Cryptocurrencies took a big hit after the FTX crisis. Bitcoin has dropped from $21,000 to $16,000, where it was barely reaching. So, what’s next for the biggest cryptocurrency by market cap? Here are the comments of three analysts…

Altcoin Sherpa: No bottom yet

Widely followed analyst Altcoin Sherpa states that the crypto asset market has not bottomed out yet. He says he waits for one more jolt before another bull market cycle begins. The analyst says that the historical performance of the crypto market is an unexpected prediction of how long the current bear market will last as there are different macroeconomic developments at play. The analyst uses the following statements:

Past bear markets/accumulation will likely not look as they do now; Every market cycle is different. The macro environment has never looked like it did in 2022 (interest rates + war + everything else is scary). So we can stay here longer.

Altcoin Sherpa thinks there is at least three to six months left before the crypto market is bullish. “Buckle your seatbelts, it will probably be a long journey,” the analyst says. He states that the accumulation process takes a long time and that the important thing is patience. “Most people will do the best dollar-cost average for Bitcoin and Ethereum,” he says.

$10,000 bottom expectation for Bitcoin

Altcoin Sherpa also says that while the crypto market may see fluctuations in new highs or lows during the months-long accumulation phase, he still believes that the market has not bottomed out yet. For active traders, there will definitely be bounces and market movements. “I think we will see 20-100 percent movements during this accumulation cycle, as we always do. But I’m still waiting for one final jolt before I can assume the bottom is coming,” he says.

Altcoin Sherpa predicts a possible bottom of $10,000 for Bitcoin’s (BTC) bottom. He says they believe the bear market started in November 2021 and lasted for about a year. Others claim that the bear market started in May 2021 and lasted for 580 days.

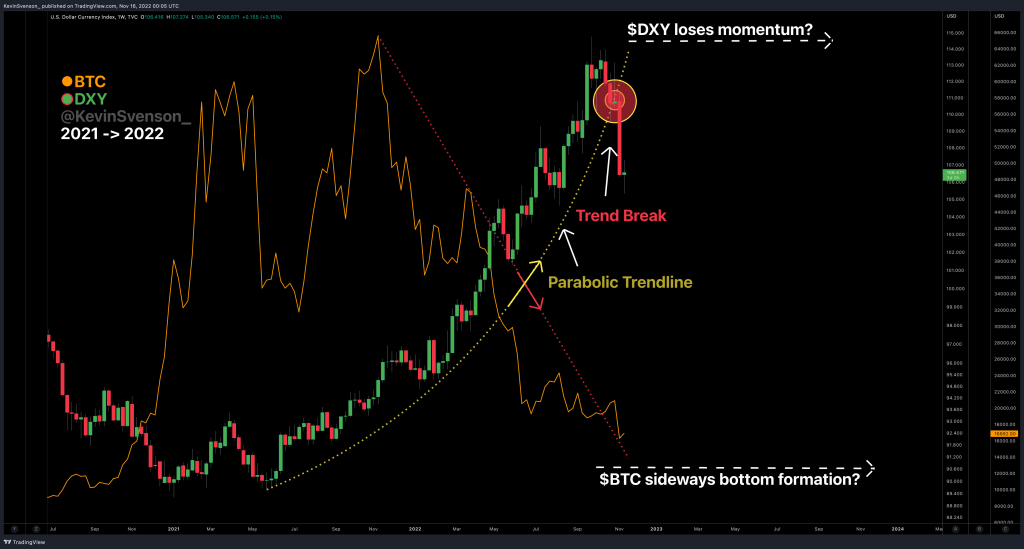

Kevin Svenson points to dominance metric in Bitcoin

cryptocoin.com As we reported, popular crypto strategist Kevin Svenson says that there is an index that is closely followed and shows that the market dominance of Bitcoin (BTC) is starting to give a bottom signal. Svenson says in his crypto news release that the US Dollar Index (DXY) is currently behaving similarly to what it was in 2015. Here he relates horizontal trading to the bottom in Bitcoin.

