Investor distrust caused by the FTX collapse was followed by Proof-Of-Reserves (PoR) issued by centralized exchanges to recover. Digital investment giant Grayscale, on the other hand, is completely against it.

Grayscale appeals to reserve wings

cryptocoin.com As you follow, all central stock exchanges have shared their reserves with the public during the past two weeks. This move was all about removing the distrust caused by FTX. Binance CEO took the lead of this trend with his stock market. CZ was the first to propose the concept of Proof of Reserve. However, digital investment giant Grayscale refuses to disclose evidence of reserves.

Company representatives announced on Twitter on Friday that they would not disclose their reserves. They suggested that this introduces security vulnerabilities.

6) Coinbase frequently performs on-chain validation. Due to security concerns, we do not make such on-chain wallet information and confirmation information publicly available through a cryptographic Proof-of-Reserve, or other advanced cryptographic accounting procedure.

— Grayscale (@Grayscale) November 18, 2022

Grayscale acknowledges that keeping reserve information private will disappoint some investors. The November 19 blog post states:

But the panic caused by others is not a good enough reason to circumvent the complex security arrangements that have kept our investors’ funds safe for years.

Amid the FTX crisis, Grayscale’s crypto products also fell hard

Grayscale’s ETHE product and Bitcoin Trust (GBTC) experienced record lows on Thursday. Due to its affiliation with FTX, the company’s parent company Digital Currency Group is also feeling pressure. Following the collapse of FTX, Genesis, another Grayscale subsidiary, recently stopped accepting client withdrawals. Subsequently, Gemini has decided to suspend withdrawals for Earn products.

[NEW TODAY] Due to recent events, investors are understandably inquiring deeper into their crypto investments. In this thread we’ve compiled additional information about the safety and security of the assets held by our digital asset products. https://t.co/MvTfUoK4o6 🧵

— Grayscale (@Grayscale) November 18, 2022

Does the proof of reserve provide the confidence needed?

An audit method called “Proof of Reserve” verifies the platforms’ available funds. Especially big exchanges like Paxos and BitMEX were already using it before the FTX crash. However, it was CZ who made the situation public during the ongoing discussions regarding the Binance-FTX transaction. Soon after, Binance began tweeting about its reserves for all to see. All central exchanges, including Crypto.com and Huobi, have since released some of their reserves to increase industry transparency.

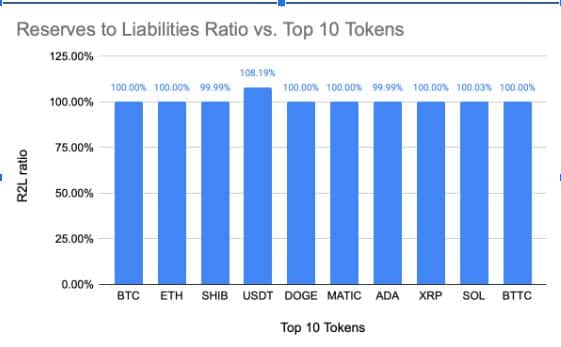

However, CZ advised investors to avoid these exchanges due to questionable on-chain activities, especially after revealing their reserves. Sumit Gupta, founder of Indian cryptocurrency exchange CoinDCX, claims that proof of reserve tells only part of the truth and that “proof of indebtedness” is required to complete the picture. To lead this, he shared a screenshot of the R2L ratio for his exchange’s top 10 assets:

The founder of CoinDCX announced that he will periodically publish the R2L rate position in the coming periods. At the moment, various moves continue to come from the stock markets, as the effects of the FTX crisis are not over yet.