Lido Finance’s locked total asset value (TVL) has managed to keep the liquid staking protocol among the best DeFi systems.

The fact that Lido Finance’s TVL remained at these levels managed to keep Lido at its highest level despite the declining period in DeFi.

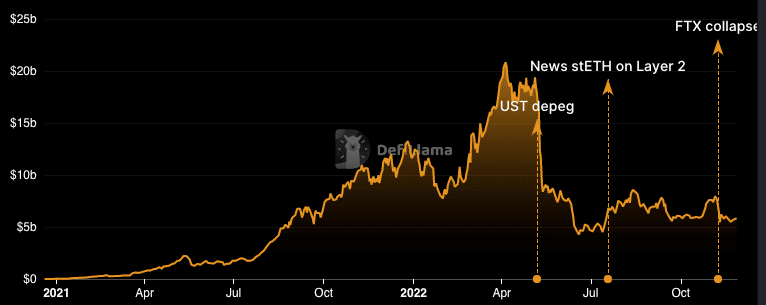

TVL Performance of Lido Finance

While the cryptocurrency market was in a bear period, problems arose in the implementation of Blockchain technology. It showed users switching to cash as locked assets fell in DeFi.

At the time of writing, the TVL value in Lido DeFi was $5.88 billion. According to DeFi Llama, Lido had retained its second position behind MakerDAO (MKR). The performance of the protocol in the last 30 days has decreased by 33%. This shows that despite the growing incentive to stake Ethereum (ETH), deposits on the Lido protocol are not in vogue.

DeFi Llama’s Lido Finance TVL chart

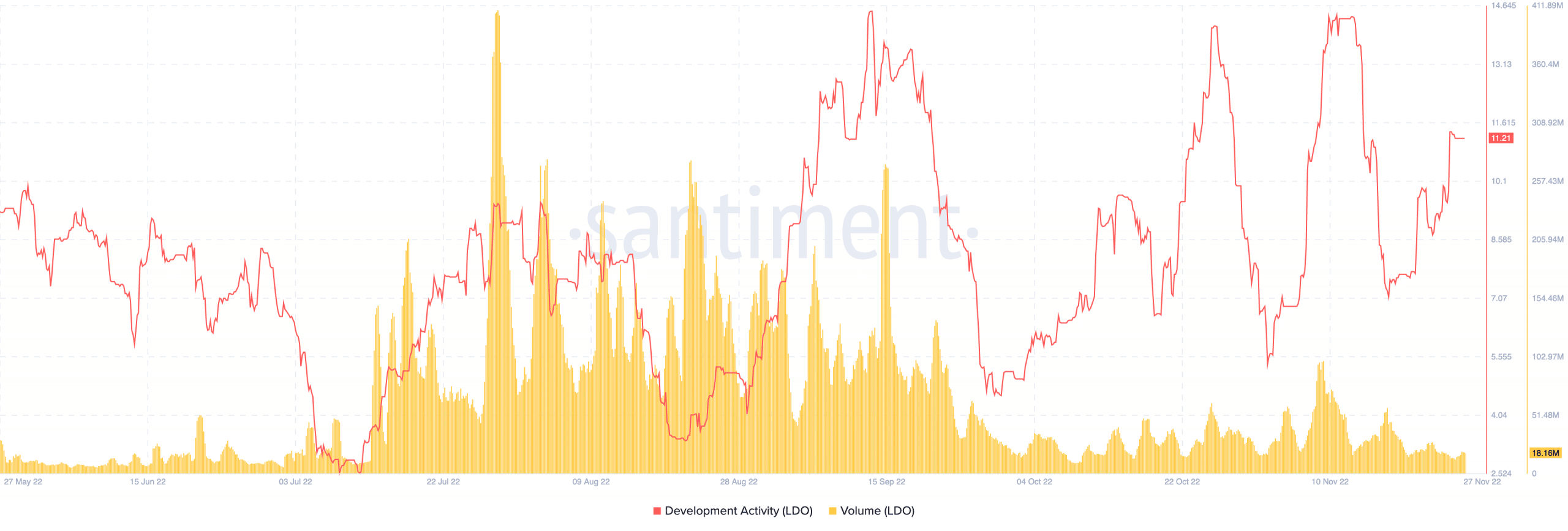

DeFi Llama’s Lido Finance TVL chartWhile there have been drops, there has been no change in Lido’s development activity. Santiment’s data showed that development activity, which fell on November 23, was back to 11.21 at the time of writing. This showed that the team is constantly making upgrades to its protocol and bringing improvements to the platform.

Lido Finance’s development activity

Lido Finance’s development activity