The trader states that the US dollar has lost its momentum. He says the dollar broke a parabolic trend. This indicates that Bitcoin will begin to see key support at its current price level. It is also a possible signal that it will move sideways for a while rather than falling to lower price levels. Apart from that, the analyst pointed out that the FTX collapse may continue to affect the crypto space, and this is putting downward pressure on the price of Bitcoin. The analyst uses the following statements:

There is potential for lower prices as these stock market crashes unfold, but it’s often a sign that we’re approaching the bottom of a cycle. The US Dollar Index (DXY), which broke the parabolic trend, is the main positive signal I’ve seen on the charts. This could allow BTC to gain support and start sideways instead of going straight down.

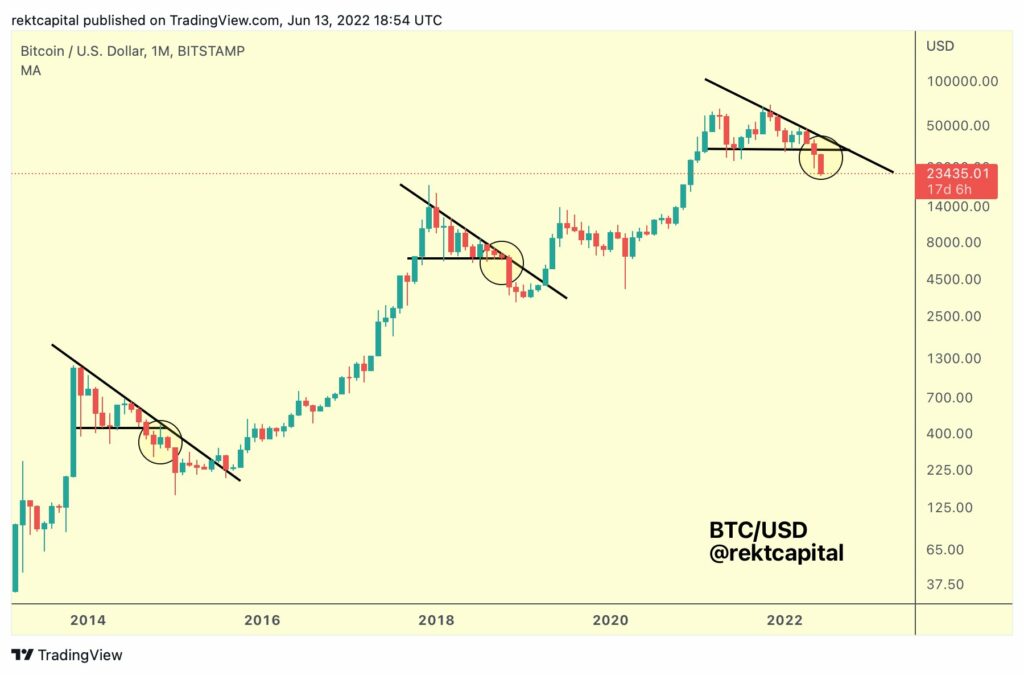

Rekt Capital explains how the bear market will end

On the other hand, Rekt Capital warned its 330,300 Twitter followers that any “strong downtrend” could cause them to miss out on the next big bull run. The analyst pointed to the existence of people who doubt whether BTC will experience another Bull Market. Noting that bull markets in BTC are based on the fear of missing out (FOMO), he said that for an uptrend, it is necessary to feel FOMO.

Next, the analyst explained the psychological background of the price zones. He used June’s highs and lows as an example. He pointed out that BTC’s June lows are now acting as a resistance level. He pointed out that the June lows in BTC were once support, now acting as resistance. “Psychologically, people were willing to buy from June’s low,” he said. But now people are much more willing to sell at June’s lows, according to the analyst. Therefore, he pointed out how things have changed for BTC in a few months.

Advising his followers to be patient, Rekt says that historically speaking, Bitcoin bear market bottoms take months to settle. Typical BTC bear market lows take months to develop before a new macro uptrend begins. “The expanded consolidation that followed is something else,” he adds. The trader also shares a long-term Bitcoin chart that he first shared in June to illustrate his views on bear market lows, capitulation and consolidation.