Crypto markets started the week weak. This suggests that buyers remain skeptical of any significant bearish purchases. Can the cryptocurrency market catch up with the US stock markets? Analyst Rakesh Upadhyay studies the charts of Bitcoin (BTC) and altcoins to find out.

An overview of the cryptocurrency market

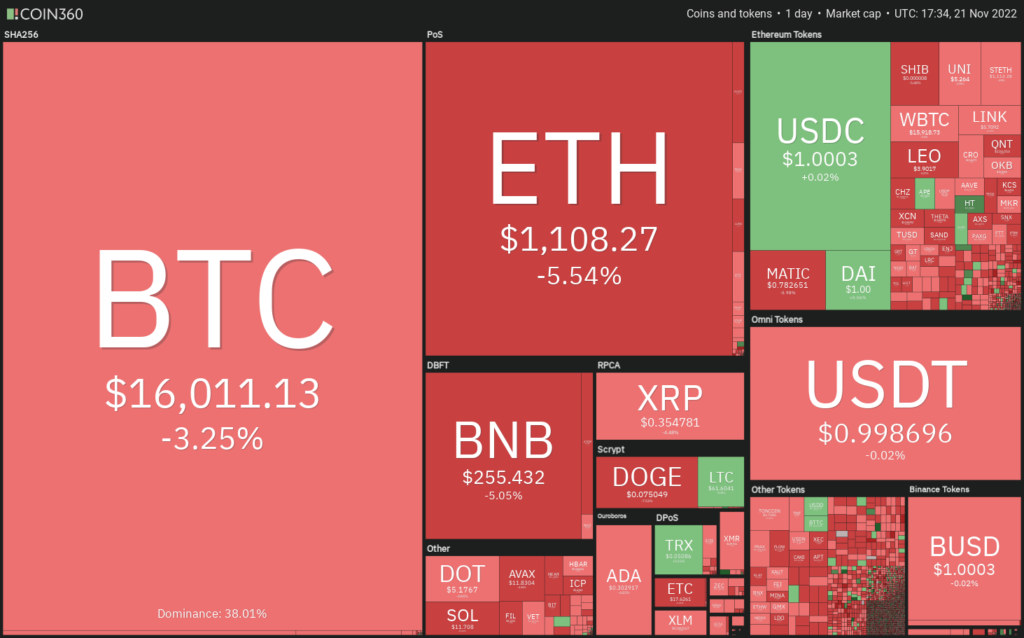

Continuing selling in crypto drove the total market capitalization to under $800 billion on Nov. Traders are increasingly concerned about the extent of the damage that the collapse of FTX could do to several crypto firms. Until the uncertainty clears, it is futile to wait for a sustained recovery in crypto prices.

cryptocoin.com As you’ve followed on , the FTX collapse broke the close relationship between US stock markets and Bitcoin. Bitcoin traded close to a 52-week low, while the S&P 500 (SPX) rebounded sharply from its October 13 low.

Daily cryptocurrency market performance / Source: Coin360

Daily cryptocurrency market performance / Source: Coin360The US dollar index (DXY) is often inversely proportional to Bitcoin. However, its fall from the highs of the last few years has not benefited Bitcoin. This is a sign that crypto is on the sidelines. It also shows that buyers are not attempting to buy.

However, Billionaire investor and hedge fund manager Bill Ackman said in a Twitter thread on Nov. He also highlighted the potential of crypto “to greatly benefit society and grow the global economy.” Now it’s time for analysis…

Bitcoin, Ethereum, BNB and XRP analysis

Bitcoin (BTC)

BTC remains in a downtrend. The bears pulled the price below the $16,229 close support on Nov. This indicates a lack of demand by the bulls.

If the price stays below $16,229, it is possible for BTC to retest vital support at $15,588. This is an important level to consider. Because a break and close below this is likely to mark the start of the next leg of the downtrend. Bitcoin could then start its downward journey towards $12,200. However, if the price rises and rises above $16,229, it will indicate that the bulls have bought the lows below $16,000. The bulls will then attempt to push the price towards the overhead resistance of $17,190.

