Altcoin whales are not stopping to collect an ever-depreciating cryptocurrency. The accumulation of whales has now reached 2019 levels.

Altcoin whales continue to accumulate in bear market

Over the past year, addresses holding 10,000-1 million LINK have amassed 4.73% of the network’s current supply. This translates to 47.31 million LINK, worth $307.52 million at market price.

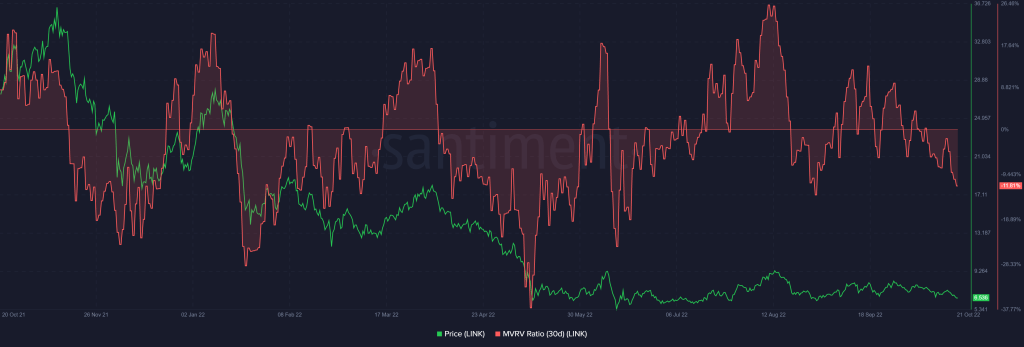

Santiment’s on-chan metric MVRV (Market Cap Realized Value) shows that investors are unlikely to lose hope of a substantial recovery. This index highlights the profit or loss of LINK traders. It tracks the last price each token moved to compared to its current market value.

A negative MVRV index, as in the case of Chainlink, means that the token is undervalued. As the price tends to correct to fair market value, we can see an upward trend with the pressure the whales put on as they fill their bags.

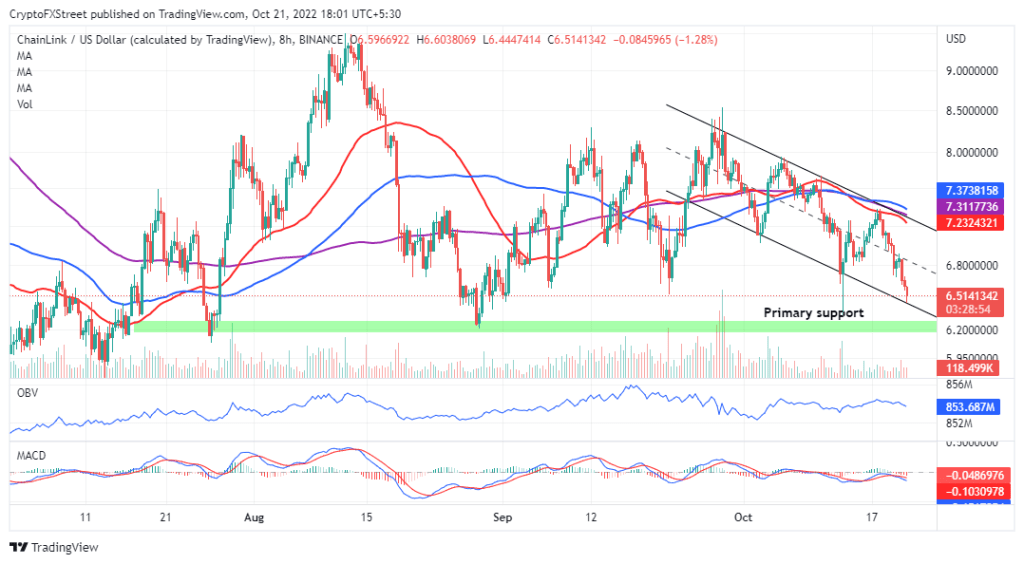

Chainlink price closes with solid support

The lower boundary of the falling parallel channel supports LINK price at $6.44. Over the past four weeks, the price has bounced from this level twice. Thus, the region turns into a suitable support area. If the bulls manage to defend this level, a new bullish move will emerge to lead Chainlink price to the upper border of the pattern. A possible break to $8.00 will set a blow for a move to $8.50 on the cards.

On the other hand, the MACD indicator has recently given a sell signal to investors. Rates were bearish as the 12-day EMA (blue) crossed below the 26 (red) day. Therefore, it would be unreasonable to go long until LINK exhausts the downtrend and confirms support. Stubborn shorts will continue to sell Chainlink. FXStreet analyst John Isige thinks shorts would prefer $6.20 for a potential take-profit level. If this level acts as a support, buyers will have an opportunity to take a position.

Altcoin accumulation may be related to project’s recent announcement

Chainlink has featured a number of key announcements that have kept its community alive during the bear market period. Speaking at SmartCon22, Chainlink Co-Founder Sergey Nazarov announced plans to launch staking at the end of 2022, in addition to a new economic model for the Web3 services platform. On September 29, international banking network SWIFT announced its collaboration with Chainlink. This move paves the way for enterprise adoption of Distributed Ledger Technology (DLT).

SWIFT is using the Cross-Chain Interoperability Protocol (CCIP) in an initial proof of concept.

CCIP will enable SWIFT messages to instruct on-chain token transfers, helping the SWIFT network become interoperable across all blockchain environments.https://t.co/8GOBNhzwCk pic.twitter.com/Pvm0Cex45e

— Chainlink (@chainlink) September 28, 2022

According to Chainlink’s official website, the transaction value the network has provided so far is $6.1 trillion. cryptocoin.com As you follow, LINK is currently trading at $ 6.91. The market cap was $3.67 billion, with a 24-hour trading volume of $419 million.