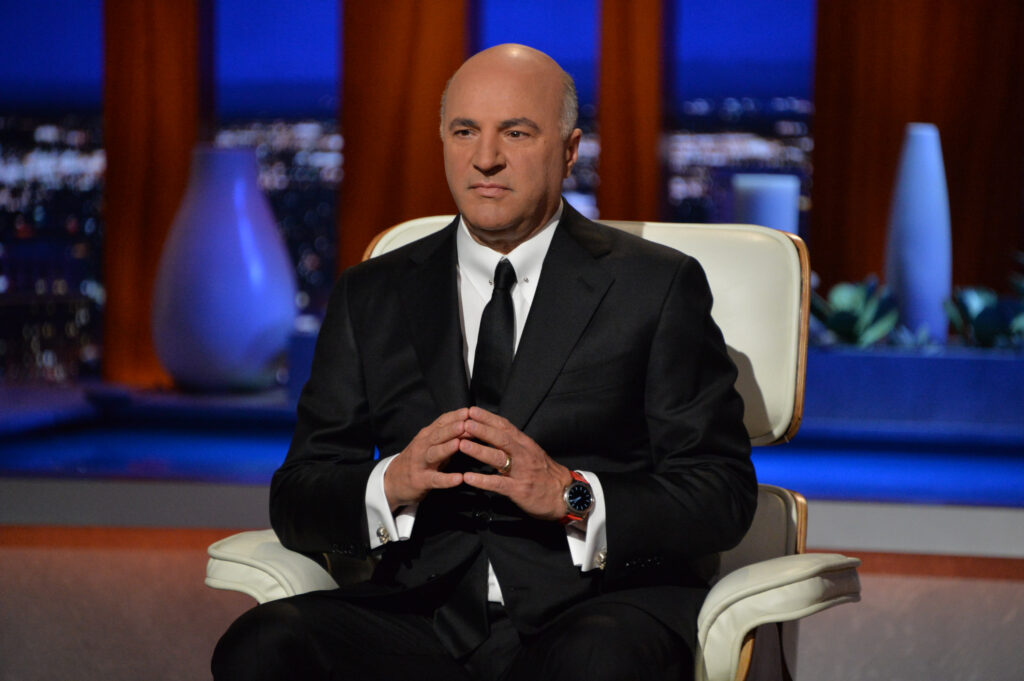

Shark Tank investor and venture capitalist Kevin O’Leary has a new prediction. He said that as a result of the upcoming meeting of world leaders, there will be an increase in interest in cryptocurrencies. The name, who previously said that he has Solana (SOL) and 31 coin projects, shared his latest prediction.

Billionaire says cryptocurrencies will be in focus after upcoming forum

Shark Tank investor Kevin O’Leary made a positive statement on behalf of cryptocurrencies in a recent interview. He spoke about the annual meeting of the World Economic Forum, which will take place in Davos, Switzerland, in January 2023. He says that one of the most important topics to be discussed in the forum will be cryptocurrencies. Kevin O’Leary shared his thoughts with the following statements:

This year, we specifically commented on the ACH transfer between banks or the international Swift transfer. Around the payment systems we talked about, you will see cryptocurrencies at the top of the list of those discussed by global bankers. Many years ago, cryptocurrencies were considered private sector innovations that were heavily regulated by global governments. Now, for the first time, token projects such as stablecoins are doing this significantly faster. More productive, more transparent, more auditable. But most of all, it could really fail in a much more convenient system. It should observe in order to transfer global assets.

O’Leary stated that he is involved in the Stablecoin Transparency Act, which aims to increase the transparency of stablecoins like Circle and Tether. He says this will be an important part of the discussions about cryptocurrencies, especially stablecoins:

As a result, with this event, you will witness the headlines of companies like Circle. We are struggling to find some kind of policy and regulation. However, despite all this, we will see a lot of crypto-based conversations with global governments on a global level. This bill, the Stablecoin Transparency Act, is at the forefront of that plan. It will happen after the interim arrangements on November 8th. I think that what will be important in terms of crypto money policy can be marked when we come to this place. A bilateral US bill… Many changes are coming for the cryptocurrency markets.

Shark Tank investor Kevin O’Leary is holding Solana and these coins

As we have reported as Kriptotokoin.com; Kevin O’Leary’s investment planning splits into two main branches. O’Leary shared that cryptocurrency investments definitely need to be diversified. The second way is to follow the companies that have built a crypto money infrastructure, he says. Kevin O’Leary made the following statements about cryptocurrencies:

I have 32 positions, 32 altcoin projects and 32 different altcoins. Frankly, I have no idea which ones will win in the next five years. But I don’t need to profit from all of them. I only need a few altcoin projects to win. This is what it means to have diversity in my portfolio.

Among the cryptocurrencies that O’Leary has invested in are the following;

Leading cryptocurrency Bitcoin (BTC), leading altcoin Ethereum (ETH), Smart Contract project Solana (SOL) and ETH-based Polygon (MATIC). The Shark Tank investor states that he prioritizes these altcoins in the majority of his savings. Next, O’Leary explains why he believes infrastructure betting is so important to the crypto investment thesis:

I made some investments on behalf of the infrastructure. You know, that old adage about the gold rush. It’s better to have pickaxes, shovels, and jeans and sell them than trying to find Gold.

O’Leary says there is no clarity ahead of the American midterm elections. With all this, he says that once it is decided by the House, Congress will turn its full attention to setting crypto policies. Specifically, O’Leary considers stablecoin projects to be the first sector to be regulated within the cryptocurrency ecosystem. O’Leary shared that he has some ideas for how the arrangement should be:

To me it will look like this: 30 days of control will be provided on the assets under it. You can bring any stablecoin you want. However, it will be subject to a 30-day audit. There are no assets supporting the token or altcoin for more than 12 months. So you’re going to apply for T-bono, it should definitely be short-lived. In my opinion, it should be an average of six months. It is very similar to the money market.