Most addresses holding bitcoin, the largest cryptocurrency, are now losing money, the first time that’s happened since the start of the coronavirus-induced crash of March 2020.

-

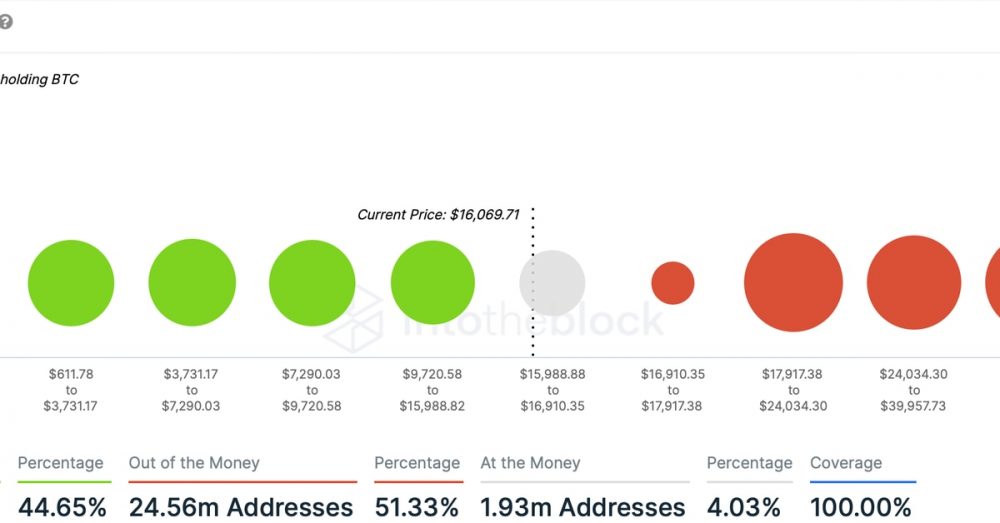

Just over 51%, or 24.56 million addresses of the total 47.85 million, are below purchase price on their investments, according to data provided by blockchain analytics firm IntoTheBlock. About 45% are in the money, that is, boasting unrealized gains, while the rest are roughly at breakeven

-

IntoTheBlock defines out-of-the-money addresses as those that acquired coins at an average price higher than bitcoin’s going market rate of $16,067.

-

The bearish momentum looks overdone, according to IntoTheBlock’s Lucas Outumuro.

-

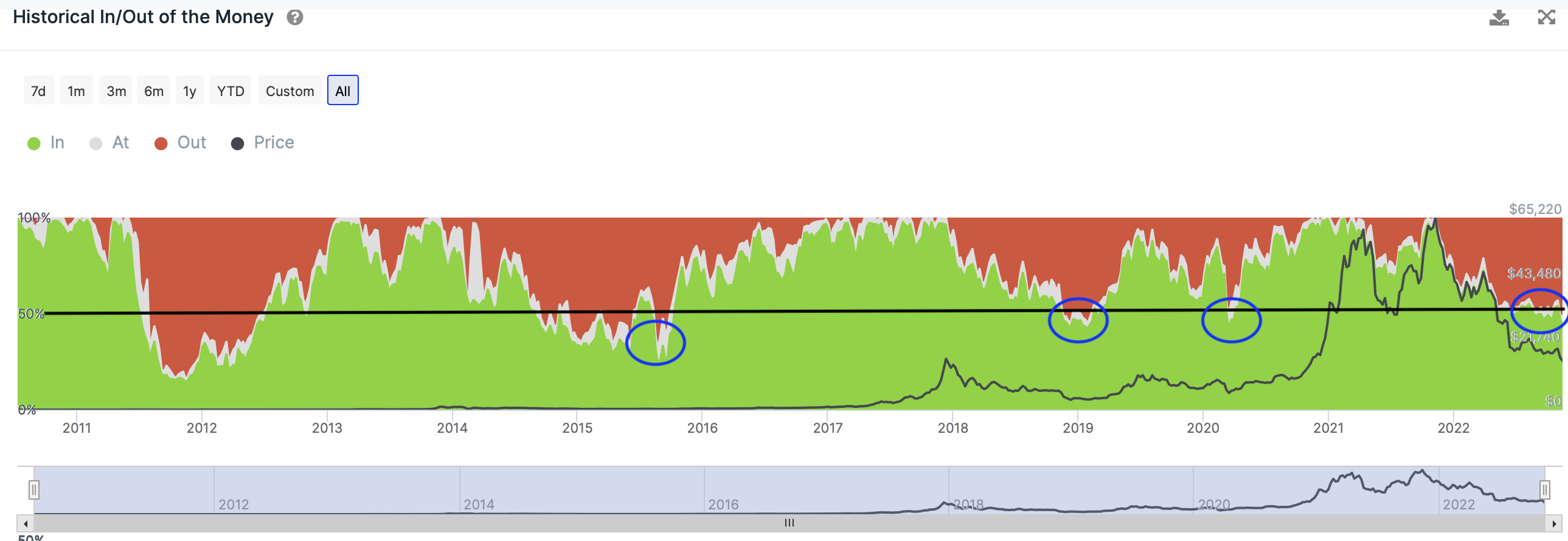

Previous bear markets ended with the majority of addresses being out-of-the-money.

Previous bear markets ended with most addresses being out-of-the-money (IntoTheBlock, CoinDesk)

-

The percentage of out-of-the-money addresses stood at 55% in January 2019. Bitcoin bottomed near $3,200 around the same time and began a bull run three months later.

-

The percentage of addresses out-of-the-money rose to 62% during the depths of the 2015 bear market.

-

Past data, however, is no guarantee of future results and the fallout from the recent collapse of FTX may bring more pain to the market.