For thousands of years, gold has been regarded as a storehouse of wealth. Also, the price of gold tended to move in the opposite direction with stocks and the dollar. This gave investors some diversification in their portfolios. This year, however, gold has not served as a cushion of safety for investors against financial market volatility.

“No recovery potential for gold amid aggressive rate hikes”

cryptocoin.com As you follow, gold saw below $ 1,620 on Friday. However, it later rebounded and climbed close to 2% above $1,650. However, rising interest rate hike expectations will continue to weigh on gold, according to Commerzbank economists. Economists make the following assessment:

Continued outflows from gold ETFs point to weak investment demand. With September, ETF outflows saw their fifth consecutive monthly exit. We do not expect the sentiment in the gold market to reverse unless the aggressive rate hikes come to an end.

“Gold has not fallen as much as the sharp rise in real returns suggested”

Gold did not become a ‘safe haven’ for investors as the US dollar and interest rates rose. Caroline Bain, chief commodity economist at Capital Economics, underlined the following in her note on Friday:

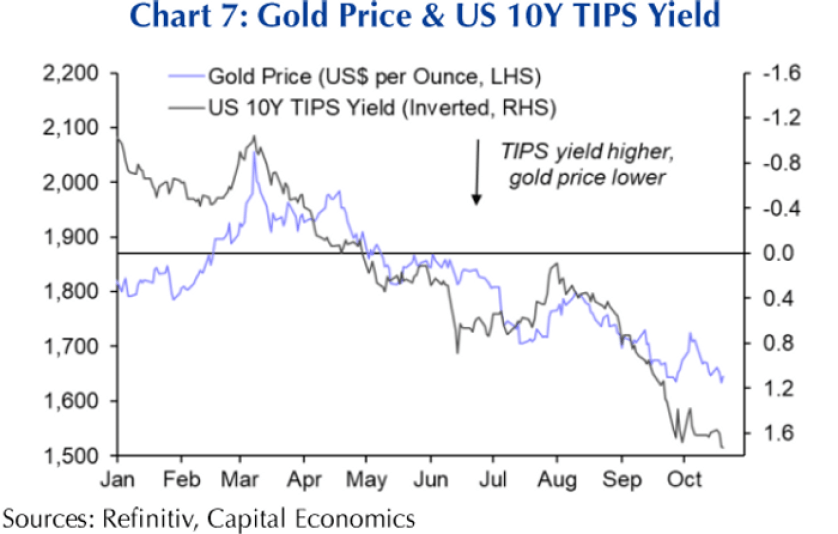

The main driver was the nearly 20 basis point increase in 10-year Treasury yields. Because recent signs that hyperinflation may be more tacky than previously anticipated suggest the Fed will remain in a hawkish mood. Admittedly, the price of gold has not fallen as much as the sharp increase in real returns might suggest. However, we suspect that the decreasing liquidity of inflation-linked bonds is a reason for this difference.

2022 and end of 2023 forecasts for yellow metal

Rising bond yields and the strength of the US dollar increase the opportunity cost of holding non-yielding gold. This reduces the attractiveness of gold. The benchmark 10-year Treasury yield tried to set a new high on Friday. John Higgins, chief market economist at Capital Economics, explained the inverse relationship between the price of non-interest-paying gold and the yield on long-term government bonds.

In an October 14 note, Higgins goes over a hypothetical example. An investor hoping to have a “safe haven” of $1,000 in today’s money 30 years from now has two options for investing. The first of these is to invest $1,000 in gold. The other is to invest in a 30-year coupon-free Treasury bond with a real yield of 2%. A day later, the bond’s real yield dropped to 1.5%. This means that they need to invest more in the bond to keep its true value at the end of the period. The price of gold will also need to rise to maintain the same initial costs of alternative investments. Higgins goes on to explain:

Gold is adjusting to the high, liquidity-distortion-adjusted level of long-term TIPS yields. So there is room for it to fall further in the near term. We anticipate that this year will end where it is now, and next year it will rise a bit as the Fed changes course and real yields fall. Our estimates for the end of 2022 and 2023 are $1,650 and $1,700, respectively.

What will the Fed’s rate steps be like?

Meanwhile, Fed officials are moving towards a 75 bps rate hike in benchmark rates. But some are starting to show signs of whether to slow the rate of growth soon. Meanwhile, San Francisco Fed President Mary Daly said on Friday that the Fed should start talking about slowing the fast pace of its latest benchmark rate hikes.

Market participants priced another 75bps increase of 94.5% at the November meeting, according to CME Group’s FedWatch tool. The Fed has increased its federal funds futures by 300 bps since its March meeting. This is one of the fastest moves in history, including three 75 basis points hikes. The indication that the central bank will switch to smaller rate hikes after the November meeting cheered the stock market on Friday. It also helped gold prices move up 1.74% on the day to $1,656.