Senior Bloomberg analyst Mike McGlone talked about an altcoin project that will surpass Bitcoin in a new tweet.

This altcoin is ready to surpass Bitcoin

Ethereum completed one of the most important updates in history by switching to the PoS algorithm in September. Despite the hype surrounding the event and all the anticipation over the price, its price dropped as low as $1200 at one point. Senior Bloomberg analyst Mike McGlone thinks it’s not too late for the post-merger effects to be felt.

Ethereum is up nearly 20% since last week, currently trading above $1,500. Mike McGlone said in a tweet in the middle of the current rally:

What can stop Ethereum from getting ahead of Bitcoin? Ethereum’s successful transition to the PoS mechanism amid the global energy crisis and its dominant position at the epicenter of the digitalization of finance and money could be a basis for sustained price growth.

What Stops #Ethereum From Outshining #Bitcoin, #Stocks? Ethereum's successful transition to proof-of-stake amid the global energy crisis and its dominant position at the epicenter of the digitalization of finance and money may be a foundation for enduring price appreciation. pic.twitter.com/mbVo8XbNwg

— Mike McGlone (@mikemcglone11) October 26, 2022

Mike McGlone especially emphasizes energy-oriented regulations such as MiCA, which is on the agenda of Europe. While Ethereum is moving away from mining, Blockchains like Bitcoin, Litecoin or Dogecoin still use the PoW mechanism. cryptocoin.comIn this article, we have presented the latest developments from the draft.

Ethereum faces centralization concerns

Ethereum had over 14% global liquidity at its peak in 2018. Currently, its global liquidity is minus 5%. According to McGlone, Ethereum price is trading at a discount as part of the current bull market. It’s also nearly four times the 2020 average, despite being 71% below its all-time high. This is a strong indicator of how the leading altcoin works.

ETH’s success is overshadowed by growing concerns that it is becoming more centralized following the upgrade. Recently, it was announced that 63% of all Ethereum validators are compliant with OFAC. Therefore, it is believed to have a higher chance of surpassing a Bitcoin before ETH 2.0.

Central stock exchanges have a large share

As of last month, $22.3 billion has been staked in Ethereum. Interestingly, about 60% of Ethereum is held in Lido Finance, Coinbase, Kraken and Binance. In this case, centralized platforms are more likely to receive blocks of transactions to be added to the Blockchain. Caleb Sheridan, co-founder and product leader of Eden Network, believes that centralization is a concern, but not a huge issue:

I imagine we will see more ETH stacked to counter any behavior that is perceived as harmful to the network.

According to Sheridan, there is enough ETH in circulation that is not staked. This means that other parties can put more money into central officials to minimize their control over the network.

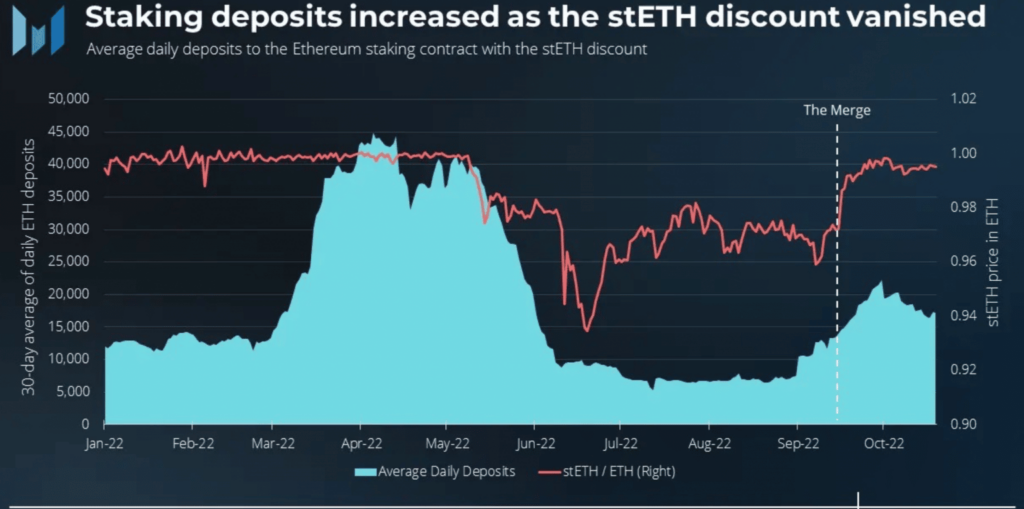

Meanwhile, there was a tangible increase in the amount of ETH staked prior to the merge. Currently, the trend continues to see new highs. Consider this, the average daily deposit for October was 13,500 ETH compared to 7,300 in August.

“The stETH discount has almost completely disappeared,” says one of the Messari analysts, looking at the chart. This was actually the situation seen in the significant increase of the red line after Merge. At the time of writing, stETH/ETH has remained at 0.995 and closed to a breakeven ratio of 1.