Crypto fund firm Pantera Capital has shared its expectations for when the decline of Bitcoin (BTC) and the overall cryptocurrency market will end. According to experts, the next Bitcoin halving could ignite the bull rally. Here are the details…

Pantera executives point to bottom and top for Bitcoin

Pantera Capital CEO Dan Morehead and other executives outlined their expectations for the market in a letter to customers. They told investors that the Bitcoin price will likely bottom out during the month of November. Afterwards, they say the coin will gain momentum before the Bitcoin halving. When calculating these dates, executives draw attention to the historical impact of the BTC halving on the market.

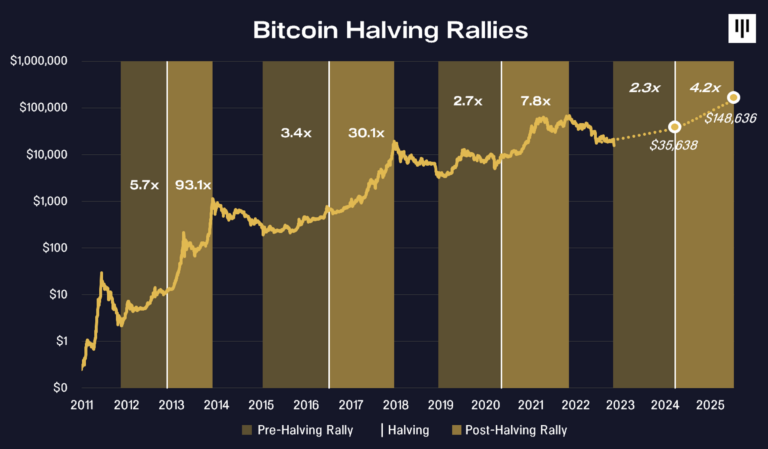

From a historical perspective, the bottom of BTC is recorded 477 days before the halving. Then it moves up and goes up. Post-halving rallies take an average of 480 days from the halving to the peak of the next bull cycle. According to executives, if history repeats itself, BTC Price will hit the bottom on November 30, 2022. Then, after a rally and halving in early 2024, we can see a strong uptrend.

149 thousand dollars call from experts

cryptocoin.com As we have reported, the next halving is expected to take place in March 2024. According to experts, the price of BTC will rise to $ 36,000 before the halving. Later, it will record an all-time high of $149,000 after a bull run. Experts also point to the change in BTC supply with the halving.

During the halving in 2020, the supply of BTC fell by 43 percent. The effect of this on the price was an increase of 23 percent. With the next halving taking place on March 22, 2024, this will be a massive cut in supply, almost half.

They also commented on FTX

In their statements, the executives also talked about the impact of FTX on the crypto market. According to experts, in the short term, it will be painful for those who lose the funds held on the FTX exchange. “More broadly, we expect more price volatility in the crypto ecosystem as contagion fears push asset holders to adjust their portfolios,” the experts say, using the following statements:

Assets associated with FTX (Solana and the projects built on it, Aptos, etc.) will likely be hit the hardest. There will likely be a backlash in adoption in the space, as some individual users who lose money choose to leave the space and others who may have joined before are afraid of being sidelined. We expect institutions that have previously been cautious about cryptos to deepen their skepticism. This is expected and unfortunate, but not significant enough to be alarming. The process may take longer, but we’re sure many people will get into the field eventually.