With the bankruptcy of the FTX exchange, users’ concerns about withdrawing their assets are growing exponentially. The collapse of FTX negatively affected the exchange’s own coin, FTT coin. The overall cryptocurrency market has also been badly affected. So, what else happened during this crisis?

Unexpected FTX (FTT) impact on the Ethereum network

It turned out that the FTX crash had an unexpected effect on Ethereum. According to Etherscan data, the surge in on-chain transactions resulted in 13,000 ETH being burned in just three days. As rumors of FTX’s bankruptcy spread, users rushed to remove their assets from exchanges. FTX stated that over $6 billion in withdrawals were processed in just three days. This indicates an increase of tens of millions on a daily basis.

FTX exchange stablecoin reserves are down 93% in 2 weeks, and hourly #ethereum withdrawals just hit an all-time high!

The UST and Celsius PTSD is strong with the market.

— Lark Davis (@TheCryptoLark) November 6, 2022

Hourly Ethereum withdrawals on FTX set an all-time record, according to a tweet by crypto expert Lark Davis on Monday. As a result, token burning has also increased due to increased on-chain transactions. The daily issuance, which has been significantly reduced with the burns after Ethereum’s merger, allows the crypto asset to reach deflationary status.

Ethereum did better than Bitcoin

The ultrasound.money ETH supply chart shows that the token supply has been on the decline on Monday. This drop came after Binance CEO Changpeng Zhao announced that the exchange was liquidating its FTT position. As a result, annual issuance now stands at -0.032% after falling sharply over the past few days. Also, the data shows that Ethereum’s supply dropped by 6,158 ETH after Merge. It’s worth noting that after the FTX crash, Ethereum held up better than Bitcoin. Bitcoin hit a two-year low of $15,682. ETH, on the other hand, has not even seen its annual low.

Celsius reveals affiliation with FTX and FTT

On the other hand, collapsing crypto lending firm Celsius Network (CEL) confirmed its exposure to FTX and trading firm Alameda Research in a tweet on Nov. This announcement came after the same day bankruptcy filings were filed by both organizations. Celsius stated that it has around 3.5 million Serum (SRM) tokens on FTX, “many of which are locked”. In addition to this, he loaned Alameda a total of $13 million. This loan is “currently under-collateralized”. It is also stated that these guarantees mostly consist of FTT.

In the interest of transparency, Celsius has approximately 3.5mm SRM tokens on FTX, most of which are locked, as well as loans to Alameda totaling approximately $13MM (based on current values) which are currently under-collateralized (primarily by FTT tokens).

— Celsius (@CelsiusNetwork) November 11, 2022

Earlier in the week, when the FTX debacle began, CEL was trading at $1.02. CEL, which has lost 43 percent in the last five days, is currently changing hands at $0.5856. In the last ten days of October and the first seven days of November, the crypto market had a bull run. However, the overall setback caused by FTX woes caused CEL to start a new bear run on November 8.

What does the CEL price indicate?

On the daily chart, the asset’s MACD line crossed with the bearish trend line on Nov. In addition, increased sales also caused its price to drop. The Relative Strength Index (RSI) at 30.44 and the Money Flow Index (MFI) at 44.64 were in a downtrend. This showed that sellers were in control of the market. The 20 Exponential Moving Average (EMA) showed the severity of the ongoing bearish move. It was below the 50 EMA line.

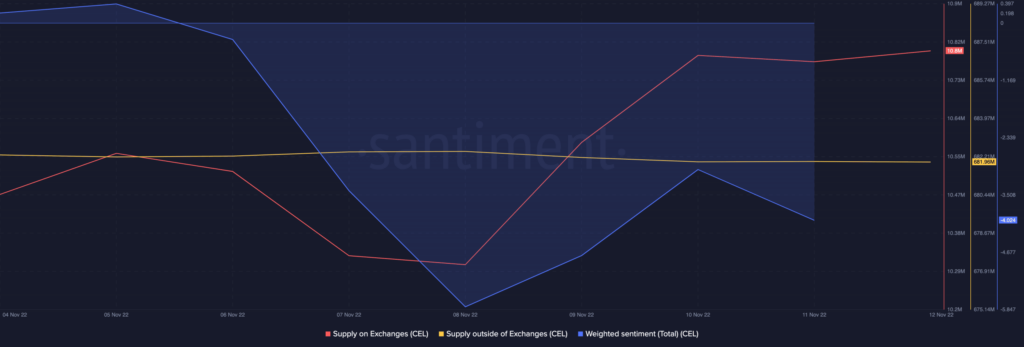

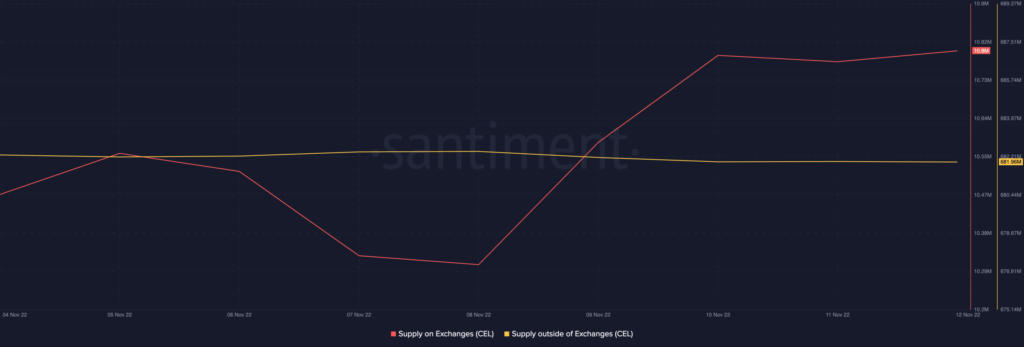

Also, the CMF dynamic line became -0.28 and has been bearish since 7 November. This meant that the CEL distribution had been growing steadily since the start of the week. Data from Santiment showed that this week was particularly bearish for CEL. The CEL token supply on exchanges has soared over the past five days, reaching 10.8 million. It has increased by 5% since Nov. This showed that coin holders transferred their CEL tokens to the exchange as soon as the FTX debacle started.

Conversely, the off-market supply of CEL fell during the same period. This showed that the buying pressure fell during the week. Looking at CEL’s network activity, a drop in daily active addresses and the number of new addresses joining the network was also noticeable. As cryptokoin.com reported, the number of addresses trading daily CELs has dropped by 74 percent as the market has been struggling with FTX shortages for the past five days. CEL suffered a decline in new demand as network growth fell 55 percent.