reiterated the US central bank’s commitment to aggressively raise interest rates to combat rising inflation. Also, markets priced in a 75 basis point gain in November. City Index market analyst Fawad Razaqzada highlights in a note:

A drop below the September low of around $1,615 is now very likely. Also, the next target for the bears is $1,600.

In a note, Standard Chartered draws attention to the following:

Gold’s quarterly rolling correlation with other assets, namely the S&P 500, Bitcoin, Brent and the VIX volatility index has strengthened.

“More losses on the horizon”

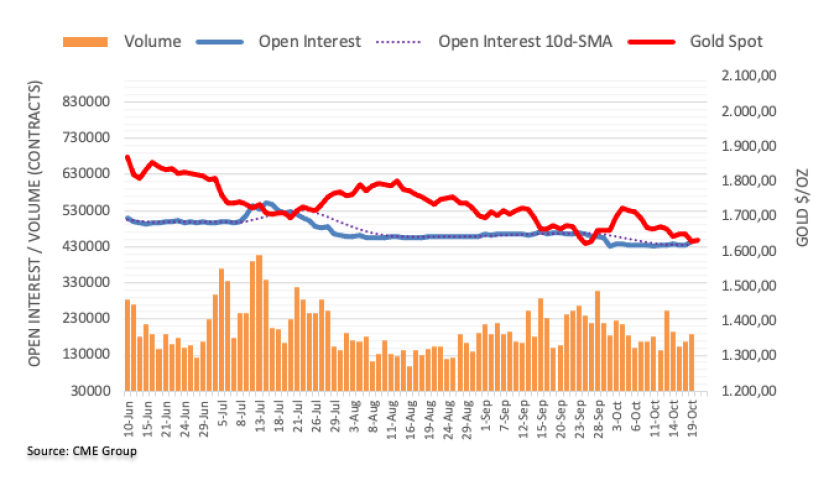

Open interest on gold futures markets rose by about 8.5k contracts for the second session on Wednesday, this time, according to preliminary data from CME Group. Along the same lines, volume rose for the second consecutive session. Accordingly, approximately 18.5 thousand contracts increased.

Market analyst Pablo Piovano notes that gold prices fell markedly on Wednesday amid rising open interest and volume. However, according to the analyst, there is more downside on the cards right now. Therefore, the analyst says there is a sudden pullback for gold at the low of $1,614 YTD.