Ethereum (ETH)

ETH continues to gradually slide towards the support line of the descending channel pattern. This is an important level for the bulls to defend. Because a break below the channel is possible to intensify sales.

ETH is likely to drop to the psychological $1,000 and then vital support at $881. The falling 20-day EMA ($1,381) and the RSI in the negative territory suggest that the bears are in control. However, contrary to this assumption, if the price bounces back strongly from the support line, it will show that the buyers are defending the level with all their might. They will then try to clear the moving averages and open the doors for a possible rally to the downtrend line of the channel.

Binance Coin (BNB)

BNB slumped to the critical support of $258, which will be the scene of a fierce battle between the bulls and bears.

The falling 20-day EMA ($284) and the RSI below 37 suggest that the bears have the upper hand. If the bears sink and hold the price below $258, selling momentum is possible. In this case, BNB is likely to drop to $239 and then $216. Alternatively, if the price rises from the current level, it will indicate that the bulls continue to buy lows to $258. It is possible for BNB to later rise to the moving averages, where the bears will again form a strong defense.

Ripple (XRP)

Buyers pushed XRP above the downtrend line on November 20. However, it failed to break through the 20-day EMA ($0.39). This shows that sentiment remains negative and traders are selling on rallies.

It is possible for XRP to drop into the support line where buyers will step in. A strong rebound from the support line will show XRP forming a symmetrical triangle pattern. On the other hand, if the price dips below the support line, XRP is likely to drop into the $0.32 to $0.30 support zone. A strong recovery from this zone will likely indicate that XRP will be stuck between $0.30 and $0.41 for several days. Thus, the bears will have to push the price below $0.30 to signal the start of the next leg of the downtrend.

ADA, DOGE, MATIC and DOT analysis

Cardano (ADA)

ADA remains in a strong downtrend. The bears pushed the price below the immediate support at $0.31 on Nov. 21. Thus, it opened the doors for a possible decline in the support line.

A minor positive for the bulls is the RSI forming a bullish divergence. This indicates that the bearish momentum will be waning. ADA is likely to attempt a rebound from the support line, which is likely to hit the wall at the 20-day EMA ($0.34). If the price turns down from this level, it will show that the bears continue to sell in the rallies. It is possible that this will cause the support line to be retested. If this level is broken, selling will likely accelerate and ADA will drop to $0.25. On the contrary, a break above the 20-day EMA will discourage buyers who will push the ADA to the downtrend line.

Dogecoin (DOGE)

DOHE has been trading between moving averages for several days. Later, DOGE fell below the 50-day SMA ($0.08) on Nov. 20. This indicates that the uncertainty has been resolved in favor of the bears.

The 20-day EMA ($0.09) is down and the RSI is in negative territory. This indicates that DOGE is likely to drop to the close support at $0.07. If this level gives way, DOGE is likely to complete a 100% reversal of the entire rally and drop to $0.06. Conversely, if the price bounces back from the current level or $0.07, the bulls will try to push DOGE back above $0.09. A close above this resistance is likely to signal the end of the correction phase. It is possible for DOGE to rally to $0.12 later.

Polygon (MATIC)

MATIC fell to the bullish trend line on Nov. 21. This level served as support in the previous two cases. Therefore, the bulls will try to defend it again.

A rebound from the uptrend line is likely to face strong selling near the 20-day EMA ($0.91). If the price turns down from this level, it is possible for MATIC to retest the bullish line again. A break below this level is likely to pull the MATIC to the key support at $0.69. Also, this level is likely to attract buyers. On the upside, the 20-day EMA remains the key resistance to watch. If buyers push the price above the 20-day EMA, MATIC is likely to rise to $0.97 and then to the firm overhead resistance at $1.05.

Polkadot (DOT)

DOT remains in a strong downtrend. The bears pushed the price below the pennant formation and the November 20 low of $5.32. This indicates the resumption of the downtrend.

It is possible for buyers to try to start a recovery from the psychological level of $5, which could reach the breakout level from the pennant. If the bears turn this level into resistance, the probability of a drop to $4.08 increases. However, if buyers push the price above the 20-day EMA ($5.86), this will indicate aggressive buying at lower levels. This is likely to trigger a short from aggressive bulls, opening the way for a rally to $6.50.